AI Set to Transform Industries by 2025 Amid Growing Investments

As artificial intelligence (AI) continues to reshape various industries, the year 2025 is poised to mark a significant shift. AI is expected to transition from a tool for experimentation to a critical driver of business success.

According to a Gartner report, AI software spending is projected to hit $297.9 billion by 2027, driven by an acceleration in market growth from 17.8% to 20.4%, with an overall compound annual growth rate (CAGR) of 19.1% over the next five years. Meanwhile, Deloitte forecasts that enterprise spending on generative AI will rise by 25% in 2025 and may reach 50% by 2027. Governments are integral to this growth, with President Trump announcing a substantial $500 billion investment to bolster AI infrastructure and support leading technology firms.

AI Revolution 2025: Proactive Solutions Transforming Industries

The AI landscape is rapidly evolving, particularly with the surge in generative AI adoption and the advent of Agentic AI. This shift allows systems to transition from reactive operations to proactive solutions, enabling them to make autonomous decisions and enhance continuous learning with minimal human intervention.

Various sectors, especially healthcare, automotive, telecommunications, and retail, are increasingly implementing AI solutions. Industries are merging foundation models with proprietary datasets to develop context-aware AI applications. In healthcare, AI advancements are seen in treatment planning and predicting complications.

As AI workloads expand, companies are focusing on resource efficiency by investing in sustainable practices. This includes infrastructure such as zero-water cooling systems and carbon-neutral energy sources to mitigate environmental impacts. Furthermore, organizations are enhancing testing frameworks to identify and address AI hallucinations, which helps ensure the reliability and security of autonomous systems.

In the search engine arena, Google is integrating advanced AI models like Gemini 2.0. This model enhances its search capabilities by tackling complex queries related to coding and mathematics. The new AI Mode provides users with more conversational and comprehensive results to compete with AI-driven platforms such as ChatGPT.

Several companies are positioned to lead this AI transformation, including NVIDIA NVDA, Fortinet FTNT, C3.ai AI, and Palantir Technologies PLTR. Each of these firms plays a unique role in advancing AI technology, making them key players in reshaping the future of artificial intelligence.

NVIDIA’s Growth Driven by AI Demand and GPU Innovation

NVIDIA is experiencing rapid growth primarily due to its leadership in AI, particularly in generative AI. As businesses increasingly integrate AI technology to boost productivity, the demand for NVIDIA’s graphic processing units (GPUs) has surged. A Grand View Research report indicates that the global generative AI market was valued at $16.87 billion in 2024, with a projected CAGR of 37.6% from 2025 to 2030.

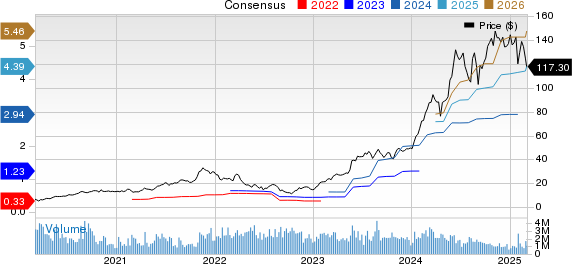

The heightened demand for generative AI and large language models powered by NVIDIA’s Hopper and Blackwell GPU architectures is bolstering data center revenues. Currently, the consensus earnings estimate for NVIDIA in fiscal 2026 is $4.39 per share, reflecting a 4.28% increase over the past month. Shares of NVDA have delivered a 32.1% return over the last twelve months.

NVIDIA Corporation Price and Consensus

NVIDIA Corporation price-consensus-chart | NVIDIA Corporation Quote

Fortinet Leads AI Cybersecurity with FortiAnalyzer

Fortinet is at the forefront of AI-enhanced cybersecurity through the expansion of its generative AI capabilities. This approach addresses the increasing demand for advanced security solutions that can swiftly adapt to new threats.

This Zacks Rank #2 company has recently introduced FortiAnalyzer, a streamlined entry point that transforms an organization’s security operations into a Turnkey AI-driven SecOps Platform for resource-constrained security teams.

The earnings consensus mark for 2025 is set at $2.45 per share, a slight increase over the past month. FTNT shares have yielded a 49.7% return over the past twelve months.

Fortinet, Inc. Price and Consensus

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

C3.ai Experiences Growth Amid Strong AI Demand and Microsoft Partnership

C3.ai is witnessing growth thanks to strong interest in its C3 Generative AI solutions and a growing partner network. In the third quarter of fiscal 2025, the company secured 47 agreements through its partner network, representing a 74% year-over-year increase.

This Zacks Rank #2 firm expanded its partnership with Microsoft to expedite AI adoption by enterprises. In the third quarter, C3.ai and Microsoft partnered on 28 agreements across nine industries, marking a 460% quarter-over-quarter surge. Their joint qualified opportunity pipeline grew over 244% from the previous year, with sales cycles shortening by nearly 20% sequentially.

The earnings consensus estimate for the company is a loss of 47 cents per share, showing a 25.40% improvement over the last month. Despite this, AI shares have declined by 28.8% over the past twelve months.

C3.ai, Inc. Price and Consensus

C3.ai, Inc. price-consensus-chart | C3.ai, Inc. Quote

Palantir Expands AI Influence in Finance Through TWG

Palantir is enhancing its AI capabilities within the financial sector via a joint venture with TWG Global, designed to strengthen its commercial AI services across financial institutions.

This Zacks Rank #2 firm has entered into a partnership with TWG Global to merge Palantir’s AI infrastructure with TWG’s expertise in the industry, aiming to improve AI integration in financial services.

The consensus earnings estimate for 2025 stands at 54 cents per share, reflecting an increase of 12.5% over the past month. PLTR shares have enjoyed a remarkable return of 240.6% over the past twelve months.

Palantir Technologies Updates: Price and Consensus Insights

Palantir Technologies Inc. Price and Consensus

Palantir Technologies Inc. price-consensus-chart | Palantir Technologies Inc. Quote

Explore Zacks’ Picks for Just $1

We’re serious.

A few years ago, our members were surprised when we offered a 30-day access to all our trade picks for just $1—no further commitments.

Many took advantage of this offer; however, others hesitated, fearing a hidden catch. The truth is, we hope you explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which saw 256 positions close with double- and triple-digit gains in 2024 alone.

Are you looking for the latest investment recommendations from Zacks Investment Research? Download our report on the 7 Best Stocks for the Next 30 Days. Click for your free copy.

NVIDIA Corporation (NVDA): Access your free Stock Analysis report.

Fortinet, Inc. (FTNT): Get your free Stock Analysis report.

C3.ai, Inc. (AI): Obtain your free Stock Analysis report.

Palantir Technologies Inc. (PLTR): Get your free Stock Analysis report.

This article was originally published in Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.