Is Kinder Morgan’s Recent Dip a Buying Opportunity? A Close Look

One of our past investments, a former Contrarian Income Portfolio holding, has experienced a significant pullback recently. Is it time to purchase on the dip in this 4.3% dividend? Let’s explore the situation.

Kinder Morgan (KMI) represents a prominent player in the energy sector, operating with 79,000 miles of pipelines that transport crude oil, carbon dioxide, and numerous products, primarily natural gas. Notably, around 40% of the natural gas produced in the U.S. travels through Kinder’s extensive networks. Additionally, the company manages 139 terminals for the storage of petroleum products, chemicals, renewables, and other assets.

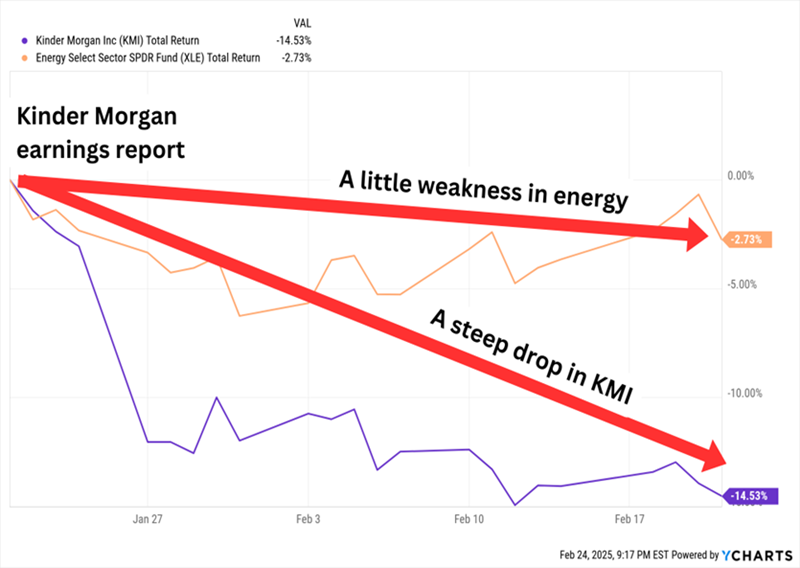

Despite its established presence, Kinder Morgan has faced challenges this year, seeing its stock decline nearly 15% since its Q4 earnings report in January. This sudden price drop has prompted me to reassess KMI (among a few other high-dividend energy stocks).

A Closer Look at the Recent Correction

Why did we divest KMI from our CIR portfolio back in September 2024? At that time, the stock felt overheated. As I mentioned when we sold, “When we sell a Stock, it is goodbye for now rather than forever. We may buy KMI back someday on a dip.”

We initially purchased Kinder Morgan in the summer of 2021, as an energy bull market was starting to gain momentum, attracting attention to the dividend potential of the stock.

The Original Rationale Behind Our KMI Investment

Old Wall Street wisdom suggests that bull markets ascend through walls of worry. Concerns about a potential dividend cut weighed on sentiment regarding KMI at the time. Interestingly, the underlying financials didn’t align with these fears, as I noted:

“The firm’s net debt levels are just four times EBITDA. Management’s target was to reduce debt to 4.5 times EBITDA. They have already surpassed this goal, established six years ago.”

Following three dividend increases and a total return of 36%, we decided to exit because KMI’s stock price had increased sharply.

KMI’s Price Growth Outpaced Its Dividend Payout

The recent 15% drop in KMI shares caught our attention once more. This decline was not primarily due to Kinder’s Q4 report, which revealed more good news than bad, but because KMI shares had essentially doubled leading up to that report. A minor disappointment—earnings rising 14% yet falling a penny short of expectations—led some investors to lock in profits.

However, the report did include several positive updates:

- Raised 2025 EBITDA and adjusted earnings per share guidance;

- A project backlog of $8.1 billion, a 60% increase compared to Q3 2024;

- Anticipated strong demand for natural gas through 2030;

- Introduction of the 216-mile Trident Intrastate Pipeline Project, which will provide approximately 1.5 billion cubic feet per day of capacity from Katy, Texas, to a LNG corridor near Port Arthur, Texas.

