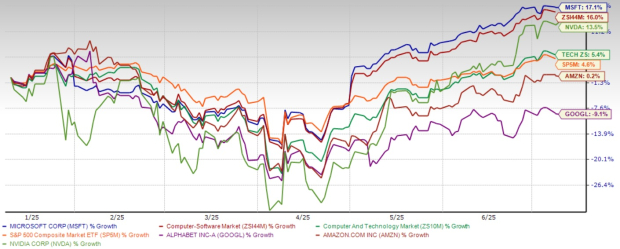

Microsoft (MSFT) is positioned as a strong investment opportunity for 2025, with an 11.76x P/S valuation, above the industry average of 9.8x, driven by significant advancements in AI monetization and a leading cloud market position. In the past six months, Microsoft’s stock has increased by 17.1%, outperforming competitors such as Nvidia (0.2%), Amazon (13.5%), and Google (-9.1%).

Microsoft’s AI business generates over $13 billion in annual revenue, reflecting a 175% year-over-year increase. With planned investments of $80 billion in fiscal 2025 to support AI infrastructure, Microsoft aims to solidify its competitive edge. As of now, Microsoft Azure holds 20-25% market share globally, closing in on AWS’s 29%. Additionally, Microsoft’s third-quarter fiscal 2025 revenues were $70.1 billion, marking a 13% year-over-year growth.

The Zacks consensus estimate for Microsoft’s fiscal 2025 revenues stands at $279.09 billion, projecting a 13.86% year-over-year growth, with expected earnings at $13.36 per share, indicating a 13.22% increase from the prior year.