SentinelOne: Leading the Way in Cybersecurity

The Rise: SentinelOne has seen impressive growth, with revenue up by 33% year over year. Its autonomous security platform, combining cybersecurity and AI, is highly sought after by businesses due to its cutting-edge protection against cyber threats.

Partnership Potentials: Recently striking a deal with Lenovo could significantly boost revenue, with analysts estimating a $1 billion mark next year. Despite its recent success, SentinelOne continues to show potential for outperformance.

Netflix: Dominating the Streaming Industry

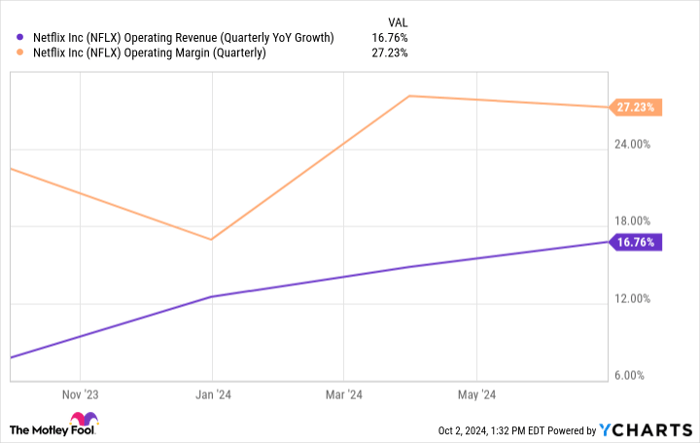

Streaming Superiority: Netflix maintains a strong position in the streaming market, with ongoing revenue growth and increased operating margins. Data shows Netflix leading the streaming viewership, highlighting its competitive edge against rivals.

Future Outlook: With a successful business model and growing ad-tier business, Netflix is well-prepared for a stellar 2025. Investors are urged to consider Netflix for potential gains.

Sea Limited: Paving the Way for Recovery

The Rebound: After a challenging period post-2022, Sea Limited is showing signs of recovery. The Singapore-based company, thriving during the pandemic, is regaining momentum in its retail, gaming, and fintech sectors.

Turning the Tide: Despite setbacks, Sea Limited is refocusing its efforts with promising prospects for growth. After a significant stock drop, the company has potential for resurgence in the coming year.

Sea Limited Sees Revenue Rise 23% to $7.5 Billion in First Half of 2024

Shopee Focuses on Asian Markets, Sea Money Prospers, Stock Up 115%

Sea Limited’s strategic exits from non-Asian markets and increased investments in its logistics infrastructure have benefited shareholders. The popularity surge of Free Fire and collaboration efforts with the Indian government have also contributed positively. Sea Money, the company’s fintech arm, has thrived, playing a significant role in Sea Limited’s substantial year-over-year revenue growth.

Despite the 23% revenue increase, a 73% surge in sales and marketing expenditures has led to a decline in net income. The majority of this spending is related to e-commerce ventures and Sea Money operations. The company anticipates these investments to yield higher revenues and profits in the long run.

Investors have shown confidence in Sea Limited’s new direction, with the stock soaring over 115% in the last year. Although the lower net income has impacted the P/E ratio, the company’s P/S ratio of 3.8 is comparable to e-commerce giant Amazon’s 3.3. With the stock still significantly below its 2021 peak, Sea Limited is poised for substantial growth in 2025.

Considerations Before Investing in Sea Limited

Despite not being among the 10 best stocks identified by the Motley Fool Stock Advisor team, Sea Limited holds promise for investors. The service has a track record of significant returns and expert guidance for building a successful portfolio. Investors looking for substantial growth potential may find Sea Limited a compelling investment option.

*Stock Advisor returns as of September 30, 2024

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.