Investing in AI: Top Picks for Future Growth

Artificial intelligence (AI) remains a dominant force shaping today’s investment landscape. Savvy investors should consider gaining exposure to this trend, as AI is poised to impact society in ways similar to the internet revolution.

Three Leading Stocks in AI Innovation

My top three stock picks for AI investment today are Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Meta Platforms (NASDAQ: META). These companies are key players in the AI sector and represent promising investment opportunities.

Where to invest $1,000 right now? Our analyst team just revealed what they believe to be the 10 best stocks to buy now. Learn More »

Nvidia and Taiwan Semiconductor: Key Players in AI Hardware

Nvidia and Taiwan Semiconductor are essential investments in the AI hardware ecosystem. This market segment is favorable because it does not require picking a single winner. Nvidia’s graphics processing units (GPUs) utilize chips from Taiwan Semi, making them crucial for training and operating AI models. As competition heats up among AI firms, like OpenAI’s ChatGPT and DeepSeek’s R1, Nvidia maintains an advantageous position thanks to its widespread use in AI development.

Nvidia’s products have powered many AI projects, positioning it as a strong buy even amidst competition from newcomers like DeepSeek. Notably, DeepSeek’s advancements in efficiency have not deterred the overall demand for AI technologies, spurring continued investment in Nvidia.

Similarly, Taiwan Semiconductor benefits from the robust demand for semiconductor chips, which are integral to both Nvidia GPUs and competing AI hardware. The company forecasts that its AI-related revenue will grow at a compound annual growth rate (CAGR) of around 40% over the next five years, underscoring the strength of the AI market.

Despite concerns about DeepSeek’s efficiency gains, investors should recognize that these lower operating costs for AI models will drive increased demand for computing resources. This situation places both Nvidia and Taiwan Semiconductor in a favorable position for future growth.

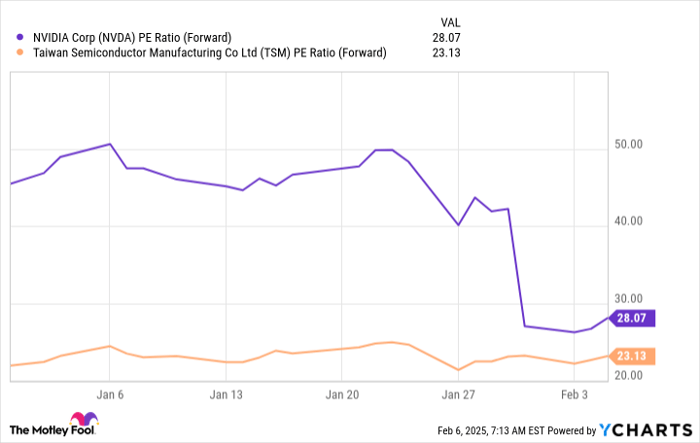

Due to recent market fluctuations, these stocks are currently available at attractive valuations.

NVDA PE Ratio (Forward) data by YCharts

From a forward price-to-earnings (P/E) perspective, both companies are competitively priced, especially considering their anticipated growth rates. In comparison, the S&P 500 trades at a P/E of 22.3, indicating that Nvidia and Taiwan Semi are not excessively priced despite their growth potential.

Meta Platforms: Funding AI Through Advertising Strength

Meta Platforms takes a slightly different approach to AI investment, focusing on applications while utilizing its strong advertising base. In the fourth quarter, Meta’s “Family of Apps” revenue surged by 21%, yielding a remarkable 60% operating profit margin. This profitability enables it to invest heavily in AI development.

Meta plans to allocate between $60 billion and $65 billion to capital expenditures this year, with a significant focus on enhancing computing power for AI. Some investors might consider this secondary to its main business, but the potential breakthroughs in AI technology could significantly enhance Meta’s operational capabilities.

CEO Mark Zuckerberg has stated that he expects a breakthrough in creating an engineering AI agent with problem-solving skills comparable to a mid-level engineer by 2025. Achieving this milestone could dramatically enhance Meta’s engineering capacity and attract more businesses to its AI solutions.

Meta’s robust advertising platform makes it a secure choice for AI investments, especially given its current P/E ratio of 28, which positions it favorably within the market.

Should You Consider Investing $1,000 in Nvidia?

Before making a decision on purchasing Nvidia stock, it’s worth noting that the Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks available right now, and Nvidia didn’t make the list. However, investing in Nvidia at the right moment could still yield significant returns.

For instance, if you had invested $1,000 in Nvidia on April 15, 2005, following our recommendation, it would be worth about $795,728 today!

Stock Advisor offers a straightforward investment guide, complete with portfolio-building advice, analyst updates, and two new stock picks each month. The service has more than quadrupled the S&P 500’s returns since 2002.

Learn more »

*Stock Advisor returns as of February 7, 2025

Randi Zuckerberg, a former director at Facebook and sibling of Meta’s CEO, serves on The Motley Fool’s board. Analyst Keithen Drury holds positions in Nvidia and Taiwan Semiconductor. The Motley Fool endorses and maintains positions in Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.