Three Promising Tech Stocks Positioned for Growth Amid Market Upswing

Tariff negotiations show progress, and market volatility appears to be easing. This environment suggests that a bull market may be regaining traction. While established names like the Magnificent 7 and prominent AI companies are set to benefit, investors willing to explore lesser-known firms could uncover significant opportunities.

This article focuses on three under-the-radar tech stocks that are already gaining momentum and show potential for further growth. Each of these companies is considered a high-growth innovator, supported by strong growth forecasts, robust stock performance, and a top Zacks Rank.

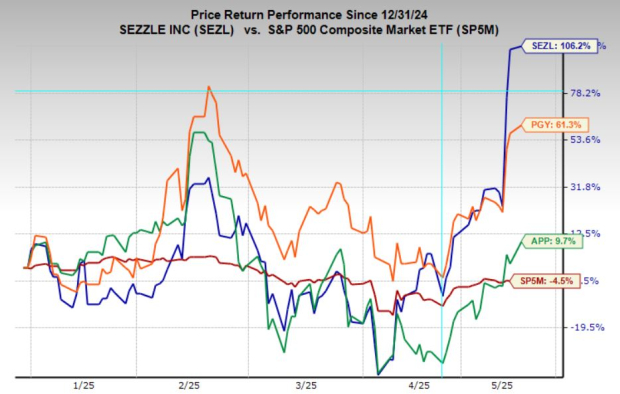

Sezzle Inc. (SEZL), Pagaya Technologies Ltd. (PGY), and AppLovin (APP) are three notable companies with substantial potential amidst current market conditions. These stocks may not be as widely recognized, but they present noteworthy opportunities for investors willing to embrace higher volatility.

Image Source: Zacks Investment Research

Pagaya Technologies Ltd: A Rising Star in AI and Finance

Pagaya Technologies Ltd. is emerging as a compelling option in the market. The company blends AI and financial technology to enhance credit decision-making and underwriting for consumer lending platforms. Its proprietary AI models enable financial institutions to broaden access to credit while effectively managing risk—a significant opportunity in a growing market.

After experiencing a downturn following a disappointing Q1 earnings report, Pagaya has rebounded quickly. Analysts have raised earnings forecasts as results turned positive. The company now holds a Zacks Rank #1 (Strong Buy) rating.

Valuation also presents an attractive picture. Pagaya trades at just 8.3 times forward earnings, despite expected sales growth of 20% this year and 16% next year. Notably, earnings are projected to increase by 112% in 2025 and 39% in 2026.

For investors seeking a high-growth, AI-focused stock with significant upside potential, Pagaya is worth considering.

Image Source: Zacks Investment Research

Sezzle Inc: Affordable Shares Amidst Strong Growth

Sezzle Inc. has become a solid prospect, especially since my initial highlight in the fall of 2024. The company plays a significant role in the Buy Now, Pay Later (BNPL) sector, providing consumers with flexible financing options while emphasizing profitability and controlled growth.

Despite its recent strong performance, Sezzle remains attractively priced, trading at 26.9 times forward earnings. This is particularly appealing given projected sales growth of 62% this year and another 20.8% next year, along with expected earnings growth of 76% in 2025 and 30% in 2026.

Sezzle also holds a Zacks Rank #1 (Strong Buy), reflecting a positive earnings revision trend. Recently, analysts raised earnings estimates significantly, with increases of 46.6% for 2025 and 45.2% for 2026. For growth-oriented investors, Sezzle offers robust momentum and an upward trajectory in expectations.

Image Source: Zacks Investment Research

AppLovin: A Stock Gaining Attention with Upgrades

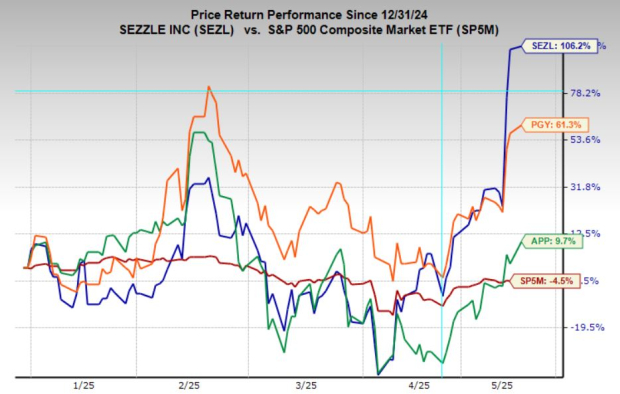

AppLovin has emerged as a standout performer in the tech sector over recent years, although it remains relatively under the radar. The company provides a leading mobile app marketing and monetization platform driven by machine learning, assisting app developers in maximizing revenue through targeted advertising and user engagement tools.

Having achieved significant gains over the past two years, AppLovin received attention early on from analysts at Zacks before its substantial rise. Recently, the stock experienced a notable wave of upward earnings revisions, with estimates increasing by 19.2% for the current quarter, 12.5% for the entire year, and 18.8% for the following year.

AppLovin’s Growth Projections Highlight Potential Investment Opportunities

AppLovin trades at a premium valuation of 42.5x forward earnings. However, anticipated sales growth of 24.3% in 2025 and 16.3% in 2026, alongside expected earnings increases of 70.6% this year and 44.8% next year, help justify this premium.

Given its strong fundamentals and consistent analyst upgrades, AppLovin is recognized as one of the most compelling but under-followed tech stocks currently available.

Image Source: Zacks Investment Research

Investment Opportunities in PGY, SEZL, and APP

For investors looking for high-growth tech options outside the major players, Pagaya Technologies (PGY), Sezzle (SEZL), and AppLovin (APP) present an enticing blend of earnings strength and long-term potential. Supported by increasing analyst estimates and strong Zacks Ranks, these stocks are poised to emerge as leaders in the next tech rally.

Emerging Semiconductor Stock Shows Promise

One notable semiconductor stock has gained attention, being only 1/9,000th the size of NVIDIA, which has risen over 800% since its recommendation. While NVIDIA continues to perform well, this upcoming semiconductor firm has significant growth potential.

The company is well-positioned to meet the surging demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. Additionally, the global semiconductor manufacturing sector is expected to grow dramatically from $452 billion in 2021 to $803 billion by 2028.

AppLovin Corporation (APP): Free Stock Analysis report

Pagaya Technologies Ltd. (PGY): Free Stock Analysis report

Sezzle Inc. (SEZL): Free Stock Analysis report

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.