“`html

Investors Gear Up for an Uncertain 2025: Key Stocks to Consider

After Wednesday’s FOMC meeting, concerns loom for investors about what 2025 may hold. Jerome Powell, the Fed Chair, voiced worries over rising inflation and indicated a more hawkish approach moving forward. Rather than fixate on predictions for next year, investors might find it beneficial to build a diverse portfolio that can weather different economic scenarios.

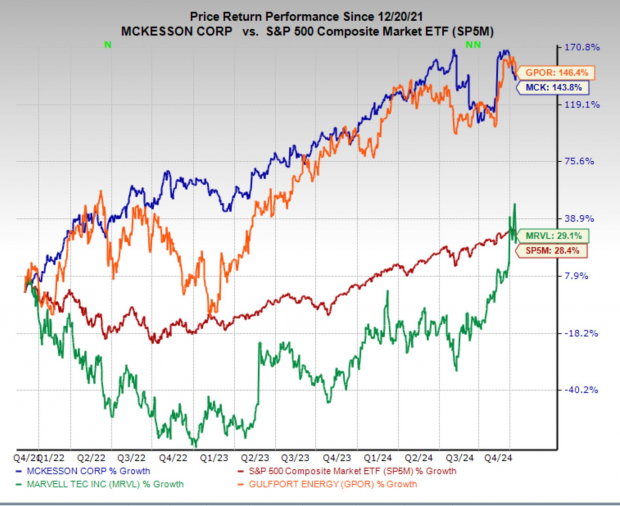

While 2024 has been marked by robust economic growth, tranquil inflation, exciting AI advancements, and boosted tech stocks, the path for 2025 could differ significantly. Should the Fed maintain a stringent policy and inflation increase, a portfolio focused on commodities may perform better than one dominated by technology. Given the unpredictable nature of the future, diversifying through a balanced stock portfolio enables some investments to mitigate potential losses in others.

Below, three stocks reflect robust fundamentals and stand poised to thrive under varied economic conditions in the coming year. Gulfport Energy (GPOR) is an inflation hedge, McKesson (MCK) offers defensive qualities for downturns, and Marvell Technology (MRVL) is likely to thrive if AI gains more traction. Each of these companies also holds a top Zacks Rank.

Image Source: Zacks Investment Research

Gulfport Energy: A Strong Hedge Against Inflation

Based in Oklahoma City, Gulfport Energy is an independent oil and gas exploration and production company focused on the Utica Shale and Scoop Stack regions. With a strong emphasis on natural gas, it’s well-positioned to benefit from favorable trends in the energy sector.

If we see rising inflation again, commodities stocks often thrive—as demonstrated in 2022. Energy is particularly sensitive to price changes, and when prices rise, energy producers typically witness a swift increase in profits due to stable production costs.

Moreover, Gulfport Energy has compelling business fundamentals, boasting a Zacks Rank #1 (Strong Buy) rating and a reasonable valuation. With GPOR trading at a one-year forward earnings multiple of 11.9x and earnings projected to increase by 46% next year, it appears to be an attractive investment option.

Image Source: Zacks Investment Research

McKesson: Resilient Healthcare Leader

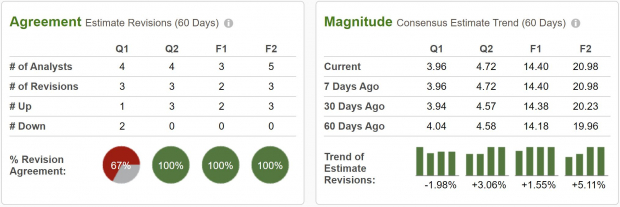

As a leading healthcare services and pharmaceutical distribution company, McKesson plays a vital role in the U.S. healthcare system, delivering medicines and supplies to various providers. The company’s operational efficiency and expansion into oncology and specialty care position it strongly within the industry.

