Market Uncertainty Challenges AI Stocks but Lingers Long-Term Promise

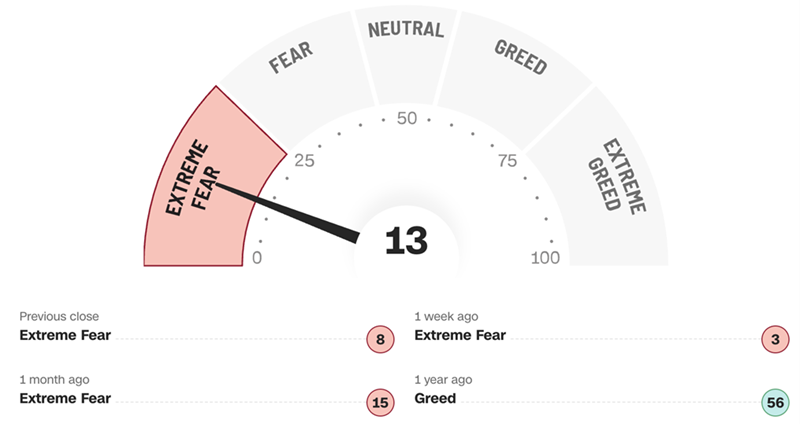

The market’s excitement over artificial intelligence (AI) is facing skepticism due to recent tariff announcements from the Trump administration. Following a strong showing that saw the market reach all-time highs, stocks initially fell sharply and neared a technical bear market. However, recovery occurred after President Donald Trump announced that most of his tariff plans would remain on hold for three months.

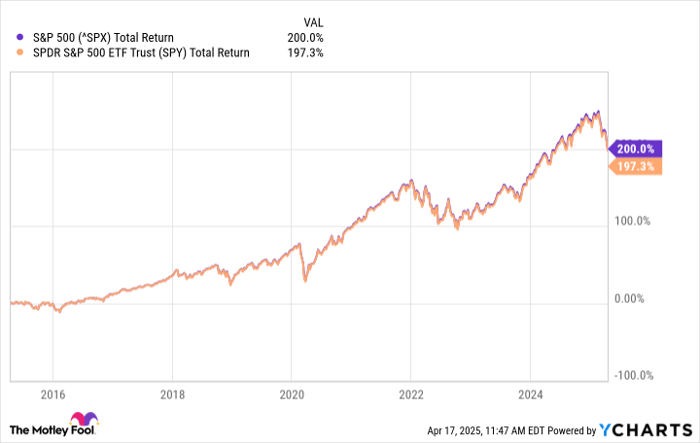

Will stocks continue their downward trend? It’s possible. History shows that such downturns often provide excellent opportunities to invest in quality stocks for the long term.

Where should you invest $1,000 today? Our analysts have identified the 10 best stocks currently worth considering. Learn More »

Artificial intelligence could potentially represent a multitrillion-dollar market opportunity over the next decade. Here, we highlight four “Magnificent Seven” stocks that are well-positioned to lead the AI sector and are currently offered at attractive valuations after recent price declines. Investing in these companies could yield significant returns in the coming years.

1. Nvidia

As a key player in the technology and AI sectors, Nvidia (NASDAQ: NVDA) has emerged as the market leader in AI data center GPU chips, with estimates indicating it commands more than 90% market share. While maintaining such dominance is challenging, major companies investing in AI data centers predominantly opt for Nvidia’s solutions. The initial success of its latest AI chip architecture, Blackwell, further solidifies Nvidia’s competitive edge. The AI market is on the cusp of expanding beyond data centers, positioning Nvidia well for future growth.

Beyond its core offerings, Nvidia is also developing technology for other industries, including autonomous vehicles and robotics. Demand for innovative and efficient chips should persist as AI models evolve. Analysts project Nvidia’s earnings to grow by an average of 37% per year in the long run. Following a recent price drop, Nvidia’s price-to-earnings (P/E) ratio has fallen to below 35, resulting in an attractive price/earnings-to-growth (PEG) ratio of less than 1, signaling strong potential for this semiconductor leader.

2. Microsoft

Microsoft (NASDAQ: MSFT), a technology conglomerate with a significant presence in enterprise software, leverages its extensive suite of offerings, including productivity software and Azure cloud services, to capture AI application sales. Valued at $2.9 trillion, Microsoft may not promise overnight wealth but stands out as a reliable investment in the AI sector.

With a history of increasing dividends for 23 consecutive years and a AAA credit rating—one of only two U.S. companies to hold such a distinction—Microsoft is poised for steady growth as it channels AI demand through Azure. Analysts expect the company’s earnings to grow by approximately 12% annually over the long term. Its P/E ratio has decreased from a high of 37 to 29, yielding a PEG ratio of 2.4, making it a solid long-term investment, especially if share prices drop further.

3. Amazon

Similarly, Amazon (NASDAQ: AMZN) stands to benefit from the growth of cloud computing as businesses create and use AI software applications. Amazon Web Services (AWS), recognized as the leading cloud platform, captures roughly 30% of the market. Given that AWS is the company’s primary profit driver, this development is promising for shareholders. Moreover, AI advancements could help Amazon streamline its supply chain costs.

Amazon’s key AI potential resides in cloud services, and its core e-commerce operations should continue to thrive, considering online commerce accounts for only 16% of total retail spending in the U.S. Furthermore, Amazon consistently explores new ventures in areas like digital advertising and smart home technologies. At a current PEG ratio of 1.5, stemming from a P/E ratio of 32 and an anticipated long-term earnings growth rate of nearly 21%, Amazon presents a compelling buying opportunity.

4. Meta Platforms

As a leading social media entity, Meta Platforms (NASDAQ: META) dominates the advertising market with its portfolio of platforms, including Facebook, Instagram, and WhatsApp, attracting 3.35 billion daily users. This robust user base generates substantial cash flow through advertising, allowing the company to invest heavily in AI and data centers.

Notably, Meta has created and open-sourced its AI model, Llama, accumulating over a billion downloads. The company is also innovating with devices such as the Meta Quest headset and AI glasses, aiming to diversify its revenue streams beyond traditional smartphone markets. Although its Reality Labs division is not yet profitable, it holds significant potential to monetize AI initiatives over the next decade. With a P/E ratio of 21, this stock represents good value if earnings grow by an average of 17% annually as analysts project.

Don’t Miss This Opportunity for Potential Gains

If you’re feeling apprehensive about not getting in on high-performing stocks, now is a pivotal time to consider action.

In exceptional circumstances, our analysts recommend a “Double Down” Stock pick for companies they believe are on the verge of significant increase. If you’re worried you’ve missed your chance to invest, now is an excellent moment to take action. The numbers speak volumes:

- Nvidia: Investing $1,000 upon our recommendation in 2009 would now be worth $249,730!*

- Apple: A $1,000 investment from 2008 would have grown to $32,689!*

- Netflix: A $1,000 investment made in 2004 would now be valued at $469,399!*

We are currently issuing “Double Down” alerts for three outstanding companies, which may not offer another chance like this soon.

Continue »

*Stock Advisor returns as of April 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, also serves on the board. Justin Pope has no interest in any stocks mentioned. The Motley Fool holds positions in and recommends Amazon, Meta Platforms, Microsoft, and Nvidia. They also recommend long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.