“`markdown

**Investors are keenly focusing on stocks that excelled in Q4 results this week, particularly Advanced Micro Devices (AMD), Simon Property Group (SPG), and Teradyne (TER).**

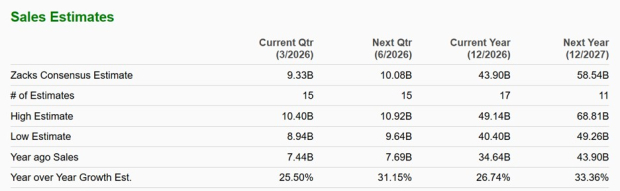

On Wednesday, AMD reported a Q4 revenue of $10.27 billion, a 34% increase year-over-year, with earnings per share (EPS) of $1.53, exceeding expectations by nearly 16%. However, despite this strong performance, the stock fell 17% in response to conservative guidance for Q1, forecasting revenues at $9.8 billion against a Wall Street estimate of $9.33 billion. Meanwhile, SPG achieved a 52-week high at $195 per share following positive Q4 results, with total returns exceeding 160% over the past five years.

Teradyne, which reported a record Q4 revenue of $1.08 billion, noted a 44% year-over-year increase in sales and EPS of $1.80, surpassing estimates by 32%. The momentum is driven by strong demand in the AI and semiconductor sectors, contributing to a stock rally of 150% over the past year. These results position AMD, SPG, and TER as significant contenders for investors seeking growth and income opportunities in the current market.

“`