Three Key Chip Stocks to Watch for 2025

The microchip industry is the backbone of modern technology, powering everything from smartphones to artificial intelligence (AI) and automobiles. Without it, many of the conveniences we enjoy today wouldn’t be possible. Investing in this sector is crucial.

Here are three chip stocks that show promise as potential buys: Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and ASML (NASDAQ: ASML). Each presents a unique investment opportunity heading into 2025.

Start Your Mornings Smarter! Receive Breakfast News in your inbox every market day. Sign Up For Free »

Nvidia: Leading the AI Charge

Nvidia has established itself as a premier chip company, known for its top-tier GPUs that utilize sophisticated proprietary technology. Over the past two years, the company’s dominance in the AI computing sector has fueled impressive growth.

By 2025, Nvidia plans to enhance its production of the new Blackwell architecture, which outperforms the existing Hopper architecture. Many of Nvidia’s major clients expect to increase their data center investments in response to rising AI demands, positioning Nvidia for further success.

Although growth may moderate compared to the explosive rate seen previously, analysts forecast a 51% increase in Nvidia’s fiscal 2026 growth (ending January 2026). With a staggering $3.4 trillion market capitalization, this is a significant achievement. Moreover, Nvidia’s stock is more reasonably priced than it may seem.

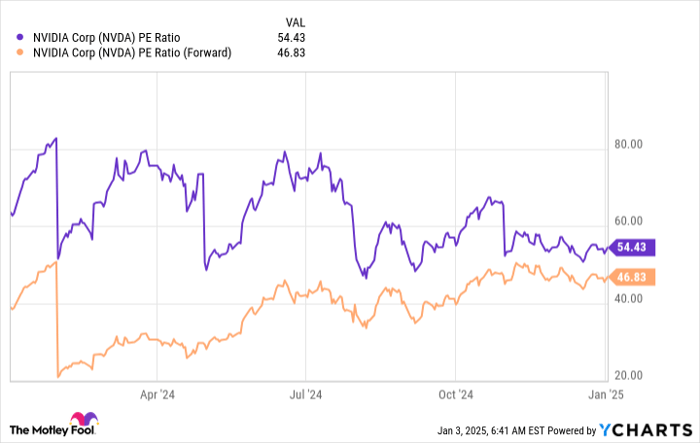

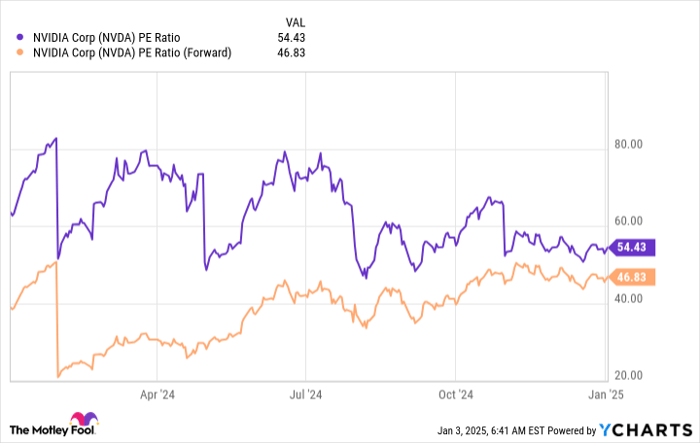

NVDA PE Ratio data by YCharts

With revenue growing at about 50%, a price-to-earnings ratio of 54 appears justified. Thus, now is a favorable time for investors to consider a position in Nvidia.

Taiwan Semiconductor: The Foundry of Choice

Nvidia’s GPUs rely on chips produced by Taiwan Semiconductor. Serving as a chip foundry, TSMC fabricates chips for numerous companies, including both partners and competitors. This makes the company an interesting choice for investors looking to capitalize on the AI wave.

Management has highlighted the significant impact AI has had on TSMC’s growth. For 2024, they anticipate that revenue from AI will triple compared to the previous year, contributing a mid-teens percentage to total revenue. This signals strong growth potential as Nvidia continues to thrive in 2025.

TSMC is set to launch its state-of-the-art 2-nanometer (nm) chips by year’s end. These new chips promise improved energy efficiency, leading to lower operational costs for high-demand AI computing hardware.

Trading at just 23 times forward earnings, Taiwan Semiconductor represents an attractive investment opportunity.

ASML: A Unique but Challenging Position

Unlike Nvidia and TSMC, ASML faces more hurdles. The company produces extreme ultraviolet lithography machines crucial to chip production, maintaining a monopoly in this space.

However, export bans from Western governments aimed at curbing China’s technological rise have impacted ASML. As a result, the company recently reduced its 2025 revenue forecast from a range of 30 billion to 40 billion euros to between 30 billion and 35 billion euros. Despite these setbacks, ASML maintains a long-term revenue projection of 44 billion to 60 billion euros for 2030, unchanged since its 2022 forecast.

ASML’s technology, refined over decades, is difficult to replicate. Given its critical role in chip making, ASML still stands as a long-term player in the semiconductor sector. With a stock price about 36% lower than recent highs, now could be a strategic moment for investment.

Seize Your Chance: Potential Profitable Investments

Worried you might have missed out on past investment successes? This might be your moment.

Rarely, our team identifies stocks with explosive growth potential, labeled as “Double Down” recommendations. If you think you’ve lost your chance to invest in promising companies, act soon; the numbers are on your side:

- Nvidia: Invested $1,000 when we recommended it in 2009 would have grown to $387,474!*

- Apple: A $1,000 investment from 2008 would now be worth $46,399!*

- Netflix: Investing $1,000 back in 2004 would have turned into $475,542!*

We’re currently issuing “Double Down” alerts for three remarkable companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Keithen Drury has positions in ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.