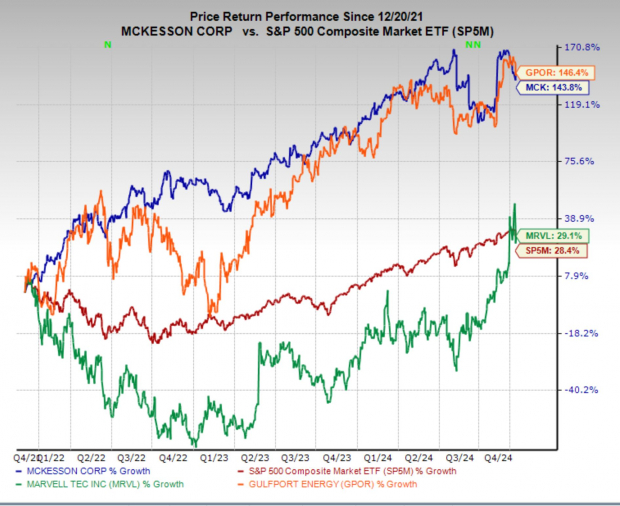

Regardless of economic conditions, demand for healthcare services usually remains steady. This stability has allowed McKesson’s earnings to grow consistently over the past two decades, from $2.40 per share to $28.87 per share.

McKesson maintains a Zacks Rank #1 (Strong Buy) rating. Its current forward earnings multiple is 17.5x, above its 15-year median of 13.3x yet below the broader market average. The company’s valuation might rise if market volatility increases.

Image Source: Zacks Investment Research

Marvell Technology: Leading in AI Innovation

Marvell Technology specializes in semiconductor solutions, focusing on data infrastructure. The company has garnered attention for its innovative chips designed for cloud computing, AI, and networking applications.

The introduction of custom silicon solutions has driven Marvell’s success, leading to strong quarterly earnings earlier this month. While Nvidia dominates the AI infrastructure market, Marvell’s unique offerings position it as a key player in this burgeoning industry.

“`

Marvell Technology’s Growth Impresses as Analysts Boost Earnings Outlook

Demand for Customized Solutions Drives Marvell’s Strong Performance

Recent trends indicate that hyperscalers are increasingly seeking tailored solutions to meet their specific computing requirements. In the last quarter, Marvell Technology reported a remarkable 20% growth in revenues quarter-over-quarter, with projections suggesting a similar 20% increase for the upcoming quarter.

This upward trajectory has prompted analysts to revise their earnings expectations for the company, leading to a Zacks Rank #1 (Strong Buy) rating for Marvell Technology. Following the announcement of its recent quarterly results, MRVL stock experienced a significant breakout. Currently, after this initial surge, the stock has entered a phase of bullish consolidation. If the AI trend continues its momentum, MRVL stock could maintain this consolidation over the next few weeks before breaking out again.

Image Source: TradingView

Opportunities in GPOR, MCK, and MRVL for Investors

For investors seeking a balanced investment strategy for 2025, Gulfport Energy, McKesson, and Marvell Technology present interesting options. This varied portfolio is well-equipped to adapt to different economic situations, whether facing inflation pressures, a potential downturn, or benefiting from technological advances. Each of these stocks provides a distinct advantage, making the portfolio resilient in diverse market environments.

Zacks Unveils 10 Stocks to Watch for 2025

Curious about which stocks might outperform in 2025? Historical data suggests significant potential, as the Zacks Top 10 Stocks have yielded impressive results.

Since 2012, under the guidance of Director of Research Sheraz Mian, the Zacks Top 10 Stocks achieved a staggering return of +2,112.6%, greatly surpassing the S&P 500’s +475.6%. Currently, Mian is sifting through 4,400 companies to identify the top 10 stocks to purchase and hold throughout 2025. Don’t miss your opportunity to learn about these recommended stocks on January 2.

Be First to New Top 10 Stocks >>

Get your Free Stock Analysis Report for McKesson Corporation (MCK)

Get your Free Stock Analysis Report for Marvell Technology, Inc. (MRVL)

Get your Free Stock Analysis Report for Gulfport Energy Corporation (GPOR)

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.