Investing Smart: Top Vanguard ETFs for Long-Term Growth

Vanguard ETFs are a favorite choice among investors for good reasons. These funds provide options to invest in almost every stock market index, sector, fixed-income, or commodity you desire. Moreover, Vanguard offers a cost-effective way for everyday investors to enter the market.

Some Vanguard ETFs have impressively low expense ratios, starting at just 0.03%. This ratio indicates that an annual cost of a $1,000 investment amounts to only $0.30. It’s important to understand that the expense ratio isn’t a direct fee; instead, it affects the fund’s performance over time.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

At the time of writing, there are 88 different Vanguard ETFs available. Most of these are solid investments, especially for long-term goals of building a diversified portfolio. However, some may offer better opportunities than others. Here are three Vanguard ETFs that stand out currently.

Why the Vanguard S&P 500 ETF Is a Must-Have

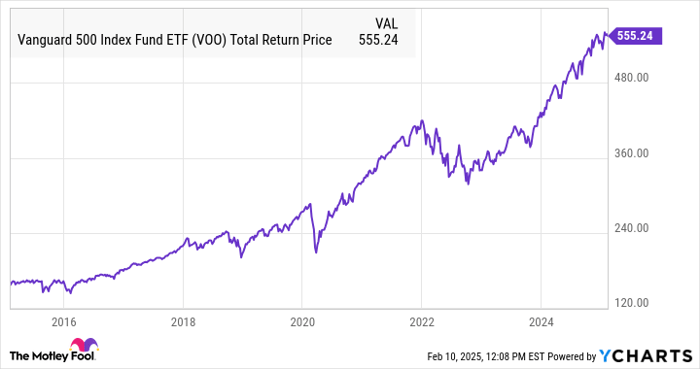

In any economic climate, the Vanguard S&P 500 ETF (NYSEMKT: VOO) is a strong contender for long-term investments. This ETF tracks the S&P 500 index, which is recognized as a leading indicator of the U.S. stock market’s overall health.

VOO Total Return Price data by YCharts

Historically, the S&P 500 has delivered annualized returns of 9%-10%. For example, a $1,000 investment with a consistent 10% return over 40 years could grow to more than $45,000. New investors should note that many stock market millionaires achieve their wealth not by picking individual stocks, but by consistently investing in the S&P 500 and holding over the long haul.

Real Estate: A Promising Asset Class

Real estate is classified as an official stock market sector but is often viewed as a separate asset class. The Vanguard Real Estate ETF (NYSEMKT: VNQ) tracks an index mainly made up of real estate investment trusts (REITs). Notable REITs include Prologis (NYSE: PLD), a leader in warehouse space, Public Storage (NYSE: PSA), which operates self-storage units, and Simon Property Group (NYSE: SPG), known for its popular shopping malls.

REITs are required to distribute at least 90% of their taxable income to shareholders, making them strong dividend stocks. Currently, the Vanguard Real Estate ETF offers a dividend yield of about 3.8%. Combined with the rising value of real estate, this creates strong potential for total returns.

The Vanguard Russell 2000 ETF: Attractive Opportunities Ahead

The Vanguard Russell 2000 ETF (NASDAQ: VTWO) is another promising option. This ETF tracks the Russell 2000 index, recognized as the top index for small-cap stocks.

Small-cap stocks look appealing right now for several reasons. Falling interest rates often favor smaller companies, as they tend to rely more on debt compared to larger firms. Additionally, these stocks could benefit from reduced business regulations following the Trump administration’s initiatives.

Currently, small-cap stocks are trading at their lowest price-to-book ratios relative to larger caps in over 25 years. The typical Russell 2000 stock has a price-to-book ratio of 2.0, while the S&P 500 averages at 4.8. This valuation gap is reminiscent of 1999, when small caps significantly outperformed large caps for over a decade.

Don’t Miss Your Chance for a Lucrative Investment

Have you ever felt you missed the opportunity to invest in some of the most successful companies? Here’s your chance to catch up.

On rare occasions, our expert analysts release a “Double Down” stock recommendation for companies poised to rise. If you’re worried you’ve missed your moment, now is a prime time to invest. Look at these impressive numbers:

- Nvidia: If you had invested $1,000 in 2009, you would have $350,809!*

- Apple: A $1,000 investment in 2008 would now be worth $45,792!*

- Netflix: If you invested $1,000 in 2004, that would now be $562,853!*

Currently, we are issuing “Double Down” alerts for three fantastic companies, and this might be one of your last chances.

Learn more »

*Stock Advisor returns as of February 3, 2025

Matt Frankel has positions in Prologis, Public Storage, Simon Property Group, Vanguard Real Estate ETF, Vanguard Russell 2000 ETF, and Vanguard S&P 500 ETF and has the following options: short February 2025 $110 puts on Prologis. The Motley Fool has positions in and recommends Prologis, Simon Property Group, Vanguard Real Estate ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $90 calls on Prologis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.