Top Stocks to Consider for Future Market Downturns

Despite recent significant market drawdowns, it is still not at the level typically associated with a “crash.” However, investors should prepare a buying list for potential crashes. Emotional reactions can often cloud judgment when portfolios decline 20% or more. By researching and establishing a list of target companies ahead of time, you can focus on fundamental questions: Will this company withstand a downturn in the next three to five years?

Three companies that stand out as strong candidates for investment during a market crash are Taiwan Semiconductor Manufacturing (NYSE: TSM), MercadoLibre (NASDAQ: MELI), and CrowdStrike (NASDAQ: CRWD). Each company’s unique qualities position them favorably against economic downturns.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor is a major chip foundry that fabricates microchips for various companies unable to produce their own. Given the specialized nature of this industry, many high-technology devices rely on chips created by Taiwan Semiconductor. If you anticipate growth in technology using advanced chips over the next five years, this company is a solid investment choice.

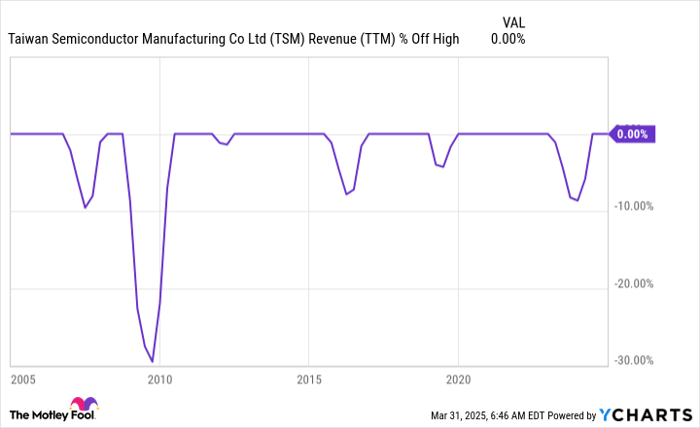

Nevertheless, the chip industry is cyclic, with demand varying widely according to predictable trends. Large-scale shifts in manufacturing and end-user demand often cause these cycles. Consequently, when downturns occur, stock values can plummet as financial performance declines.

TSM Revenue (TTM) data by YCharts

Owning shares in Taiwan Semiconductor involves accepting the volatility tied to the chip sector. A significant market crash may result in decreased consumer demand for high-tech devices, adversely affecting Taiwan Semiconductor. However, economic recovery would revitalize demand, pushing stock prices to new heights.

MercadoLibre

MercadoLibre stands out as a leader in Latin American e-commerce and fintech. Resembling a combination of Amazon (NASDAQ: AMZN) and PayPal (NASDAQ: PYPL), the company is specifically designed to serve this underserved region. Consequently, it offers investors global diversification often missing in domestic portfolios. While market crashes may impact global economies, specific domestic issues may leave Latin American financial systems relatively unscathed, allowing MercadoLibre to maintain stability despite being listed on a U.S. exchange.

Furthermore, Latin America remains in the early stages of e-commerce and fintech development, lagging behind the U.S. Despite potential slowdowns from a global recession, it’s unlikely this trend will cease altogether.

CrowdStrike

Among essential software products for effective business operation, none is more crucial than cybersecurity. Without secure data operations, consumer trust erodes, directly impacting revenues. Thus, CrowdStrike—a leading cybersecurity software firm—should continue performing well during market declines.

While onboarding new clients may prove challenging during downturns, CrowdStrike is expected to retain its existing customer base. This positions the company with a low risk during recessions and a high potential for recovery once the economy rebounds.

However, due to CrowdStrike’s high valuation, a market downturn might lead to a steeper sell-off compared to peers. Yet as the market stabilizes and growth resumes, CrowdStrike could witness a significant rebound, providing substantial returns for investors.

This selection focuses on stocks that may experience significant short-term declines but are likely to recover robustly as the market improves. As a long-term investor, I look at a timeframe of three to five years rather than purely short-term fluctuations. A narrow focus may push investors toward safer assets during downturns, rather than investing in undervalued stocks poised for growth on recovery.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Prior to investing in Stock with Taiwan Semiconductor Manufacturing, consider the following:

The Motley Fool Stock Advisor analyst team has identified what they perceive to be the 10 best stocks for present investment—and Taiwan Semiconductor did not make the list. The chosen stocks could yield significant returns in the upcoming years.

For instance, when Nvidia appeared on this list on April 15, 2005, if you had invested $1,000 at that time, it would now be worth $676,774!*

Stock Advisor offers an accessible guide for investors seeking success, including portfolio-building guidance, regular analyst updates, and two fresh Stock picks each month. The Stock Advisor service has outperformed the S&P 500 more than fourfold since 2002*. Don’t miss the latest top 10 list, accessible upon joining Stock Advisor.

see the 10 stocks »

*Stock Advisor returns as of April 1, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Amazon, CrowdStrike, MercadoLibre, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon, CrowdStrike, MercadoLibre, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short March 2025 $85 calls on PayPal. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.