Top Dividend Stocks with Yields Between 5.3% and 7.6%

Investors often seek opportunities to buy undervalued dividend stocks, with current yields ranging from 5.3% to 7.6%. Despite a general market rebound, certain dividend payers remain undervalued.

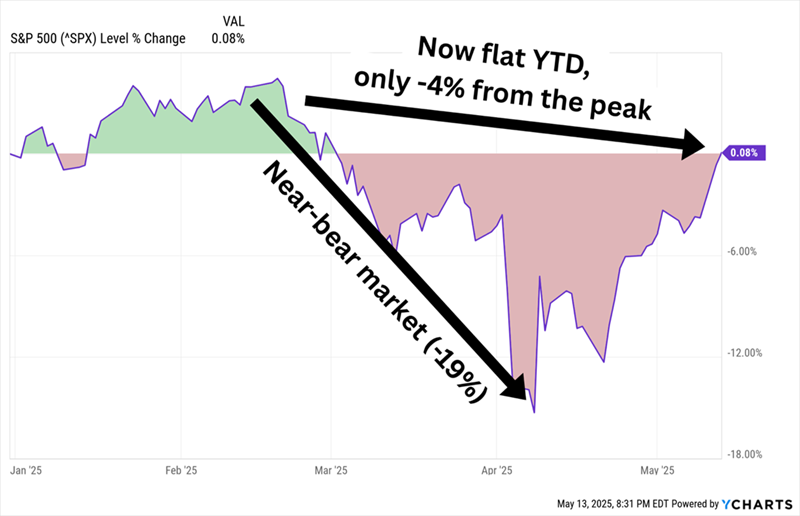

Many traditional investors, focused solely on the S&P 500, may feel they missed out on recent market dips. The best opportunity for the “SPY” ETF, a commonly held investment, appeared fleeting, lasting only a week or two:

The S&P 500 Dip Was Brief

However, several affordable dividend stocks remain that have yet to benefit from this upswing. Below are five companies offering dividend yields of 5.3% or higher, coupled with notable affordability based on two key metrics:

- Price/Earnings-to-Growth (PEG): The PEG ratio compares earnings to expected growth. A PEG ratio of 1 suggests a stock is fairly valued. Ratios above 1 indicate overvaluation, while those below 1 suggest undervaluation. Each stock analyzed here has a PEG below 1.

- Forward Price-to-Cash Flow (P/CF): This metric assesses a stock’s value relative to its cash flows. Each stock mentioned has a forward P/CF ranking within the cheapest 20% of the S&P 500 or would rank there if included.

Bristol-Myers Squibb (BMY)

Dividend Yield: 5.6%

Bristol-Myers Squibb (BMY) stands out as a notable name in pharmaceuticals, valued at $90 billion with successful products like Revlimid, Opdivo, and Eliquis. Its low PEG of 0.12 and a cash flow multiple of just 7 suggests it is undervalued. The dividend yield exceeds 5%, making it attractive for income investors.

However, BMY has faced challenges. The stock has struggled over the past five years and recently hit a significant decline. While the healthcare sector is generally weak, BMY’ profitability concerns are largely due to increased competition eroding its core products. For instance, Revlimid’s sales plummeted by 44% in the first quarter. Moreover, generics pose further threats to its revenue streams.

While analysts anticipate a rebound in 2025, it relies heavily on 2024’s disappointing results with a projected 9% decline from 2023 earnings at guidance midpoint. BMY’s dividend remains secure, but its stock price forecast carries uncertainties.

BMY: Industry Challenges Impacting Returns

HF Sinclair (DINO)

Dividend Yield: 5.4%

HF Sinclair (DINO) emerged from the 2022 merger of HollyFrontier Corp., Holly Energy Partners, and Sinclair Oil. The company operates seven refineries in the U.S. and other facilities in Canada and the Netherlands, with a total crude oil processing capability of 678,000 barrels per day.

DINO shares appear inexpensive, with a PEG of 0.2 and P/CF of 7.3. The stock has fallen over 30% in the past year, though it recently experienced a rebound. The challenges it faces reflect broader issues in the refining industry, driven by trade uncertainties, tariffs, and the anticipated sluggish demand for fuel.

