Retailers Prepare for Modest Holiday Growth Amid Economic Challenges

With the holiday season on the horizon, retailers are getting ready for a modest increase in sales due to economic pressures. Rising inflation, global tensions, and a divisive presidential election are likely to shape how consumers spend their money. According to the National Retail Federation (NRF), holiday sales are projected to grow between 2.5% and 3.5%, marking the slowest growth in the past six years.

Even with expected slowdowns, holiday spending will remain significant. The NRF forecasts total sales from November to December to reach between $979.5 billion and $989 billion, indicating a slight rise from last year’s $955.6 billion. This growth lags behind the 3.9% increase observed in 2023.

Retail giants like Abercrombie & Fitch Co. ANF, Costco Wholesale Corporation COST, Burlington Stores, Inc. BURL, and Boot Barn Holdings, Inc. BOOT are preparing strategies to navigate these challenges while looking for new opportunities. Positive job growth and stable wage increases may aid in maintaining consumer spending. Additionally, a recent 50-basis point drop in interest rates has improved economic optimism.

Key Trends for This Holiday Season

This year offers shoppers just 26 days between Thanksgiving and Christmas, a six-day reduction from last year. With a shorter shopping window, consumers are likely to spend more cautiously, seeking out budget-friendly options. Retailers are expected to respond by offering deeper discounts and enticing promotions to capture the attention of cost-conscious shoppers.

Online shopping continues to shine as a key growth area for retailers. The NRF anticipates that online and non-store sales will rise by 8% to 9%, reaching $295.1 billion to $297.9 billion. This marks a substantial increase from last year’s $273.3 billion, highlighting the ongoing trend of consumers choosing online shopping for its convenience.

To meet increased holiday demands, retailers plan to hire between 400,000 and 500,000 seasonal workers. Although this figure is slightly lower than last year’s 509,000, it underscores the importance of additional staff to handle holiday sales events. Many companies are already ramping up their seasonal hiring efforts to attract early shoppers.

Furthermore, we’ve identified four stocks in the Retail – Wholesale sector that are strategically positioned, backed by strong fundamentals.

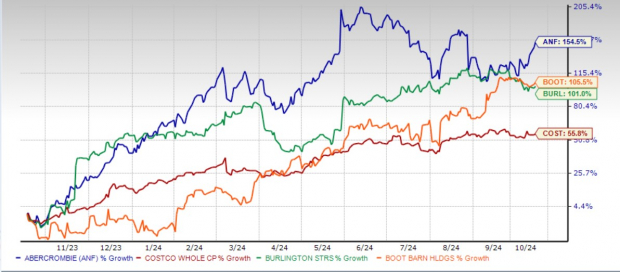

Review of Stock Performance for ANF, COST, BURL & BOOT

Image Source: Zacks Investment Research

Prominent Retail Stocks to Watch

Abercrombie & Fitch: Strong Brand and Expanding Presence

Abercrombie & Fitch is emerging as a compelling investment. The company successfully integrates digital and in-store shopping, enhancing customer experience and loyalty. Targeted marketing strategies have increased brand visibility and attracted new customers. Their current product lineup meets diverse customer needs, expanding their market reach. Operating across regions like the Americas, EMEA (Europe, the Middle East, and Africa), and APAC (Asia-Pacific), Abercrombie & Fitch is poised for global growth.

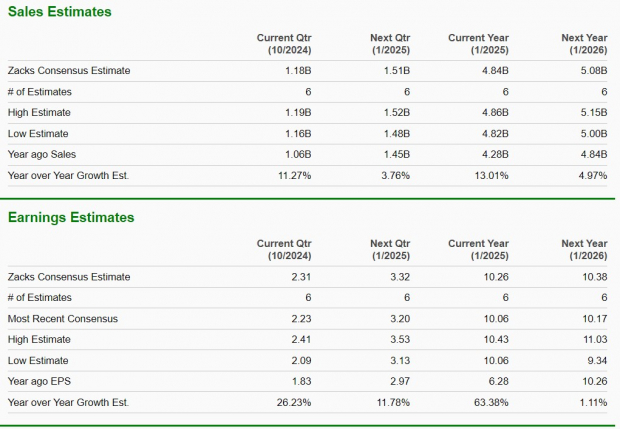

Currently, Abercrombie & Fitch has an average trailing four-quarter earnings surprise of 28%. According to the Zacks Consensus Estimate, the company expects to see sales and earnings per share (EPS) increase by 13% and 63.4%, respectively, over the previous year’s figures. The company holds a Zacks Rank #1 (Strong Buy). For a complete list of today’s Zacks #1 Rank stocks, check here.

Image Source: Zacks Investment Research

Costco: Strategic Membership Approach

Costco is adept at navigating fluctuations in the retail market. The company’s focus on strategic investments, a customer-first approach, and merchandise initiatives, combined with its unique membership model, differentiates it in the retail sector. By identifying new markets and tailoring product offerings to meet customer preferences, Costco continues to strengthen its market position.

