“`html

Tech Giants Invest Big in AI Infrastructure: Here’s How Nvidia, AMD, and Micron Stand to Gain

According to Morgan Stanley, a group of four tech giants (Microsoft, Amazon, Alphabet, and Meta Platforms) could spend a combined $300 billion building data center infrastructure for artificial intelligence (AI) development during 2025.

Nvidia (NASDAQ: NVDA) commands a large share of the market for AI data center chips, positioning it to benefit significantly from this spending surge. However, it won’t stand alone as a winner — Advanced Micro Devices (NASDAQ: AMD) is poised to release an impressive range of AI hardware this year, and Micron Technology (NASDAQ: MU) plays a crucial role as one of Nvidia’s key component suppliers.

Nvidia: Leading the AI Chip Market

Building AI models requires powerful computing resources, and Nvidia’s graphics processors (GPUs) lead the pack. Tech companies are vying to stock their data centers with these chips not only to run their AI applications but also to lease computing power to external developers for profit.

In 2023, Nvidia’s H100 was the top AI GPU. Even as the newer H200 began shipping in early 2024, the company had already rolled out a new series of GPUs featuring its advanced Blackwell architecture, delivering remarkable performance improvements. For instance, the Blackwell GB200 NVL72 can process AI tasks 30 times faster than the H100.

While Nvidia started distributing GB200 samples to customers at the end of 2024, rapid shipment scaling is anticipated this year. Analysts predict Blackwell revenue may surpass Hopper revenue (which powers the H100 and H200) by April.

The company’s fiscal year 2025 is set to conclude soon, with Nvidia projected to achieve a record $128.6 billion in total revenue, reflecting a 112% increase from fiscal 2024. Notably, around 88% of this revenue is expected from the data center sector, primarily driven by AI GPU sales.

As investors keep a close eye on Blackwell sales throughout the year, discussions have surfaced about an upcoming architecture called “Rubin,” which is reportedly six months ahead of schedule. This advancement may allow Nvidia to showcase new GPUs before year-end, offering insights into potential revenue for calendar 2026 and beyond.

Despite a remarkable 700% rise in Nvidia’s stock value over the last two years, analysts still view it as undervalued, suggesting it may not be too late for investors to consider adding it to their portfolios.

Advanced Micro Devices (AMD): A Rising Competitor

AMD manufactures processors for a range of widely-used consumer electronics, including Sony‘s PlayStation 5 and the infotainment systems in Tesla‘s electric vehicles. Additionally, AMD has emerged as a competitor to Nvidia in the data center market.

In 2023, AMD introduced its MI300X AI GPU to rival the H100. This product attracted significant clients like Oracle and Microsoft, many of whom have found AMD’s offerings to provide lower costs and improved performance. Recently, AMD launched the MI325X, with eyes set on releasing the MI350 series soon.

The upcoming MI350, built on AMD’s Compute DNA (CDNA) 4 architecture, is anticipated to offer a staggering 35-fold performance boost over the MI300X. Expected for shipment in the latter half of 2025, it follows Nvidia’s GB200 but is still expected to capture market attention.

Ahead of its fiscal year 2024 earnings report, CEO Lisa Su initially forecasted $2 billion in AI GPU sales, but has since raised expectations to over $5 billion. AMD’s data center revenue jumped by 122% during the third quarter compared to last year, signaling rapid growth in GPU sales.

Additionally, AMD leads the market for AI chips in personal computers. This area is poised for growth as AI tasks transition from data centers to users’ devices, enhancing user experiences. The company’s latest Ryzen AI 300 Series chips are projected to be used in over 100 computing platforms by the end of 2025, including those from top brands such as Microsoft, HP, and Lenovo.