Despite this backdrop, DINO has markedly outperformed the energy sector and overall market since the lows in April, rising approximately 40%. However, profitability concerns led to a pause in dividend growth. DINO’s current quarterly dividend of 50 cents suggests an annual payment of $2 per share, although anticipated earnings of $1.58 may constrain immediate growth. Dividend coverage should improve significantly to 180% by 2026.

Positive Outlook for Future Dividend Growth with Improved Market Conditions

AES Corp. (AES)

Dividend Yield: 5.6%

Based in Virginia, AES Corp. (AES) supplies electricity to approximately 2.7 million customers through its utility business. Nonetheless, AES also operates in renewable energy, serving corporate clients and data centers across 11 states and in regions of South America, Europe, Asia, and the Middle East.

The company engages in various energy types, including coal, gas, hydro, wind, solar, and biomass. AES shares are currently undervalued, possessing a PEG of 0.8 and a forward P/CF of just 5, making it an attractive option for investors seeking reliable dividend yields.

# AES Faces Financial Struggles Amid Aggressive Renewable Shift

AES has seen significant downward pressure on its shares, which have declined by over half since the beginning of 2023. The company’s bold transition to renewable energy has yet to yield positive financial outcomes. Investors are further dissuaded by project delays and elevated debt levels.

Renewables Transition Reshapes AES’s Market Dynamics

AES’s focus on renewables distinguishes it from traditional utility companies. Although the dividend yield appears attractive, the stock shows more volatility typically associated with cyclical stocks rather than the stability expected from utilities.

Strategies for Recovery: Asset Sales and Cost Cuts

There is a silver lining for AES. The company is addressing its financial challenges through significant asset sales, cost reductions, and postponing coal retirements. These actions may help to bolster its growth trajectory in the near future.

Secure Dividends Amid Financial Uncertainty

The company’s dividend remains well-supported, with projections indicating that expected earnings are over three times what AES needs to maintain the payout. This suggests a degree of safety for investors regarding future distributions.

The Dividend Magnet: Can AES Rebound?

Polaris (PII): A Rough Ride for Investors

Dividend Yield: 7.0%

Polaris Industries manufactures recreational vehicles, including ATVs and boats, but its stock has not experienced similar excitement. Since reaching its peak in July 2023, shares have plummeted over 70%, reflecting a downturn attributed to soft demand sparked by high vehicle prices and rising interest rates. Consequently, the company reduced production, leading to a 20% revenue decline and an almost 80% drop in profits for 2024.

Negative Earnings Forecasts Raise Concerns

In 2025, ongoing tariff uncertainties exacerbated demand issues, prompting Polaris to withdraw its guidance for the year. Analysts anticipate a $1.71 per share loss, followed by a slight recovery to an 8-cent loss in 2026. While Polaris’s PEG ratio stands below 0 at -1.6, it raises questions about the company’s valuation.

Dividend Stability in Question

Despite nearly 30 years of uninterrupted dividend growth, Polaris faces potential short-term risks regarding its dividends due to two projected years of negative earnings. Meeting its annual dividend obligation of approximately $150 million could become challenging, especially amidst long-term debt of $1.6 billion, with over $400 million due within the next year.

PII’s Dividend: A Matter of Cautious Monitoring

Atlas Energy Solutions (AESI): New but Promising

Dividend Yield: 7.6%

Atlas Energy Solutions provides equipment and services to oil and gas companies, notably in the Permian Basin. The company began trading after its March 2023 IPO and started offering dividends shortly thereafter, increasing distributions aggressively—though the approach has been somewhat volatile.

Dividend Drama and Market Volatility

Earlier forecasts indicated intentions to raise dividends quarterly. In February, a 4% increase was implemented, but no changes were made in May, likely due to a decline in oil prices affecting demand for frac sand.

Assessing Future Dividend Stability

Though AESI is currently facing challenges, its low-cost assets generate strong cash flows, lending some reassurance regarding the near-term dividend stability. However, continued success hinges on favorable oil prices.

Market Outlook: Opportunities and Caution

While some of these names require a cautious approach, there are other investment opportunities worth considering at this time that offer solid dividends and investment strategies.