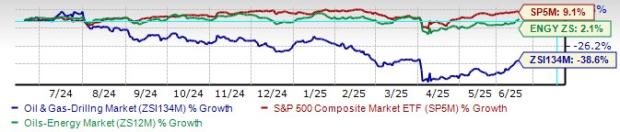

The Zacks Oil and Gas – Drilling industry is currently facing significant challenges due to contracting delays, soft gas prices, and macroeconomic uncertainty, reflected in its Zacks Industry Rank of #235, placing it in the bottom 4% of 245 Zacks industries. Notably, earnings estimates for the industry have diminished dramatically: estimates for 2025 have decreased by 85.2% and by 51.7% for 2026 in the past year. The industry has also underperformed, declining 38.6% over the last year compared to the broader Zacks Oil – Energy sector’s 2.1% increase and an overall S&P 500 gain of 9.1%.

Despite the bearish outlook, there are indications of long-term recovery potential, particularly in the deepwater drilling segment, where demand is expected to rise by 40% by 2030, driven by large undeveloped reserves. Key players such as Transocean Ltd. (RIG), Patterson-UTI Energy (PTEN), and Precision Drilling Corporation (PDS) are strategically positioned to navigate current market volatility and capitalize on future growth opportunities. For reference, Transocean’s recent contract drilling revenues reached $906 million, up 18.7% from the previous year, while Patterson-UTI generated $51 million in adjusted free cash flow in Q1 2025, and Precision Drilling has a market capitalization of $687.3 million.

Overall, the industry is navigating a volatile landscape, with near-term earnings visibility hampered by geopolitical risks and weak gas prices, particularly affecting land drillers with exposure to gas-weighted basins. The frail economic situation may lead some companies to delay investments in drilling operations, further complicating the outlook for the sector.