The Strategic Timing of Investments: Capitalizing on Seasonal Trends

Welcome to your Sunday Digest, where we explore investment opportunities that correlate with seasonal spending patterns.

Throughout my early career in corporate finance, I noticed that December sparked significant spending frenzy within my department. Our corporate environment fostered a “use it or lose it” mindset regarding budgets. Executives who maximized their allocations would most likely receive similar budgets the following year, while those who underspent risked reductions in future funding.

Later, while working on Wall Street, I discovered that this phenomenon isn’t unique to any single company. In fact, CFOs across corporations often remain unaware of spending at the departmental level, allowing managers to freely spend leftover budgets as long as they meet overall financial targets. This widespread behavior creates a year-end buying surge, especially for enterprise companies like Cloudflare Inc. (NET), which provides DDoS (distributed denial-of-service) protection for approximately 80% of corporate and government websites. IT departments typically splurge on desirable software during this time, which leads to sales boosts for companies like Cloudflare ahead of their fourth-quarter earnings announcements each February.

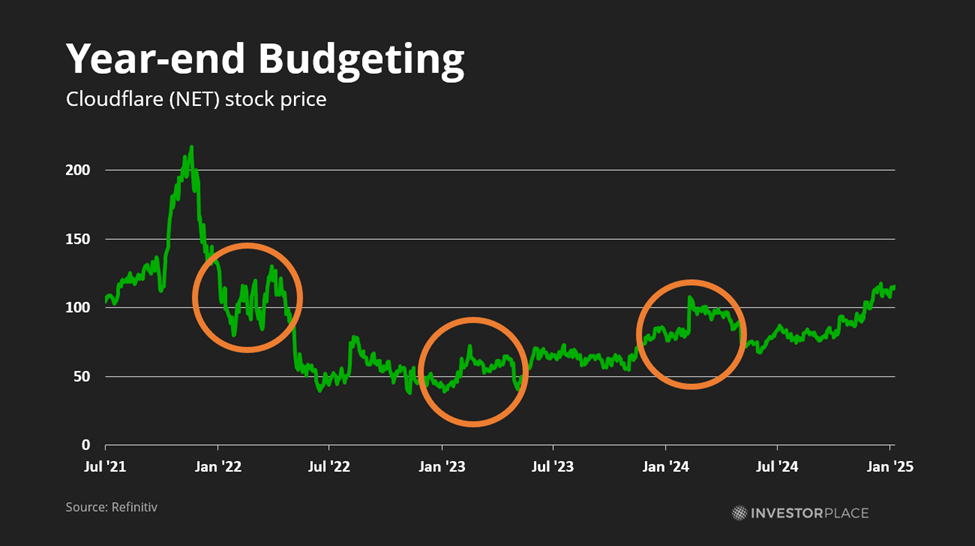

The chart below illustrates Cloudflare’s stock price, which usually increases during first-quarter earnings cycles. The marked points in orange highlight these trends.

This seasonal spending trend is especially strong in businesses tied to distinct seasonal cycles. For instance, natural gas prices tend to rise as winter approaches, with the Henry Hub index averaging a 12% increase from July to January since 2000. This seasonal surge results in substantial profits for companies involved in the natural gas sector.

The holiday shopping season exemplifies another critical time for retail companies. Retail giants like Amazon.com Inc. (AMZN) consistently surprise analysts with their strong sales during Black Friday, showcasing the recurring profit potential that becomes apparent from back-to-school purchasing and year-end shopping.

In light of these observations, we’re eager to introduce TradeSmith’s innovative new trading strategy, regarded by TradeSmith CEO Keith Kaplan as their most significant advancement since the inception of TradeStops 20 years ago. This strategy leverages over 70 years of historical data to pinpoint the optimal moments when seasonal trends are most impactful. They are calling this breakthrough “Trade Cycles,” and you can explore this system by clicking here.

Moreover, TradeSmith’s seasonality detector works synergistically with other quantitative tools. It’s important to recognize that seasonal patterns alone do not guarantee a successful investment. This is evidenced by the unfortunate fates of numerous cybersecurity firms that could not meet quality expectations and numerous retail outlets that closed down after failing to capture the holiday market. A recent example is Christmas Tree Shops, which filed for bankruptcy in May 2023, closing all of its locations shortly thereafter.

By marrying seasonal analysis with tools that identify top-tier firms, TradeSmith empowers investors to discern prime buying opportunities. To illustrate the Trade Cycles concept, let’s take a closer look at three exemplary companies.

Capitalizing on Winter Demand

Cheniere Energy Inc. (LNG) stands as the largest liquified natural gas exporter in the United States. Operating out of Houston, this company benefits from competitively priced U.S. gas resources, and its unique contracting structure, known as “take-or-pay,” allows it to profit from the price differences between domestic and international markets without bearing commodity price risks.

Winter offers a particularly lucrative opportunity for Cheniere. Demand for stored natural gas surges as European countries prepare for winter, leading to quicker price increases in European markets than in the U.S. For example, between July 2024 and now, Dutch TTF Natural Gas prices rose 18%, compared to a mere 5% increase at Henry Hub.

