“`html

Maglev Dreams: The Transformative Power of the U.S. Stock Market in 2024

Tom Yeung here with your Sunday Digest.

Historical Vision Meets Modern Reality

In 1909, a young physics graduate student proposed building a magnetically levitated train inside a vacuum tube. The idea was revolutionary: magnetic forces would propel the train, allowing it to maintain momentum without friction, a concept now known as “maglev.” Theoretically, this train could move at 2,500 miles per hour, meaning a trip from Boston to New York could take less than 15 minutes.

Unfortunately, the necessary technology was absent in 1909. Linear motors needed another 40 years to develop, and the first commercial maglevs did not appear until the 1980s. Currently, only a few maglev trains can travel faster than 300 miles per hour due to the challenges in creating and maintaining inter-city vacuum tubes.

The graduate student, Robert H. Goddard, went on to achieve fame as the inventor of the liquid-fueled rocket. Today, perpetual-motion machines remain confined to the realms of science fiction.

The Stock Market: A Perpetual Motion Machine?

At first glance, the U.S. stock market appears to operate like a perpetual-motion “maglev.” High-performing stocks consistently rise, while weaker ones dwindle. In 2024, investing in the 25 top-performing S&P 500 stocks from 2023 could result in a remarkable 35% return, compared to the average 13% for all S&P 500 stocks and a -12% for the 25 lowest performers.

Leading this surge recently was Nvidia Corp. (NVDA), which realized a 239% return in 2023 followed by a 171% increase in 2024.

This strategy of investing in high-flyers has proven effective during various years. For instance, expensive stocks notably increased in value during 2016, 2021, and 2022. Looking ahead to 2025, some investors might consider buying top performers from 2024 and hoping the trend continues.

Understanding the Market’s Limits

However, sustained growth is not guaranteed. Every company eventually faces stagnation or decline; no firm has defied the passage of time indefinitely. Additionally, certain sectors exhibit seasonal trends, particularly retail, travel, and energy, impacting stock performance cyclically.

For example, natural gas companies like Cheniere Energy Inc. (LNG) typically excel during colder months as gas prices rise. Historically, Cheniere has averaged a 20% increase in the first quarter of each year since 2009. Retail stocks often experience a “Santa Claus Rally” at the year’s end as holiday shopping kicks into high gear.

Anticipating Changes Ahead

To assist investors in navigating market cycles, TradeSmith plans to unveil what they call their most significant financial innovation in 20 years. During a presentation on January 8, they will explain how their breakthrough can predict significant stock movements for 5,000 companies—accurately forecasting changes with 83% back-tested accuracy.

In the meantime, I anticipate a broader reversal in 2025 where cyclical stocks recover while some of the pricey stocks remain stagnant. In my December recommendations for 2025, I included three cyclical Dividend Kings expected to outperform the average return of blue-chip Dividend Aristocrats, potentially doubling their dividend yields. Notable mentions include Dollar General Corp. (DG), expected to rebound as optimism among rural consumers rises.

Dividend King 1: Sensing a Turnaround

Today’s first Dividend King is a promising small-cap AI stock. This company, a key supplier in the U.S. automotive industry, stands to benefit from the increasing demand for AI-powered self-driving vehicles.

Valued attractively, Sensata Technologies Holding PLC (ST) is renowned for delivering reliable automotive sensors. Spun off from Texas Instruments Inc. (TXN) in the mid-2000s, Sensata specializes in mission-critical sensors suitable for harsh environments, covering everything from electrical systems in high-voltage electric vehicles to tire pressure gauges.

Autonomous vehicles require more sensors and components than traditional models, increasing reliance on Sensata’s expertise. Analysts predict revenue growth will leap from zero this year to 8% by 2026, with earnings per share increasing even faster due to enhanced value.

Given its current valuation at just 8.0 times forward earnings, significantly lower than its long-term average of 13.5, Sensata represents an attractive investment opportunity for the upcoming year.

Dividend King 2: Playing Defense

The second Dividend King is a specialty chemical manufacturer facing a cyclical downturn. In late October, management shocked analysts by announcing a 95% dividend cut for 2025 as part of their recovery strategy. Consequently, the stock has dropped by 45%, with analysts predicting no meaningful growth until 2026.

Despite the downturn, Celanese Corp. (CE) offers significant promise. As the most profitable among major U.S. specialty chemical producers, Celanese benefits from low-cost natural gas at its Texas plant, creating remarkably high returns. Moreover, the company boasts two decades of consistent net income and acquisitions that have strengthened its market position.

Over time, Celanese’s end markets are expected to rebound, positioning it favorably as a cost-effective producer of essential acetyl-chain products.

“`

Investors Eye Celanese and Moderna for Major Gains in 2025

Celanese: A Solid Investment Opportunity

Celanese, a producer of essential materials used in everything from paints to pharmaceuticals, stands out with little competition in its sector. The company enjoys a strong competitive advantage, sometimes referred to as a “moat.”