This ambitious project will demand significant investment; management anticipates growth capital expenditures averaging about $2.5 billion annually over the next three to four years. This may explain Kinder’s modest expectation of increasing its dividend by 2% in 2025.

While some dividend growth is preferable, a 2% increase may not keep pace with inflation. Further, this figure falls short of my expectations given KMI’s already moderate yield of 4.3%.

Given various expensive indicators—including a PEG of 2.7 and a forward P/E of 21—investors might find more attractive price and yield alternatives without detriment to Kinder’s business.

Could there be comparable, yet more advantageous, opportunities in the energy sector?

Exploring Other Dividend Opportunities

Enterprise Products Partners LP (EPD, 6.4% yield) stands out as a leading energy infrastructure company. With over 50,000 miles of pipeline, 300 million barrels of liquids storage capacity, and 26 fractionation facilities, EPD has established itself among the most reliable toll-takers in the sector. It boasts Dividend Aristocrat status, having raised its dividend for 27 consecutive years. Notably, during its latest earnings call, management projected it could achieve $1 billion to $1.1 billion in excess distributable cash flow even after fully funding growth capex. This cash flow may not go directly to distributions but can help pay down debt or buy back units, benefiting investors who currently enjoy a well-covered yield exceeding 6%. EPD has lagged compared to some of its peers in the energy space this past year but trades at just over 9 times DCF, at the lower end of its historical valuation range.

The Dividend Magnet Phenomenon: A Cautionary Note

Energy Transfer LP (ET, 6.9% yield) represents another significant infrastructure player within the sector. The company operates 107,000 miles of natural gas and 14,500 miles of crude oil pipelines, in addition to 235 billion cubic feet of natural gas storage capacity and over 70 processing and treating facilities. Although it recently faced a slight EBITDA disappointment, it has optimistic developments, including its first natural gas supply contract.

Investing in Midstream Energy: Promising Yields and Challenges

Texas-based Cloudburst is making waves in the data center sector. This innovation energizes utilities and midstream companies, propelling them into the AI frontier. However, there is a concern regarding future volatility should Wall Street’s sentiment towards this technology change. Compared to its competitor EPD, ET’s distribution history lacks a robust track record, having significantly reduced its payout in 2020. Nevertheless, ET has emerged as a quarterly raiser, boosting its distribution by 63% since early 2022, and currently features an attractive price-to-distribution cash flow (P/DCF) ratio of less than 8.

Dividend Growth Slowing Down

Marathon Petroleum Corporation (MPC) created MPLX LP (MPLX, 7.2% yield) in 2012 to oversee its vast array of midstream assets. MPLX operates an extensive infrastructure network that includes pipelines, refineries, renewable diesel facilities, and extensive natural gas processing assets. Following a solid performance in Q4, MPLX announced significant advancements in its Permian Basin expansion. With a distribution yield exceeding 7% and a history of increasing payouts by around 10% annually over the last three years, MPLX is a favorite among income investors. Management emphasizes that returning capital through distributions is a priority, indicating a positive outlook for future payouts. Despite its recent success, MPLX still trades for less than 10 times its DCF.

Is This Thing Even On?

Earn 8%+ in Monthly Dividends Without Tax Hassles

Higher yields from MLPs like MPLX and ET come with additional considerations, such as the inconvenience of filing a K-1 form during tax season. This requirement complicates tax filings, often frustrating both investors and their accountants alike.

Consider this advice: Aim for increased yield with less tax-related complexity.

As we wait for Kinder Morgan to enhance its appeal with more traditional dividends, some stocks in my “8%+ Monthly Payer Portfolio” stand out as worthwhile investments right now. These alternatives not only offer higher yields without K-1 forms but also provide monthly payments, aligning perfectly with your regular expenses.

Don’t miss these promising income opportunities while they’re still accessible at reasonable prices. Click here to discover more details and download a FREE Special report with all the names and tickers of my 8%+ Monthly Payer Portfolio stocks and funds.

See also:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.