Key AI Stocks to Buy Amid Tariff Concerns in 2025

In recent years, artificial intelligence (AI) was a dominant investing theme, but it ceded attention to tariff issues in early 2025. Despite this shift, AI remains a significant trend, and the decreased focus creates a valuable investment opportunity to acquire leading stocks at lower prices.

Among the stocks I am considering are Nvidia (NASDAQ: NVDA), Taiwan Semiconductor (NYSE: TSM), and The Trade Desk (NASDAQ: TTD). Currently, these stocks appear to be attractively priced, and investors would benefit by buying before the market shifts its attention back to AI.

Where to invest $1,000 right now? Our analyst team just revealed their picks for the 10 best stocks to buy now. Continue »

Investment Potential in Nvidia and Taiwan Semiconductor

Nvidia and Taiwan Semiconductor are complementary investments. Taiwan Semiconductor manufactures chips that power advanced devices, including Nvidia’s highly sought-after graphics processing units (GPUs). These GPUs excel at parallel computing, making them ideal for AI model training. Data centers focused on AI may use over 100,000 GPUs, predominantly sourced from Nvidia due to its leading technology.

Despite hype about tariffs affecting AI demand, semiconductors currently remain exempt. However, the Trump administration is investigating potential tariffs specific to the semiconductor industry. While the outcomes are uncertain, President Donald Trump acknowledges the importance of these chips, suggesting that significantly high tariffs would be imprudent. The aim of tariffs would be to incentivize companies to bring production back to the U.S., which Nvidia and TSMC are already doing.

TSMC is building a fabrication facility in Arizona and has announced plans for three additional facilities — two for packaging and one for research and design. This investment totals $100 billion, on top of the $65 billion TSMC has already allocated in the U.S. The current production capacity at its existing Arizona facility is fully booked through 2027.

Some chips produced at the Arizona facility are for Nvidia’s cutting-edge Blackwell GPU, with additional assembly happening in the U.S. by various Nvidia partners. Therefore, Nvidia’s top GPU is exempt from tariffs as it is produced domestically.

Investors should consider that companies like Nvidia and TSMC are already positioning themselves to mitigate tariff concerns. Despite the current environment, both stocks are trading at prices below their early-year levels.

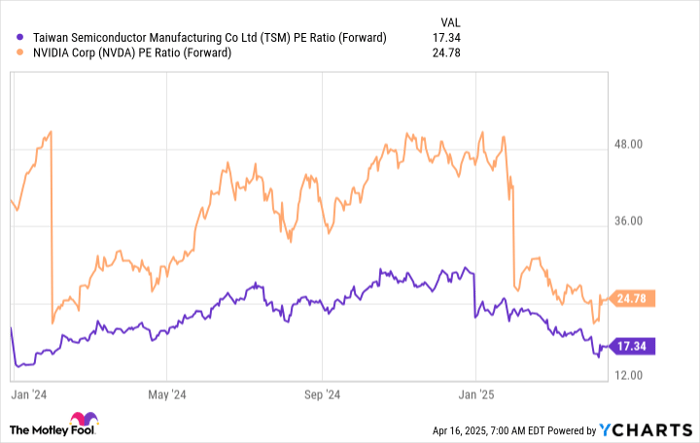

TSM PE Ratio (Forward) data by YCharts

From a forward price-to-earnings (P/E) perspective, both stocks appear favorably priced, presenting a buying opportunity that doesn’t frequently arise.

The Trade Desk’s Software Focus

Unlike the hardware focus of Nvidia and TSMC, The Trade Desk emphasizes software. This advertising technology firm connects buyers with optimal advertising spaces. AI plays a vital role here, analyzing existing campaign performance to optimize ad spending effectively.

The Trade Desk is currently migrating its clients from the Solimar platform to the AI-driven Kokai platform. During this transition, the company faced obstacles and sacrificed short-term revenues to foster long-term client relationships, resulting in missing its internal targets for the first time in its history.

This situation led to a significant stock sell-off, exacerbated by a broader market downturn following its Q4 earnings report. The stock is now approximately 65% below its all-time high, which presents a valuable investment opportunity.

Although The Trade Desk trades at 28 times forward earnings, making it pricier than Nvidia and TSMC, the market potential it addresses is vast and expanding. The Trade Desk has ample room for expanding margins, which could lower its valuation over time. Securing shares of this promising company now could be a wise decision for long-term investors.

Is Nvidia a Smart Investments in the Current Climate?

Before purchasing stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they determine to be the 10 best stocks to buy now, and Nvidia was not included in that list. The stocks they selected have the potential for significant returns in the years ahead.

For instance, when Netflix was featured on December 17, 2004, a $1,000 investment would now be valued at $518,599!* Similarly, if you invested in Nvidia when it appeared on April 15, 2005, that investment would have grown to $640,429!*

It’s noteworthy that the Stock Advisor has delivered a total average return of 791% compared to 152% for the S&P 500. Don’t miss the latest top 10 list upon joining Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 14, 2025

Keithen Drury currently holds positions in Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool also holds and recommends these stocks. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.