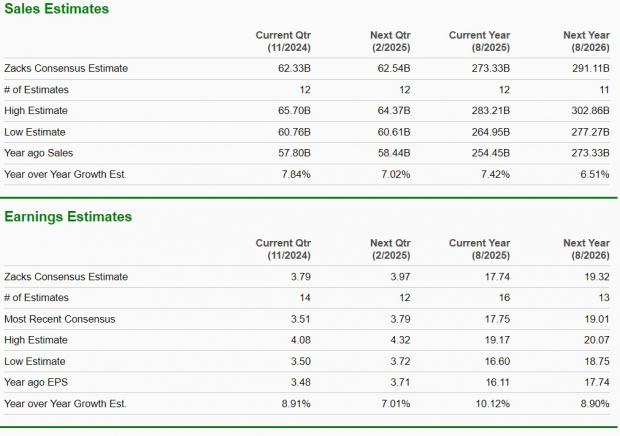

The Zacks Consensus Estimate for Costco anticipates current year sales increase of 7.4% and EPS growth of 10.1% compared to last year. This company holds a Zacks Rank #2 (Buy) and boasts a trailing four-quarter earnings surprise of about 2%.

For the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Burlington: Adapting to Consumer Trends

Burlington Stores is a recognized off-price retailer that excels at responding to shifting consumer trends. By closely monitoring customer preferences and adjusting its product range, Burlington effectively captures market share while balancing promotional sales and regular pricing to attract budget-conscious shoppers without sacrificing margins. Its initiatives to enhance merchandising and optimize store productivity are paying off, supported by strategic store openings and real-time inventory management.

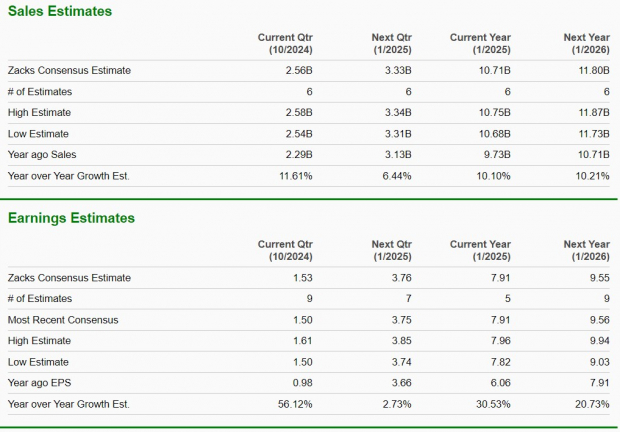

The Zacks Consensus Estimate for Burlington Stores indicates anticipated growth of 10.1% in sales and 30.5% in EPS compared to last year’s results. This company is currently rated a Zacks Rank #2.

Image Source: Zacks Investment Research

Boot Barn Holdings: Thriving with a Versatile Lineup

Boot Barn Holdings boasts a wide range of products, including western wear, boots, and outdoor apparel. This diverse portfolio not only meets seasonal demands but also attracts a varied customer base. The company is actively investing in its omnichannel shopping experience, ensuring customers can easily transition between online and brick-and-mortar stores. Boot Barn’s tailored marketing campaigns and exclusive product lines help it stand out in a competitive market. Additionally, customer loyalty programs encourage repeat business. As the economy recovers, rising consumer confidence supports increased discretionary spending, setting the stage for significant sales growth.

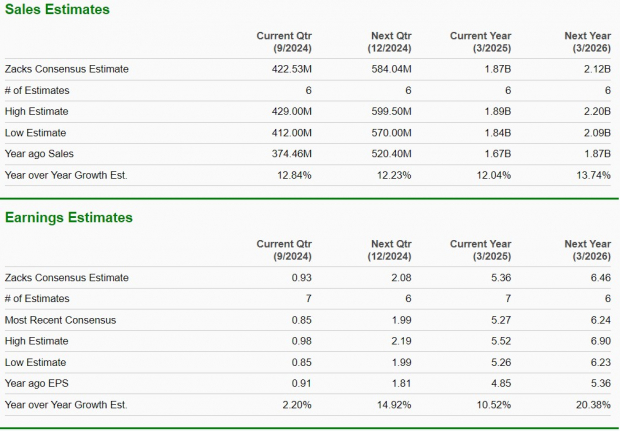

The Zacks Consensus Estimate indicates that for the current financial year, Boot Barn Holdings’ sales are projected to grow by 12%, with earnings per share (EPS) expected to rise by 10.5% compared to the previous year. This Zacks Rank #2 company has achieved an average earnings surprise of 7.1% over the past four quarters.

Image Source: Zacks Investment Research

Zacks Identifies Top Semiconductor Stock

Unlike other major players, the new chip stock is significantly smaller than NVIDIA, which has soared more than +800% since our recommendation. While NVIDIA remains robust, this emerging stock presents ample growth potential.

With strong earnings growth and an expanding clientele, this company is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is anticipated to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.