Following Hedge Fund Strategies: Insights from Chase Coleman’s AI Investments

Examining the investment choices of successful hedge fund managers can generate valuable ideas for stock selection. Hedge funds managing over $100 million are required to report their holdings to the SEC, making this information publicly available 45 days after the quarter ends. While this data may not reflect real-time trading activity, analyzing how long these managers hold their stocks can yield important insights.

Chase Coleman, a renowned billionaire and the founder of Tiger Global Management, is a prominent figure in the hedge fund world. His significant investments in top-performing artificial intelligence (AI) stocks are worth noting, as he maintains long-term positions in these companies. Investors may benefit from considering Coleman’s strategy and exploring similar investments.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Coleman Holds Nearly Half of His Portfolio in AI Stocks

Coleman has concentrated a considerable portion of his fund in just a few stocks. Significant holdings include:

Data source: Hedge Follow.

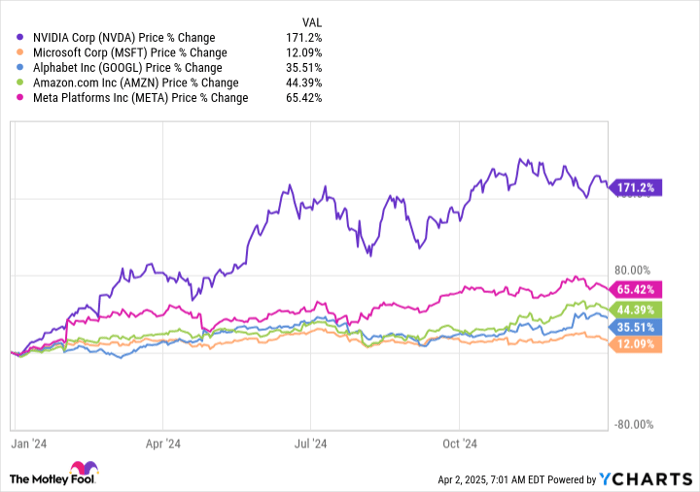

These stocks collectively make up 42.6% of his portfolio, indicating a strong focus on major players in the tech-driven AI sector. Coleman’s long-term commitment to these shares reflects a strategic approach that has worked effectively this year.

NVDA data by YCharts

Notably, the market sentiment around these five companies has recently declined, with each stock down about 20% from their peak prices in February.

This negative sentiment may stem from ongoing economic uncertainties, including tariffs and the potential for a trade war. Investors fear such circumstances could hamper these companies’ core operations, restricting their ability to allocate funds for AI, particularly impacting Nvidia, which has experienced the steepest decline.

However, I believe that AI expenditures will remain resilient, as tech giants cannot afford to lose their competitive edge in the AI arms race. Thus, I anticipate that the momentum around AI investments will persist, with substantial opportunities for growth still available.

If you have not yet invested in this sector but are considering it, the current dips in stock prices create an opportune moment to enter the market.

AI Stocks Present Attractive Buying Opportunities

Given the rapid growth of these companies, I will analyze their valuation using the forward price-to-earnings (P/E) ratio. Today’s prices are reminiscent of values seen in 2023.

NVDA PE Ratio (Forward) data by YCharts

Some companies, such as Amazon and Alphabet, have not seen these low valuations since early 2023, when recession fears loomed large. Current market pessimism suggests that investors may have an excellent entry point for long-term positions.

The essential question for investors is whether current market dynamics will impact these companies in the long term. If the outlook remains stable, as I believe, today’s prices represent a favorable buying chance, allowing investors to capitalize on future growth driven by AI advancements.

Should You Invest $1,000 in Nvidia Now?

Before committing to an investment in Nvidia, consider the following:

The Motley Fool Stock Advisor team recently identified what they view as the 10 best stocks for investors to buy now, with Nvidia not being among them. The selected stocks are poised to deliver impressive returns over the coming years.

For example, had you invested $1,000 in Nvidia on April 15, 2005, following the site’s recommendations, your investment would have grown to $578,035!!

Stock Advisor offers a straightforward investment roadmap, complete with portfolio-building guidance, regular analyst updates, and two new stock picks every month. Since its inception, the Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*. Join now to access the latest top 10 stock list.

*Stock Advisor returns as of April 5, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development for Facebook and sister of Meta CEO Mark Zuckerberg, also sits on the board. John Mackey, former CEO of Whole Foods Market, a subsidiary of Amazon, is a board member as well. Keithen Drury holds positions in Alphabet, Amazon, and Nvidia. The Motley Fool maintains positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. It also recommends long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. A complete disclosure policy is available from The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.