Warren Buffett Announces Retirement from Berkshire Hathaway Leadership

Warren Buffett recently announced he would step down as CEO of Berkshire Hathaway at the close of this year. Over the past six decades, the investing legend has guided the holding company to remarkable success, making it one of the largest firms globally.

Buffett is famed for his long-term investment strategies and his preference for holding winning stocks, even as they dominate his portfolio. Currently, just four key stocks account for 57% of Berkshire Hathaway’s $277 billion stock portfolio. Below are these stocks and reasons they remain solid choices for long-term investors.

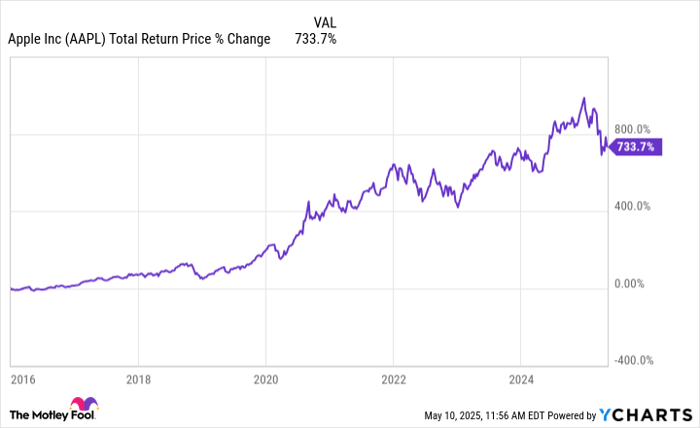

1. Apple: Current Value of Berkshire’s Stake: $59.5 Billion

Buffett has called personal electronics giant Apple (NASDAQ: AAPL) Berkshire’s best business. Since purchasing shares in 2016, Apple has remained the company’s largest holding. At the latest shareholder meeting, Buffett humorously noted that Apple CEO Tim Cook has generated more profit for Berkshire than he ever did.

AAPL Total Return Price data by YCharts

With over 2.35 billion active devices globally, Apple’s iOS ecosystem is a powerful channel for selling subscription services and collecting App Store fees. Although its growth may have slowed, Apple’s massive profitability allows for significant stock buybacks, establishing a solid floor for its price.

2. American Express: Current Value of Berkshire’s Stake: $43.1 Billion

Buffett has often praised the U.S. economy, emphasizing that American consumers drive its growth. American Express (NYSE: AXP), a credit card issuer and payment processor, has catered to high-income earners and businesses since its founding in the 1800s.

AXP Total Return Price data by YCharts

Buffett has held this stock since 1991, demonstrating the company’s resilience as a financial mainstay in the U.S. economy. American Express has successfully reached Gen Z and millennial consumers, ensuring its vital role in American consumerism for generations to come.

Image source: The Motley Fool

3. Bank of America: Current Value of Berkshire’s Stake: $28.4 Billion

Berkshire Hathaway’s significant investment in Bank of America (NYSE: BAC) reportedly originated from Buffett’s idea while relaxing at home. In 2011, Berkshire acquired preferred shares and stock warrants, transitioning to common shares by 2017. With over $3.3 trillion in assets, Bank of America provides extensive economic exposure through sectors like commercial real estate and mortgages.

BAC Total Return Price data by YCharts

However, investors should consider that bank stocks can be sensitive to interest rates and economic downturns. Buffett’s successful investment was aided by favorable negotiation terms not typically available to individual investors. Nevertheless, his sustained confidence in Bank of America distinguishes it among competitors.

4. Coca-Cola: Current Value of Berkshire’s Stake: $28.2 Billion

As a global beverage leader, Coca-Cola (NYSE: KO) is perhaps the most iconic Buffett investment, with Berkshire acquiring shares in 1988. Although not the quickest growth option, Coca-Cola has consistently performed well over generations.

The company is renowned as a Dividend King, boasting 62 consecutive annual dividend increases. Berkshire’s holdings generate over $800 million in annual dividends, creating a steady income stream.

KO Total Return Price data by YCharts

Coca-Cola’s growth potential remains strong, with a global population exceeding 8 billion. Its highly fragmented beverage market allows for new product launches and acquisitions of emerging brands, ensuring sustained profitability over time.

Should You Invest $1,000 in Apple Right Now?

Before considering an investment in Apple, examine the following:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks to invest in today—Apple isn’t among them. The selected stocks have the potential for substantial returns in the coming years.

For instance, if you had invested $1,000 in Netflix on December 17, 2004, following our recommendation, it would now be worth $598,613! Alternatively, a $1,000 investment in Nvidia on April 15, 2005, would have grown to $753,878!

In comparison, Stock Advisor has achieved an average return of 922%, greatly outperforming the 169% return of the S&P 500. Don’t miss your chance to access the current top 10 list by joining Stock Advisor.

*Data as of May 12, 2025.

American Express and Bank of America are advertising partners of Motley Fool Money. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.