The Emerging Role of Quantum Computing in AI Innovations

When artificial intelligence (AI) emerged as a transformative technology, discussions focused on its potential in corporate settings to boost productivity, data analytics, and overall efficiency. While AI plays a significant role in these areas, its capabilities extend even further.

Subtle applications of AI can lead to advancements in drug discovery, financial fraud detection, and cybersecurity. To unlock major progress in these fields, however, AI protocols must undergo further enhancements.

This is where quantum computing becomes relevant. Currently not a mainstream component of AI, quantum computing presents enormous opportunities for growth and development.

Let’s delve into the quantum computing market and identify the leading companies making strides in this sector. After a comprehensive analysis of key players, I will highlight a top disruptor that investors may want to consider.

Image source: Getty Images.

1. Quantum Computing Represents a Massive Opportunity

According to management consulting firm McKinsey & Company, the total addressable market (TAM) for quantum computing could reach as high as $131 billion by 2040. Within this landscape, McKinsey identifies mobility, life sciences, chemicals, and financial services as key sectors poised to gain a combined $1.3 trillion in value through quantum computing adoption by the middle of the next decade.

2. A Promising Quantum Computing Stock

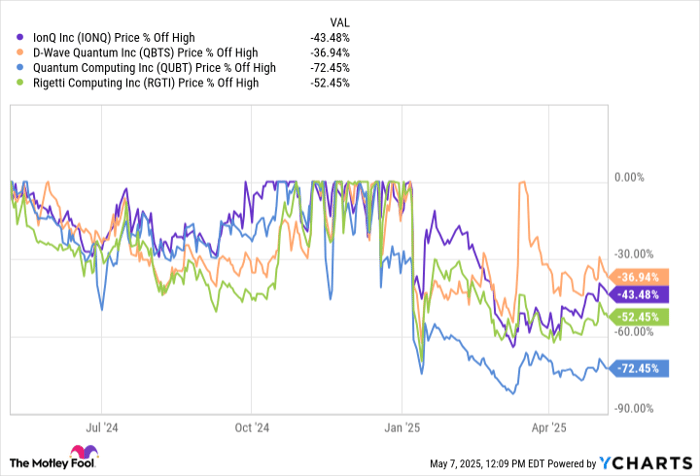

Interest in quantum computing began to rise late in 2024, attracting attention towards companies like IonQ, D-Wave Quantum, Quantum Computing, and Rigetti Computing. An uptick in buying activity often accompanies new trends as smaller firms attract speculation and hype.

IONQ data by YCharts.

The chart indicates that these quantum computing stocks are trading significantly lower than their previous highs, suggesting potential buying opportunities. However, a closer look at their valuations reveals a different picture.

IONQ PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

Despite steep declines, the companies in this sector still boast high price-to-sales (P/S) ratios, indicating they have not yet generated significant revenue. Each firm is valued at or above $1 billion without a clear path to profitability. This suggests that investing in these stocks may not be advisable at this time.

Several larger companies, known as the “Magnificent Seven,” including Amazon, Alphabet, and Microsoft, are also making strides in the quantum computing space. Currently, my top pick in this sector is Nvidia (NASDAQ: NVDA).

Nvidia is now recognized for its AI chips, particularly graphics processing units (GPUs). However, its CUDA software platform works in tandem with these hardware offerings, which positions Nvidia as a potent player in both AI and quantum computing.

Recently, Nvidia has introduced CUDA-Q, a software suite that supports complex tasks in quantum computing alongside its GPU hardware. As Nvidia continues to lead in the AI chip market, it is well-positioned to establish itself within the quantum computing industry as well.

3. Nvidia Stock Offers Value Amidst Market Fluctuations

Like other stocks mentioned, Nvidia’s shares have also seen a decline, falling 24% from their 12-month high. This drop equates to a nearly $1 trillion loss in market capitalization.

However, unlike smaller quantum computing stocks, Nvidia’s valuation remains more favorable. The recent compression of its forward price-to-earnings (P/E) ratio suggests a normalization of expectations for the company.

NVDA PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

Even amid uncertainties regarding tariffs and Nvidia’s prospects in China, the company remains a leader in the AI chip market. Quantum computing also represents a substantial long-term opportunity worth billions for Nvidia. For investors with a long-term perspective, now may be the time to consider Nvidia at its current price.

Seize a Lucrative Investment Opportunity

If you feel you missed out on the most successful investments, now is a prime opportunity.

Our analyst team has identified several promising stocks they believe are on the verge of notable growth. If you’re concerned about missing your chance, this may be the perfect time to act.

- Nvidia: If you invested $1,000 in our recommendations from 2009, you’d have $302,503!*

- Apple: If you invested $1,000 in 2008, you’d have $37,640!*

- Netflix: If you invested $1,000 in 2004, you’d have $614,911!*

Our experts have also issued alerts for three highly promising companies, and this chance to invest may not arise again soon.

*Returns as of May 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.