Alibaba Group Shows Strong Growth Potential Amidst Market Challenges

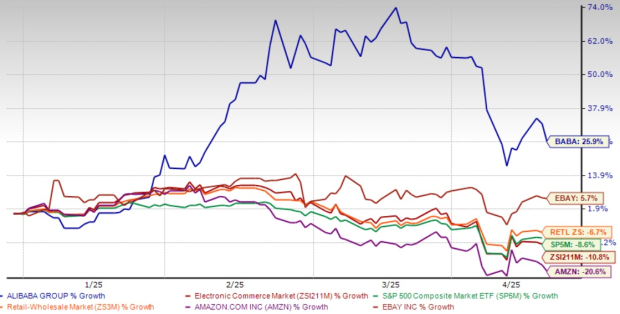

Alibaba Group (BABA) shares have surged by 25.9% year to date, outperforming the Zacks Internet-Commerce industry, the Zacks Retail-Wholesale sector, and the S&P 500, which have decreased by 10.8%, 6.7%, and 8.6% respectively. This growth suggests that the company has a significant trajectory ahead, despite facing competition from global e-commerce giants like Amazon (AMZN) and eBay (EBAY). While Amazon shares have declined by 20.6% this year, eBay has experienced a modest gain of 5.7%.

This positive performance positions Alibaba as a compelling investment opportunity moving into 2025, fueled by three critical growth catalysts.

Year-to-Date Stock Price Performance

Image Source: Zacks Investment Research

1. Accelerating Growth in Core Businesses

Alibaba’s December quarter results highlighted its strategic refocusing efforts, reporting revenues of $38.38 billion—a year-over-year increase of 8%. Particularly notable was the growth in customer management revenues for Taobao and Tmall Group, which rose by 9% year-on-year, showcasing the success of monetization initiatives and increased adoption of tools like Quanzhantui.

The Zacks Consensus Estimate for fiscal 2025 revenues stands at $137.03 billion, reflecting a projected growth of 5.01% compared to the prior year. Recent revisions also show a favorable outlook with a 1.4% increase in earnings expectations over the last month, estimating earnings at $8.92 per share. This trend indicates market optimism regarding Alibaba’s path forward.

Alibaba Group Holding Limited Stock Price and Consensus

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

See the Zacks earnings Calendar to stay ahead of market-making news.

Recent developments in AliExpress further emphasize the company’s international growth. The introduction of the AliExpressLocal Marketplace allows U.S. sellers greater flexibility in pricing and marketing. The March Expo event recorded a 27% year-on-year increase in orders from U.S. small and medium-sized enterprise buyers, particularly in sports products, which saw a staggering 197% increase in sales.

Moreover, Fliggy, Alibaba’s travel subsidiary, rolled out AskMe, an AI-powered travel assistant. This tool enhances personalized travel planning by utilizing multiple intelligent agents. The travel sector in China is rebounding, with “Buy Now, Plan Later” bookings up over 20% in 2024, putting Fliggy in a prime position to capture market share.

2. Leading AI Infrastructure Accelerates Growth

Alibaba’s robust AI strategy serves as another growth driver. The Qwen AI model family has gained substantial traction, with over 90,000 derivative models created globally, positioning Qwen as a leading choice among developers. More than 290,000 users have accessed Qwen APIs via Alibaba Cloud.

A remarkable triple-digit growth rate in AI-related product revenues has persisted for six consecutive quarters, prompting Alibaba to commit to its largest long-term investment in cloud and AI infrastructure in over a decade.

Recent innovations include Accio, an AI-driven B2B search engine which attracted a million users within five months of its launch. Built on Alibaba’s Qwen large language model, Accio provides features such as Business Research and Deep Search, catering directly to sourcing decision-makers in the U.S., U.K., Germany, and France, 64% of whom plan to integrate AI by 2025.

Additionally, Ant Group, Alibaba’s affiliate, has developed a novel approach to AI model training, cutting computing costs by 20% through innovative use of both Chinese and U.S. semiconductors, thus diversifying its supplier base away from dependence on a single source like NVIDIA Corporation (NVDA).

3. Solid Financial Position and Shareholder Returns

Alibaba’s strong financial foundation and focus on shareholder returns make it a stock worth considering. The company maintains a robust net cash position of $51.9 billion, which supports strategic investments and substantial returns to shareholders.

Management has adhered to its goal of increasing shareholder value through aggressive buybacks, repurchasing $1.3 billion in shares during the December quarter alone, alongside the $10 billion bought back in the first half of the fiscal year. With a total share count reduction of 5% over nine months and $20.7 billion remaining in its buyback program through March 2027, investors may see continued improvement in earnings per share.

Additionally, Alibaba has streamlined its operations, selling non-core assets like Sun Art and Intime for proceeds totaling approximately $2.6 billion. This capital discipline, combined with strategic investments, highlights the company’s commitment to growth and enhanced shareholder returns.

Currently, Alibaba is trading at a compelling discount, presenting a noteworthy opportunity for investors.

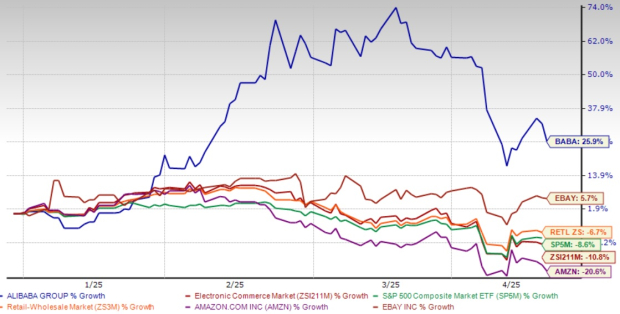

Alibaba Stock: Undervalued with Strong Growth Potential

Alibaba Group Holding Limited (BABA) shows a forward 12-month Price/Earnings (P/E) ratio of 9.8X, significantly below the industry average of 19.17X. This valuation suggests that BABA’s stock is markedly undervalued compared to its competitors, trading at nearly half the industry average. The lower-than-median P/E ratio indicates an appealing entry point for investors, as the stock appears to be trading below its fair market value while maintaining robust fundamentals.

BABA P/E Ratio Shows Attractive Valuation

Image Source: Zacks Investment Research

The Bottom Line

Despite having already posted strong gains in 2025, Alibaba’s growing fundamentals in e-commerce, cloud services, and artificial intelligence (AI) position it well for sustained long-term growth. The company’s significant infrastructure investments and expanding range of AI applications enhance its investment appeal. Additionally, Alibaba’s commitment to returning value to shareholders strengthens its case as a solid investment option. For those seeking exposure to the dual trends of AI innovation and Asian e-commerce expansion, Alibaba offers a compelling value proposition at current market levels. Currently, BABA exhibits a Zacks Rank of #1 (Strong Buy).

Exclusive Access to Zacks’ Buys and Sells for Just $1

We’re not kidding.

In a unique offer, we provided our members with 30-day access to all our stock picks for only $1, without any obligation to spend more. This opportunity has been embraced by thousands, while others hesitated, thinking it was too good to be true. There is a reason behind this initiative: we invite you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively closed 256 positions with double- and triple-digit gains in 2024.

Interested in our latest recommendations? Download “7 Best Stocks for the Next 30 Days” for free by clicking here.

For comprehensive analysis, check out free stock reports on:

- Amazon.com, Inc. (AMZN)

- eBay Inc. (EBAY)

- NVIDIA Corporation (NVDA)

- Alibaba Group Holding Limited (BABA)

This article was initially published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.