With its current share price sitting at $69, many analysts consider it a bargain. This evaluation is based on its modest trading at 8.5 times depressed forward earnings. If the company returns to midcycle profit levels, shares could rise to around $125, marking an 80% potential gain. While this increase may take two to three years, the long-term benefits make Celanese an appealing Dividend King for investors.

Growth Stock Highlight: The 2025 Immunotherapy Bet

Historically, cancer treatments have evolved significantly. In the late 1800s, surgeon William Coley noted interesting results when a cancer patient recovered after a severe infection. This led to the understanding that infections could trigger immune responses to fight cancer. Fast forward, researchers identified T-cells in the 1960s as vital players in eliminating cancerous cells, paving the way for modern immunotherapies.

Today, cancer vaccines aim to train the immune system to recognize and combat tumors using these insights. According to The Economist:

When scientists first began to sequence the DNA of tumours, in 2008, they found that cancer cells contained hundreds, if not thousands, of mutations that distinguished them from their healthy neighbours. Some of these mutations in cellular DNA cause cancer cells to produce abnormal proteins, known as neoantigens, which can set the immune system’s alarm bells ringing.

The idea behind a cancer vaccine, then, is to introduce these neoantigens directly into the body, thereby training the immune system to see any cancer that carries them as a foreign body, ripe for elimination.

Advancements in mRNA technology have transformed how these vaccines are created. For instance, Moderna Inc. (MRNA) can now develop personalized vaccines in as little as six weeks. The company is currently engaged in late-stage trials with Merck & Co. Inc. (MRK) to address melanoma.

In addition, Moderna is working on a more general “off the shelf” vaccine that targets common tumor markers, which is expected to receive approval soon. This positions Moderna as a potentially lucrative investment, especially as the world shifts its focus from COVID-19 vaccines to the larger immunotherapy market, often viewed as the “holy grail” of cancer treatment.

Growth Stock Spotlight: Alphabet’s AI Innovations

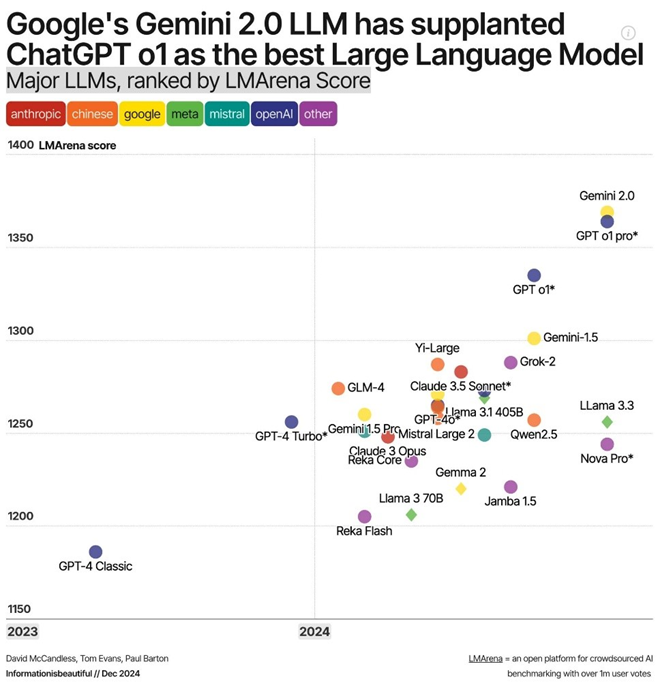

In December, Alphabet Inc. (GOOG), Google’s parent company, introduced exciting new AI models, including Gemini 2.0 and Veo, a cutting-edge generative video model. Independent assessments have shown that Gemini 2.0 surpasses OpenAI’s “o1” model in several rankings, and users praise Veo for its impressive capabilities.

With these developments, Alphabet has suddenly moved from playing catch-up with OpenAI to leading the field. Furthermore, the company’s advancements in quantum computing and chip technology have sparked investor interest. After revealing a breakthrough in its “Willow” quantum chip in early December, Alphabet’s shares jumped 6% due to improved error rates in its quantum systems.

As Alphabet continues to innovate, its shares could be undervalued at 25 times earnings. Analysts anticipate a 30% upside within the next year.

Identifying Opportunities: Cycles and Strategies

Different stocks have varying cycles. For instance, advertising firms like Google typically thrive on a four-year cycle due to advertising peaks during presidential elections. In contrast, industrial companies such as Celanese operate on a two- to three-year cycle characterized by fluctuations in supply and demand.

Long-term investors often find value in these cyclical trends, holding stocks for over a year to maximize potential returns. Conversely, active traders are advised to target companies with shorter cycles, which can yield 10% to 50% returns in mere months.

To support these trading strategies, TradeSmith offers tools designed to help investors identify the optimal times for buying and selling stocks. An upcoming webinar on January 8 at 10 a.m. Eastern will provide insights into utilizing these resources effectively.

Wishing you prosperity in the New Year! I look forward to discussing more investment opportunities next Sunday.

Best regards,

Tom Yeung

Markets Analyst, InvestorPlace