Key Earnings Updates for Q1 2025: Major Companies Shine

The 2025 Q1 earnings cycle is underway, with numerous companies scheduled to announce their quarterly results soon. In this period, guidance has become particularly significant due to the heightened uncertainty stemming from recent tariff announcements and economic shifts.

Many companies, including Boston Scientific (BSX), Meta Platforms (META), and Microsoft (MSFT), have reported positive results, which have led to favorable share reactions. Here’s a closer examination of the recent performance.

Boston Scientific Raises Guidance

Boston Scientific significantly outperformed expectations, achieving a strong 12% EPS beat and sales ahead of projections by 2.3%. The company raised its full-year guidance, reflecting an optimistic outlook. Consequently, BSX now possesses a Zacks Rank of #2 (Buy).

Following this favorable report, analysts revised their sales and EPS expectations upward. BSX is now projected to see 16% EPS growth alongside a 17% increase in sales, supported by a Style Score of ‘B’ for Value.

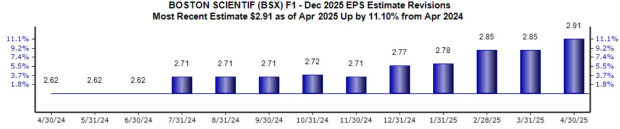

Here are the current fiscal year EPS revisions:

Image Source: Zacks Investment Research

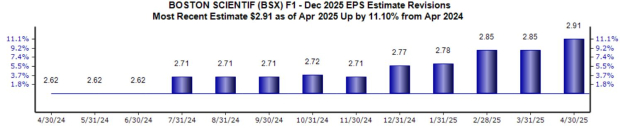

And the sales revisions trend for the current fiscal year:

Image Source: Zacks Investment Research

The strong performance across various segments has bolstered Boston Scientific’s positive outlook and contributed to its updated guidance amid current uncertainties.

Meta Platforms’ Advertising Revenue Strong

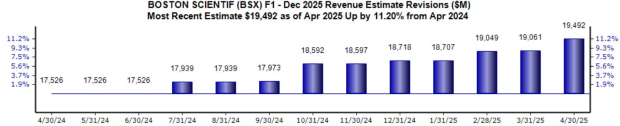

Meta Platforms continued its impressive performance by exceeding expectations for EPS and sales, driven by robust advertising revenue that reached $41.3 billion—a year-over-year increase of 16%.

Below is a quarterly chart that illustrates META’s advertising revenue growth:

Image Source: Zacks Investment Research

The average price per ad increased by 10% year-over-year, while the daily active people across Meta’s platforms rose by 6%. This growth in user engagement provided significant advantages for the company.

Microsoft’s Cloud Demand Impresses

In Microsoft’s latest release, the company reported an EPS of $3.46 and revenue of $70.0 billion, both significantly exceeding consensus expectations. Overall sales saw an impressive 13% year-over-year growth, with EPS climbing 18%.

Strength in Microsoft Cloud and AI solutions propelled these robust results. Notably, Microsoft Cloud revenue surged 20% year-over-year to $42.4 billion. The demand for services from this tech giant shows no signs of weakening, with positive trends expected to continue.

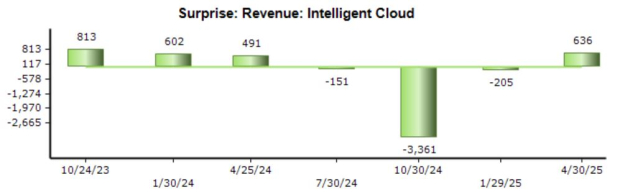

The Intelligent Cloud segment, which includes Azure, generated revenue of $26.8 billion, up 21% from the previous year, marking a notable return to form after a period of misses.

Image Source: Zacks Investment Research

Bottom Line

The Q1 2025 earnings cycle continues to progress, with all three companies highlighted—Boston Scientific (BSX), Meta Platforms (META), and Microsoft (MSFT)—recording positive market responses following their respective quarterly releases.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.