S&P 500 Hits New Highs: Top Tech Stocks to Watch This Earnings Season

In today’s episode of Full Court Finance at Zacks, we explore the S&P 500’s rise to new highs, driven by optimistic earnings from Taiwan Semiconductor.

We also highlight three promising tech stocks—AppFolio, Spotify, and Vertiv—to consider as earnings season heats up.

The S&P 500 reached all-time highs on Thursday, as investors returned to tech stocks like Nvidia following strong earnings from Taiwan Semiconductor TSM. These results indicate a positive outlook for growth, particularly in the AI sector. Taiwan Semi supplies major tech companies, including Nvidia and Apple, signaling robust demand.

Despite potential market fluctuations due to a busy earnings season and the upcoming presidential election, strong earnings growth and lower interest rates are likely to sustain the current bull market.

Is AppFolio a Smart Buy for Investors?

AppFolio, Inc. APPF specializes in technology for property management and real estate. The company provides a wide range of services, including accounting, marketing, and investment management for various property types.

With a focus on the real estate sector, AppFolio’s revenue has seen an impressive average growth of nearly 30% over the past five years. In Q2, the company increased its total managed units by 9% to 8.4 million.

Image Source: Zacks Investment Research

Looking ahead, AppFolio is projected to grow sales by 25% in 2024 and by 20% in 2025, rising from $620 million in FY23 to an expected $935 million in FY25. It is also forecasted that adjusted earnings will increase by 146% in 2024 and 30% the following year.

APPF stock has risen 120% over the past five years, outperforming the S&P 500’s 100% gain. However, it has recently fallen 25% from its July highs and is trading 40% below the average Zacks price target. Current market analyses suggest that APPF stock is oversold and may find support around its 2024 lows.

With a strong balance sheet and seven out of eight brokers rating it as a “Strong Buy,” AppFolio might be worth considering as its Q3 earnings release approaches on Thursday, October 24.

Should You Invest in the Growing Spotify Technology?

Spotify Technology SPOT is revolutionizing the music landscape, much like Netflix did for movies. Over the last few years, Spotify has seen an 80% increase in Premium Subscribers and a 110% jump in monthly active users. Currently, it dominates 32% of the global streaming music market, significantly ahead of Apple Music’s 15%.

The company’s increases in prices, growth strategies, and efficiency measures have revitalized its performance. In the past year, Spotify’s FY24 earnings estimate has surged by 300%, while the FY25 projection rose by 160%.

Spotify is expected to turn around from an adjusted loss of -$2.95 last year to a profit of $6.24 per share in 2024, with further growth anticipated the following year. Revenue is expected to increase by 19% in 2024 and 15% in 2025, targeting $20 billion—effectively doubling its revenue from 2020 to 2025.

Image Source: Zacks Investment Research

Spotify stock has surged 370% since the end of 2022, with a 95% increase in 2023 alone. After recently surpassing its 2021 peak, SPOT has dipped below its 21-day moving average, suggesting the possibility of short-term profit-taking.

Nevertheless, Spotify is trading at a 40% discount compared to the Zacks Tech sector and is 40% below its previous highs in terms of forward sales. The stock has returned to neutral RSI levels, making this an opportune moment for potential investors ahead of its Q3 results expected on November 12.

Why You Should Consider Vertiv Stock Now

“`html

Vertiv Partners with Nvidia to Drive Future Growth

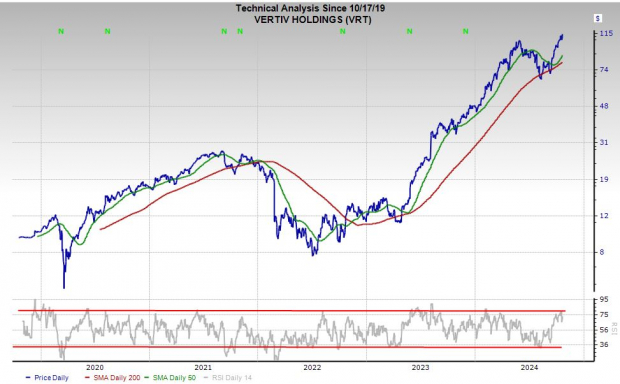

Vertiv’sVRT offers power, cooling, and IT infrastructure solutions for data centers, communication networks, and other areas. By partnering with AI leader Nvidia NVDA, Vertiv aims to tackle upcoming challenges in data center efficiency and cooling.

According to Vertiv’s CEO, advances in AI are fueling VRT’s robust growth potential.

Image Source: Zacks Investment Research

Analysts project a 13% revenue growth for Vertiv in 2024, with another increase of 14% the following year. This is expected to improve its bottom line by 46% and 30% in those respective years. With an enhanced EPS outlook, Vertiv currently holds a Zacks Rank #2 (Buy).

Over the past five years, Vertiv shares have seen a significant rise of over 1,000%, including a remarkable 200% jump in the last 24 months. Recently, VRT has reached new heights, though there is potential for selling pressure as it moves above its 21-day average.

Vertiv will announce its Q3 results on Wednesday, October 23. Should the stock retract to its 21-day, 50-day, or 200-day moving averages, this may provide a buying opportunity for investors looking at AI-related stocks.

7 Stocks to Watch Over the Next Month

Just released: Experts have identified 7 top stocks from the current list of 220 Zacks Rank #1 Strong Buys. They consider these tickers “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market by over 2X, with an average annual gain of +23.7%. Be sure to take note of these 7 selected stocks.

See them now >>

Want the latest recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double today. Click here to get this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

AppFolio, Inc. (APPF): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`