Investing in Strong Cash Flows: Three Companies to Watch

Strong cash flows are essential for financial stability, enabling companies to reduce debt, explore growth opportunities, and distribute dividends. This financial strength also helps firms weather economic downturns, making them appealing options for long-term investors.

For those looking to invest in such companies, three standouts are Apple (AAPL), Broadcom (AVGO), and Visa (V). Here’s an overview of each.

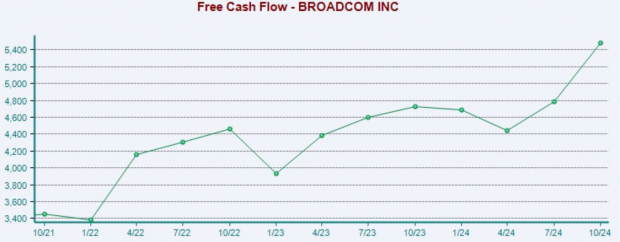

Broadcom: A Leader in AI Innovation

Broadcom has positioned itself as a key player in the AI market, with recent quarterly results underscoring strong demand for its products. Its fiscal year 2024 concluded with record annual revenue of $51.6 billion, up 44% year-over-year, thanks to robust demand for its solutions. The stock currently holds a Zacks Rank #2 (Buy), and its earning potential appears optimistic, especially after reporting free cash flow of $5.5 billion—up 15% from the previous year.

Image Source: Zacks Investment Research

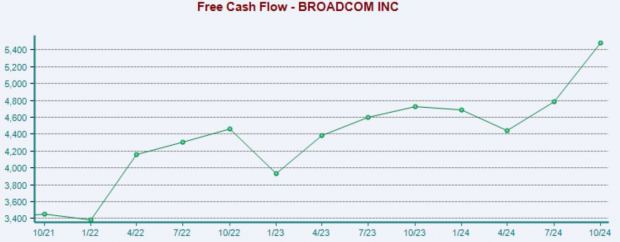

Apple: The ‘Cash King’

Apple continues to make headlines with its advancements in AI, particularly through the integration of Apple Intelligence in its latest iPhone models. The technology giant reported free cash flow of $16.5 billion, solidifying its reputation as the ‘Cash King’. The earnings per share (EPS) outlook for the current fiscal year remains strong, with an estimated $7.43 per share, projecting a 10% increase year-over-year.

Image Source: Zacks Investment Research

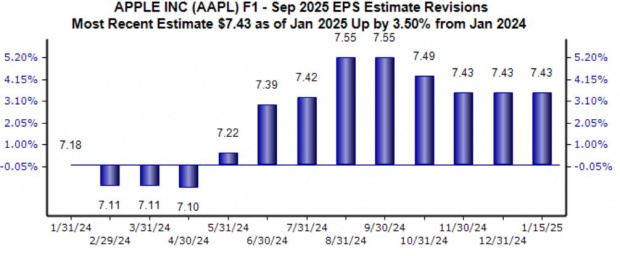

Visa: Consistent Cash Generation

Visa is well-known for its ability to generate cash and its outlook for this fiscal year reflects continued positivity. The EPS estimate of $11.23 suggests an 11% improvement, following a solid trend. In its latest financial release, Visa reported free cash flow of $6.3 billion, a remarkable 34% increase compared to the previous year.

Image Source: Zacks Investment Research

Conclusion: Solid Investment Choices

Companies with strong cash-generating abilities, like Apple, Broadcom, and Visa, present appealing investment opportunities. Their ability to fund growth, distribute dividends, and manage debt positions them well, especially during economic challenges.

For investors seeking reliable cash-generators, these three companies align well with that criterion.

Zacks Names #1 Semiconductor Stock

This new semiconductor stock is just 1/9,000th the size of NVIDIA, which has seen an impressive rise of more than +800% since we recommended it. While NVIDIA remains strong, this new chip stock has significantly more potential for growth.

With robust earnings growth and an expanding customer base, it is set to meet the skyrocketing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to surge from $452 billion in 2021 to $803 billion by 2028.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free. Click for this report:

Apple Inc. (AAPL): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.