This cyclical pattern allows us to predict Cheniere’s stock performance, which has shown an upward trajectory of 20.7% in the first two months of the year since 2009. The accompanying chart from TradeCycles highlights this trend:

Cheniere Energy and DraftKings: Investing Insights for the Upcoming Year

Cheniere Energy’s Promising Future with LNG Exports

With the new Trump administration promising to increase fossil fuel drilling, the U.S. Energy Information Administration (EIA) predicts a 15% surge in LNG exports during the initial year of Trump’s presidency. This development enhances the attractiveness of Cheniere Energy, leading Wall Street analysts to raise their earnings forecasts for 2025 by 13% since July, suggesting a bullish trend ahead.

Cheniere’s stock is currently categorized in TradeSmith’s “green zone,” indicating a favorable combination of reduced risk and a positive growth trajectory. For investors looking to benefit from the Trump administration’s energy strategy, Cheniere Energy emerges as a compelling option.

The Seasonal Advantage in Sports Betting

Sports betting companies experience a unique cycle driven by the seasons. Football and basketball seasons peak in the second and fourth quarters, creating significant profits for gambling establishments during these times. For example, January typically sees a boom for casinos, from Las Vegas to Macau, fueled by gamblers spending their year-end bonuses, with this trend lasting until about March.

This seasonal pattern allows companies like DraftKings Inc. (DKNG) to benefit from increased revenue in the first quarter as cash-rich customers place bets on major events like the Super Bowl and March Madness. Historically, DraftKings sees encouraging figures during Q2 and Q4 but experiences a dip in Q3.

Since its IPO in 2020, DraftKings has recorded a 13% rise in share prices from January to mid-February, coinciding with its typical announcement of fourth-quarter results. August also stands out for the company, aligning with the release of its second-quarter results, which covers wagering on the NBA playoffs and NCAA Final Four. However, Q3 tends to be quiet.

TradeSmith’s metrics categorize DraftKings as a solid “green zone” stock, showcasing positive momentum in the market. The company has executed a strong marketing strategy, allowing it to capture significant market share alongside rival Flutter Entertainment plc (FLUT), which owns FanDuel. In contrast, traditional casino giants like MGM Resorts International (MGM) and Caesars Entertainment Inc. (CZR) have fallen behind.

Looking ahead, analysts are optimistic about DraftKings’ potential to turn a profit. They anticipate that the company’s net income will become positive this fiscal year, with predictions of surpassing $1 billion in annual profit by 2027.

Benefitting from the Year-End Spending Surge

Investors with an eye on seasonality might want to consider Cloudflare Inc. (NET), a leading cybersecurity firm that has become crucial in defending websites against DDoS attacks—malicious attempts to overload sites with traffic.

In November 2021, for example, Microsoft’s Azure cloud faced an unprecedented attack that generated requests from 10,000 locations across 10 countries. At the time, Cloudflare successfully mitigated the 3.47 terabits-per-second assault—thought to be the largest recorded until then—and later handled an even bigger attack of 5.6 terabits per second last year.

Today, Cloudflare protects about 20% of all websites, translating to 80% of those with DDoS protection. If you’ve encountered a message on your browser indicating a site is protected, that’s Cloudflare’s technology at work.

This comprehensive visibility helps Cloudflare to effectively thwart cyber attacks and strengthen its defenses. By identifying malicious entities targeting specific customers, the company can shut down these threats, securing other clients in the process. As a result, Cloudflare has become essential for many Fortune 500 companies. Larger cloud providers, like Amazon, can afford to develop their DDoS solutions, but many others rely on Cloudflare for protection against potential operational disruptions.

This reliability has positioned Cloudflare as a necessary stock for investors, especially in the first quarter. Since 2019, the company has outperformed earnings-per-share expectations by 41%, consistently driven by robust fourth-quarter sales.

Cloudflare’s Growth Continues Amid Seasonal Trends

Cloudflare, a prominent cybersecurity firm based in San Francisco, is experiencing rapid expansion with its secure access service edge (SASE) product. The company has made strides by enhancing its offerings through strategic bolt-on acquisitions.

Due to this proactive approach, Cloudflare’s growth trajectory remains strong. Analysts project the company’s revenues to increase by 23% this year from an already substantial base, with net income expected to rise by 25% to $942 million.

Even with a notable rise in shares throughout 2024, Cloudflare’s solid performance indicates the potential for further gains this year.

Understanding Seasonal Profitability

Investing based on seasonal trends can seem too optimistic at times.

Consider this: if it were common knowledge that a stock would increase following impressive fourth-quarter results, investors would already be purchasing shares in January prior to the announcement. More strategic investors might start buying in December, November, or even October. In a perfect world, hedge funds would offset any extraordinary seasonal profits before regular investors have a chance.

Yet, real-world scenarios provide unforeseen challenges.

High-quality firms, like Cloudflare, often see gains due to year-end spending, while weaker companies, such as Qualys Inc. (QLYS), may struggle. After missing revenue expectations in February 2024, Qualys shares plummeted 10%, continuing to decline by another 24% over the following 11 months as their difficulties became evident.

This reality demonstrates that seasonality can amplify both the successes and failures of investments.

That’s why I recommend tuning into Keith’s latest presentation on Trade Cycles. In this session, he explains how TradeSmith’s quantitative tools can pinpoint the best stocks to buy and identify optimal times for investment.

Establishing this system wasn’t straightforward. Keith’s team conducted a staggering 2.4 quintillion tests using custom-built algorithms. Their effort paid off, as Keith’s model portfolio has achieved an impressive 857% return since 2006, significantly outperforming the stock market’s 412% return.

To learn how you can access these valuable tools, click here.

Looking forward to connecting again next week.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace