Key Tech Stocks to Watch Amid Rebounding Market

Several tech stocks have gained attention in this week’s earnings report, becoming increasingly relevant as the broader market shows signs of recovery.

Among them, three companies are particularly notable for their advancements in artificial intelligence, which are enabling them to capture greater market share.

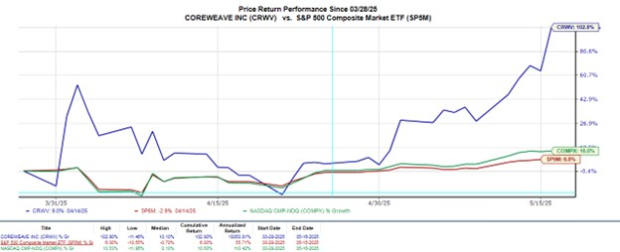

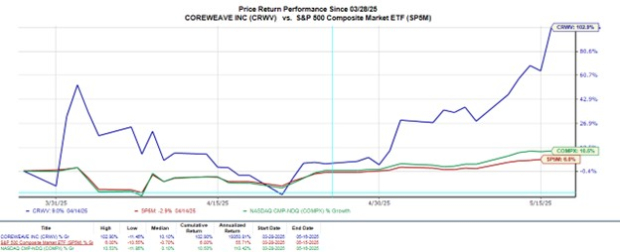

CoreWeave – CRWV

CoreWeave CRWV, which focuses on AI cloud computing infrastructure, released its inaugural quarterly report on Wednesday following its public debut in March. Although CoreWeave reported a net loss of $149.6 million, or -$1.49 per share, its revenue surged 420% year-over-year, reaching $981.6 million.

Investor sentiment has been bolstered by Nvidia NVDA’s recent disclosure of a significant stake in CoreWeave, owning 24.18 million shares. Nvidia’s high-performance GPUs are integral to CoreWeave’s services. Additionally, CoreWeave secured a $4.1 billion contract with OpenAI, alongside major clients like Microsoft MSFT and Meta Platforms META.

CoreWeave shares surged more than 35% this week and have risen over 100% since the IPO, hitting an all-time high of $84.

Image Source: Zacks Investment Research

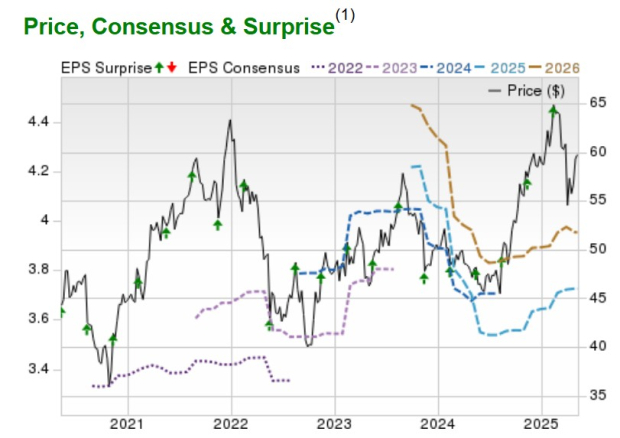

Cisco Systems – CSCO

Cisco Systems CSCO reported strong operational results for its fiscal third quarter on Wednesday, surpassing both revenue and earnings expectations. The company’s focus on networking, security, and data center solutions tailored for AI workloads has driven this growth.

Cisco’s Security segment revenue climbed 54% to $2.01 billion, aided by over $600 million in AI infrastructure orders during the quarter. Overall, Q3 sales rose 11% to $14.15 billion, beating estimates of $14.05 billion. Cisco has consistently met or exceeded EPS expectations since 2012, with Q3 EPS reaching $0.96, above estimates of $0.91 and an increase from $0.88 in the same quarter last year.

Additionally, Cisco is partnering with the AI Infrastructure Partnership (AIP) alongside Microsoft, BlackRock BLK, and Nvidia to invest in scalable AI data centers.

Image Source: Zacks Investment Research

CyberArk Software – CYBR

CyberArk Software CYBR, known for its identity security solutions, reported strong financial results this week, driven by heightened demand. The company’s emphasis on integrating artificial intelligence into its security offerings has led to the establishment of an AI Center of Excellence, enhancing threat detection.

Currently trading over $350 a share, CYBR has gained 35% in 2025. The company reported Q1 sales of $317.6 million, reflecting a 43% year-over-year increase and exceeding estimates of $305.66 million. EPS improved by 30%, rising to $0.98 from $0.75 in Q1 2024, surpassing expectations of $0.79. CyberArk has shown an impressive average earnings surprise of 44.33% over its last four quarterly reports.

Image Source: Zacks Investment Research

Bottom Line

CoreWeave, Cisco Systems, and CyberArk Software exhibited notable quarterly performance. With bullish market sentiment returning and the potential growth driven by AI, these tech stocks could see upward movement in the near future.

The views and opinions expressed herein are those of the author and do not necessarily reflect any other organization.