Three High-Growth Stocks to Consider for Your Portfolio

For investors, finding stocks with long-term potential is crucial. While it’s wise to choose companies that are solid investments regardless of timing, some prospects show promise for significant growth in the coming years. Examples include Nvidia during the rise of artificial intelligence and Amazon in the early 2000s. While timing may not be everything, it certainly matters.

Considering an investment of $1,000? Our analysts have identified the 10 best stocks currently on the market. See the 10 stocks »

With that in mind, let’s explore three promising stocks that could be worthwhile to buy and hold for the next decade. Each company appears to be on the cusp of significant growth.

In no particular order…

Dutch Bros Coffee

Typically, the coffee industry does not boast high-growth rates, whether discussing retail or home brewing. Major player Starbucks has long captured much of this market’s growth. However, changes are brewing in the premium coffee drive-thru sector. Current coffee drinkers are shifting toward a more relaxed and casual experience instead of the formal setting that Starbucks provides.

Meet Dutch Bros (NYSE: BROS). Anyone traveling through the western U.S. is likely familiar with its 950 kiosks. Customers often enjoy friendly service that emphasizes personality and fun—qualities that resonate with today’s clientele.

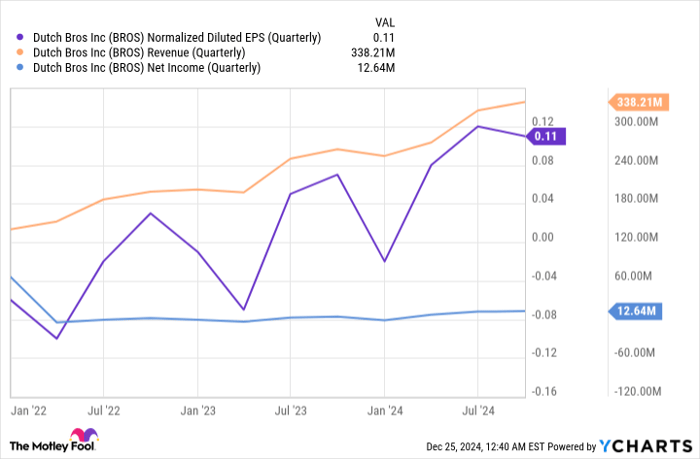

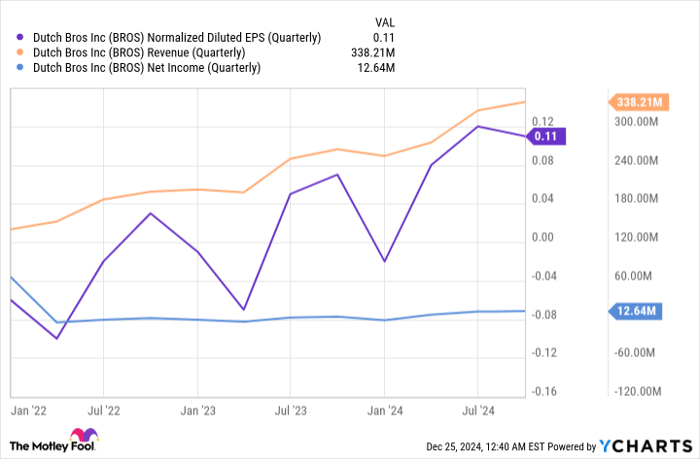

Recent financials support its positive trajectory; Dutch Bros reported a 2.7% increase in same-store sales for the third quarter compared to the previous year, marking its seventh consecutive quarter of growth. Overall sales surged 28% year over year, aided by the addition of 38 new locations.

BROS Normalized Diluted EPS (Quarterly) data by YCharts. EPS = earnings per share.

This performance is just the beginning. Dutch Bros aims to grow its total outlets to 4,000 in the coming years, and with its current growth momentum, achieving this target seems feasible.

SoFi Technologies

Another noteworthy option is online bank SoFi Technologies (NASDAQ: SOFI). The online banking sector is poised for considerable expansion, making this a strategic time to invest.

Although online banking isn’t a new concept, it continually evolves. As new generations of consumers become more comfortable with technology, they expect enhanced digital services. According to Straits Research, the global online banking market is projected to grow nearly 14% annually through 2030, with Technavio estimating growth closer to 17%. SoFi has a great opportunity to capture a significant portion of that market.

