Market Hopes Rise Again with Dow’s Record High

After a brief pause, the stock market is experiencing another surge as the holiday season approaches. Historically, the fourth quarter has been favorable for stocks, which bodes well for the Dow’s continued ascent. Investors are encouraged to consider three strong blue-chip stocks: Amazon.com, Inc. AMZN, NVIDIA Corporation NVDA, and The Walt Disney Company DIS.

These companies are poised to benefit from the market’s upward trend and offer promising returns.

Dow Achieves Historic Closing

On Monday, the Dow soared 1%, gaining 440.06 points to reach a record close of 44,736.57 points. This marks the 45th time the index has set a record this year.

While technology stocks have been the main drivers of the recent rally, investor attention has shifted towards sectors more sensitive to the economy following the election. This shift has helped industrial and utility stocks to increase, benefitting both the Dow and the S&P 500.

The boost on Monday followed the announcement of President-elect Donald Trump’s selection of Treasury Secretary Scott Bessent, viewed as someone who could steer the economy while keeping inflation in check. Hopes for significant reforms, including tax cuts, are driving investor optimism.

Expectations for Continued Dow Growth

The Dow’s rally commenced on November 6, the day Trump won the presidential election, adding over 1,500 points in a single day; this represents the largest post-election gain in 128 years.

Investors are anticipating reduced taxes and regulatory changes, as Trump has shown a commitment to issues impacting the stock market and the dollar’s value.

Additionally, there is optimism that the Federal Reserve will maintain its rate cuts due to slowing inflation, now nearing the 2% target. Since September, the Fed has reduced interest rates by a total of 75 basis points, now placing its benchmark rate between 4.5% and 4.75%.

Federal Reserve Chairman Jerome Powell indicated the central bank is not in a rush to cut rates, citing economic strength. Nonetheless, many investors remain hopeful for a rate cut in December, with a 56.2% chance assigned for a 25-basis point reduction at the upcoming meeting.

Three Blue-Chip Stocks to Watch

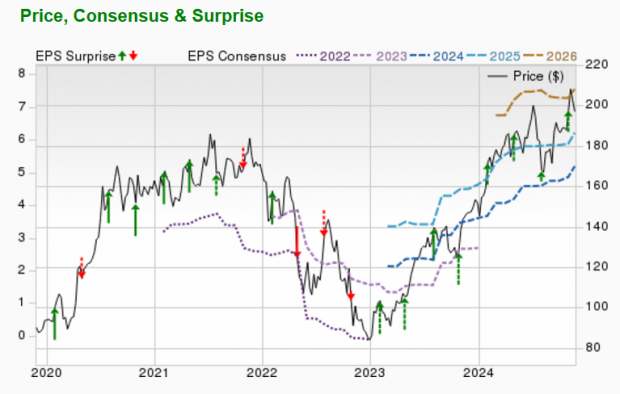

Amazon.com, Inc.

Amazon.com, Inc., a leading e-commerce giant, boasts extensive operations in North America and is expanding globally. The success of AMZN’s online retail business largely stems from its Prime program and vast distribution network. The acquisition of Whole Foods Market has helped Amazon solidify its presence in physical grocery retail. Furthermore, AMZN is a major player in the cloud-computing sector, particularly through Amazon Web Services.

Amazon is projected to achieve an earnings growth rate of 79% this year, with the Zacks Consensus Estimate for its current-year earnings having risen by 9.3% in the past 60 days. AMZN currently holds a Zacks Rank of #2 (Buy).

Image Source: Zacks Investment Research

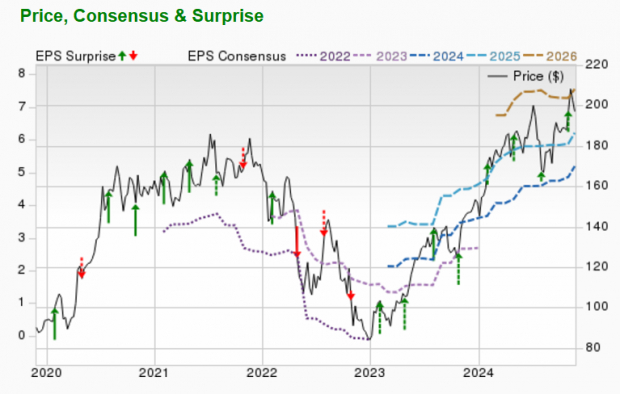

NVIDIA Corporation

NVIDIA Corporation is recognized globally for its innovations in visual computing technologies and is known as the creator of the graphics processing unit (GPU). Over the years, NVDA has shifted its focus from PC graphics to AI-based solutions that cater to high-performance computing, gaming, and virtual reality.

For this fiscal year, NVIDIA’s expected earnings growth rate is over 100%, with the Zacks Consensus Estimate for current-year earnings up by 3.2% in the last 60 days. NVDA holds a Zacks Rank of #2.

Image Source: Zacks Investment Research

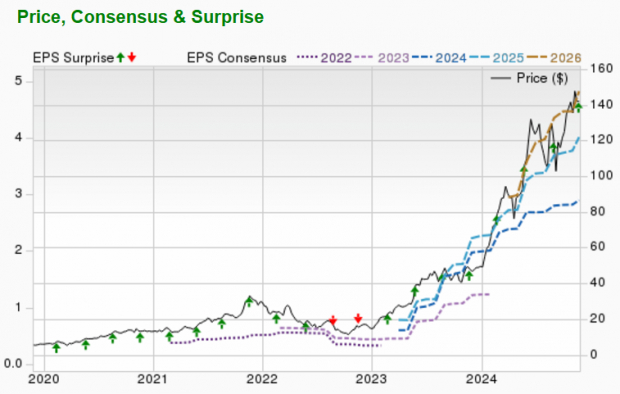

The Walt Disney Company

The Walt Disney Company operates various assets, including movies, television shows, and theme parks, reporting revenues of $91.4 billion in fiscal 2024. The fourth-quarter results for fiscal 2024 showed growth in Disney+ subscribers and the Media and Entertainment Distribution segment. Increased spending by guests at domestic theme parks and resorts also contributed to this growth.

The expected earnings growth rate for Disney this year is 8.3%, with the Zacks Consensus Estimate for current-year earnings rising by 4.9% over the past 60 days. DIS currently carries a Zacks Rank of #2.

Image Source: Zacks Investment Research

5 Stocks with High Potential

These stocks have been selected by a Zacks expert as the top candidates for gaining +100% or more in 2024. Although not every pick may prove successful, previous recommendations have shown remarkable returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report are under the radar on Wall Street, presenting an excellent opportunity for early investments.

Explore These 5 Potential High Gain Stocks >>

For the latest recommendations from Zacks Investment Research, you can download the report titled 5 Stocks Set to Double. Click here to access this free information.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.