Key Earnings Highlights from Philip Morris, Meta, and Netflix

The 2024 Q4 earnings season is concluding, as over 98% of S&P 500 companies have reported their quarterly results. Several stocks, notably Philip Morris PM, Meta Platforms META, and Netflix NFLX, have shown positive momentum following their earnings reports. For those tracking post-earnings trends, we take a closer look at these notable performances.

Philip Morris Shows Strong Innovation

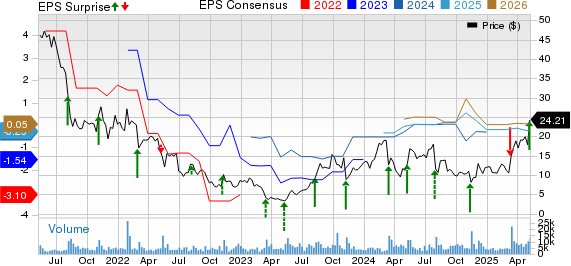

Philip Morris has experienced a boost from their recent earnings results, with earnings per share (EPS) increasing by 14% and sales rising by 7%. The company’s strong demand reflects its robust market presence, bolstered by ongoing product innovations.

In a significant milestone, smoke-free products surpassed 40 billion units for the first time during FY24. Additionally, the Smoke-free Business (SFB) saw net revenues increasing by 14.2%, alongside an 18.7% rise in gross profit.

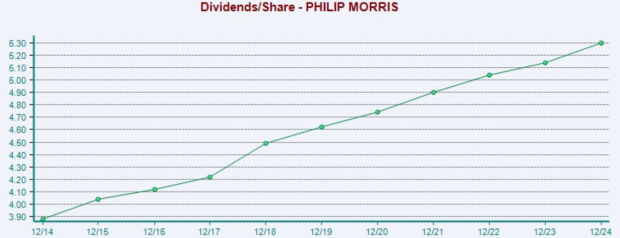

The stock also provides an attractive passive income option, boasting an annual yield of 3.5% that outperforms the market average. Philip Morris has a strong track record of dividend growth, earning the status of a Dividend King. Below is a chart illustrating annual dividends paid by the company.

Image Source: Zacks Investment Research

Meta Platforms Achieves Record Profit

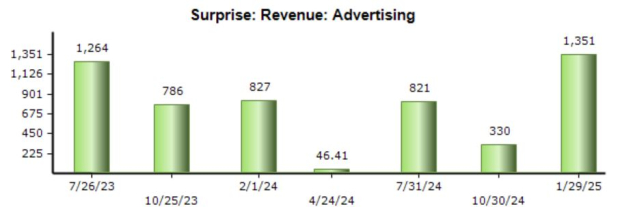

Meta Platforms reported impressive headline figures, with adjusted EPS at $8.02 and record sales totaling $48.4 billion, demonstrating year-over-year growth rates of 50% and 21%, respectively. The net income of $20.9 billion marked a historic high for the company.

The ad business remains a core strength, with $46.8 billion in revenue exceeding expectations, reflecting 20% growth from the previous year. Recent measurements indicate that Meta’s advertising results have consistently surpassed market predictions.

Image Source: Zacks Investment Research

Moreover, Meta continues to see user growth, with Family Daily Active People (DAP) increasing by 4% year-over-year, now totaling approximately 3.4 billion. Average revenue per user has similarly risen, showing a 41% increase from last year, bolstered by strong advertising initiatives.

Netflix’s Ad-Supported Tiers Propel Growth

Netflix’s recent success stems from user growth and the favorable impact of ad-supported membership tiers. Shares have shown significant performance throughout the past year, leading to a Zacks Rank #2 (Buy) designation.

In Q4, ad-supported plans represented over 55% of sign-ups in available regions, with membership in these plans growing nearly 30% from the previous quarter.

Image Source: Zacks Investment Research

Conclusion

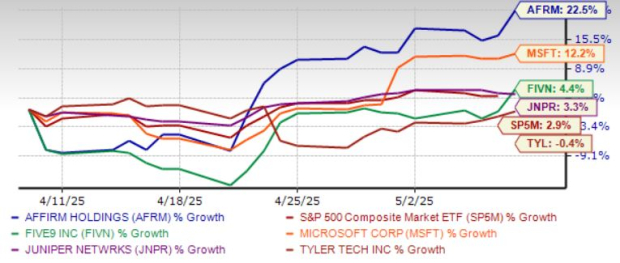

While recent market trends may be forgettable, the Q4 results from Philip Morris PM, Meta Platforms META, and Netflix NFLX showcase positive performance, with shares of each company gaining momentum following their earnings announcements.

Only $1 to see All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we surprised our members by offering 30-day access to all our picks for only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Many did not—believing there was a catch. Yes, we have a reason. We want you to become familiar with our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and others that closed 256 positions with double- and triple-digit gains in 2024 alone.

see Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX): Free Stock Analysis report

Philip Morris International Inc. (PM): Free Stock Analysis report

Meta Platforms, Inc. (META): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.