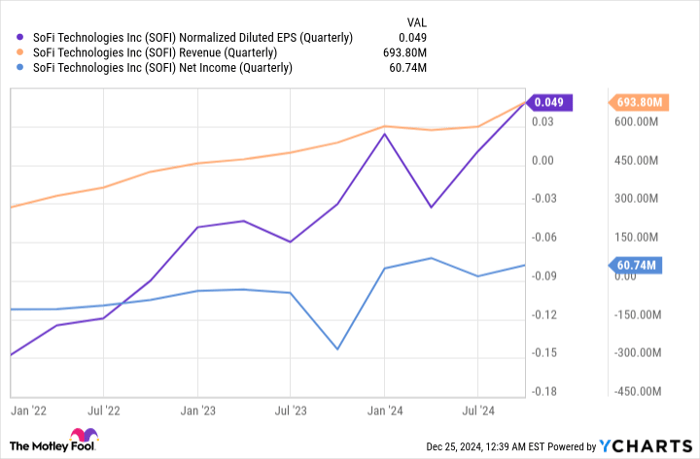

But SoFi offers more than just traditional online services. Operating as a commercial bank, it provides checking and savings accounts, investing services, loans, and credit—all without any physical branches. This business model has proven successful, as the company now has nearly 9.4 million customers and has seen consistent quarterly growth for the last 18 quarters.

More significantly for potential investors, SoFi is on track to post its first full-year profit of $0.13 per share this year.

SOFI Normalized Diluted EPS (Quarterly) data by YCharts. EPS = earnings per share.

Looking ahead, analysts believe SoFi could achieve per-share earnings of $0.29 in 2025 and $0.49 in 2026, further encouraging confidence in its innovative business model.

IonQ

Finally, consider IonQ (NYSE: IONQ) as a long-term investment option. Although it’s not yet a household name, IonQ specializes in quantum computers that can tackle problems in minutes that would take traditional computers years to solve.

This advanced technology holds promise across various sectors, including artificial intelligence, cybersecurity, drug development, and financial modeling. Despite its high-tech capabilities, IonQ’s products are not designed for personal use; rather, they serve institutional needs that require powerful computational resources.

IonQ’s third-quarter revenue reached $12.4 million, more than double from the previous year, reflecting a sustained growth rate since quantum computing began to gain traction.

The demand for such technology continues to rise, with Precedence Research predicting that the global quantum computing market will expand from about $1 billion annually to $16 billion by 2034, translating to an average annual growth rate of over 30%.

In response to IonQ’s advancements, tech giant Alphabet recently entered the quantum computing sphere, unveiling its quantum chip, Willow, in December, suggesting a competitive landscape.

Alphabet’s Quantum Leap: A Competitive Edge in Technology

The Landscape of Quantum Computing: A Closer Look

Alphabet, the parent company of Google, holds a significant advantage in the tech world. With more financial resources than IonQ, Alphabet is well-positioned to advance and market its quantum computing solutions. Nonetheless, IonQ has established a strong head start against this formidable newcomer.

A New Investment Opportunity Awaits

Have you ever felt like you missed your chance to invest in top-performing stocks? There’s good news—you might have another opportunity on the horizon.

Our expert team frequently identifies stocks they believe will see substantial growth. When they designate a company as a “Double Down” stock, it can signal an exciting investment opportunity. If you think you’ve already missed your shot, consider buying in now before it becomes too late. Take a look at some remarkable numbers:

- Nvidia: Investing $1,000 when we doubled down in 2009 would now be worth $363,593!*

- Apple: An investment of $1,000 from 2008 would have grown to $48,899!*

- Netflix: If you invested $1,000 in 2004, it would now stand at $502,684!*

Currently, we are issuing “Double Down” alerts for three extraordinary companies. This might be one of the best chances you’ll get in a while.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, the former CEO of Whole Foods Market, part of Amazon, is also a board member. James Brumley has invested in Alphabet. The Motley Fool has holdings in and recommends Alphabet, Amazon, Nvidia, and Starbucks. The Motley Fool also recommends Dutch Bros. For more information, you can review The Motley Fool’s disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.