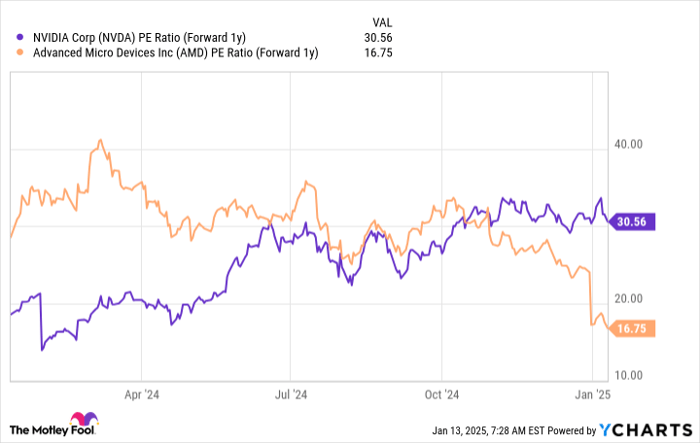

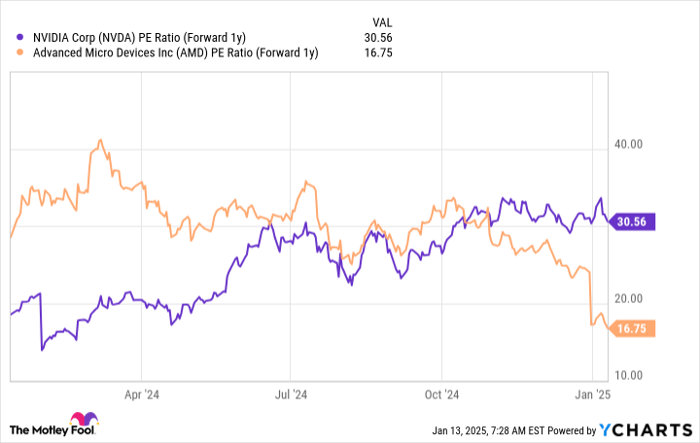

Though AMD is still building its presence in the AI sector compared to Nvidia, its stock appears to be a good investment opportunity at present. With Wall Street estimating AMD’s fiscal 2025 earnings, its stock currently has a forward price-to-earnings (P/E) ratio of just 16.7, making it notably cheaper than Nvidia’s:

NVDA PE Ratio (Forward 1y) data by YCharts

Micron: The Backbone of AI Memory Solutions

Micron is a leading producer of memory and storage chips, which may not seem as glamorous as GPUs, yet they play a vital role in AI processing. Memory chips hold information at the ready for GPUs, making immediate retrieval possible, which is especially important for quick responses in AI applications, such as chatbots.

Micron’s HBM3E (high-bandwidth memory) for data centers stands out in the industry, delivering 50% more capacity while using 30% less energy than its competitors. Demand is so high that Micron’s HBM3E is sold out until 2026, driven largely by Nvidia’s use in the Blackwell GB200.

The market for data center HBM was valued at around $16 billion in 2024, with predictions that it could surge to $100 billion by 2030. Micron is already developing a new HBM4E solution, aiming to boost performance by 50% over HBM3E.

In its fiscal 2025 first quarter (ending Nov. 28, 2024), Micron reported $4.4 billion in data center revenue, marking an astonishing 400% increase from a year prior. For the first time, the data center division accounted for over 50% of Micron’s total revenue.

“`

The Technology Showdown: Micron vs. Nvidia Investment Insights

Micron Technology Inc. is projected to earn $8.90 per share in fiscal year 2025, according to Wall Street’s consensus estimate from Yahoo!. This puts Micron’s stock at a forward price-to-earnings (P/E) ratio of 11.1, making it notably more affordable compared to competitors like AMD and Nvidia.

Micron’s fortunes may hinge on Nvidia’s success with its GB200 GPUs. A rise in GPU sales could lead Micron to see increased demand for its HBM3E products. Thus, the current discount on Micron’s stock compared to Nvidia’s may present a buying opportunity for investors looking for value.

Should You Consider a $1,000 Investment in Nvidia?

Before deciding to invest in Nvidia, it’s essential to weigh your options. The analyst team at Motley Fool Stock Advisor has identified what they believe are the 10 best stocks to buy right now—and Nvidia isn’t among them. These selected stocks may yield significant returns in the future.

For perspective, consider this: when Nvidia was recommended on April 15, 2005, an investment of $1,000 would have grown to an astounding $807,495 by now.*

With Stock Advisor, investors gain a structured approach to building a portfolio, regular analyst updates, and two fresh stock picks every month. Since 2002, it has notably outperformed the S&P 500 by more than fourfold.*

Explore the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, a former director of market development for Facebook and sibling to Meta Platforms CEO Mark Zuckerberg, currently serves on The Motley Fool’s board. Other directors include Suzanne Frey, an executive at Alphabet; and John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary. Anthony Di Pizio holds no positions in the stocks mentioned. The Motley Fool is invested in and promotes Advanced Micro Devices, Alphabet, Amazon, HP, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The organization also recommends specific options related to Microsoft. For further details, refer to The Motley Fool’s disclosure policy.

The opinions expressed in this article reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.