The biotech industry has shown strong performance in 2025 despite economic headwinds, buoyed by over 40 FDA drug approvals this year and a surge in mergers and acquisitions (M&A). Notable deals include Johnson & Johnson’s acquisition of Halda Therapeutics for prostate cancer treatments and Novartis’s $12 billion purchase of Avidity Biosciences for RNA therapeutic developments. This consolidation reflects a strategic effort by large firms to diversify product portfolios amidst rising generic competition.

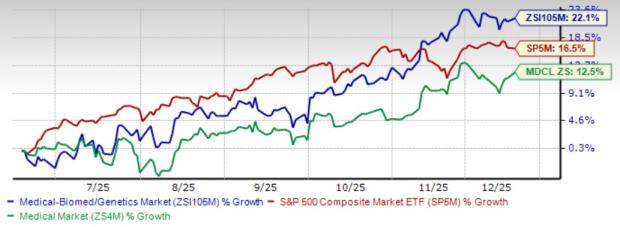

The Zacks Biomedical and Genetics industry, encompassing biopharmaceutical firms focused on groundbreaking drug development, currently holds a Zacks Industry Rank of #89, positioning it among the top 37% of more than 243 Zacks industries. This ranking is supported by a remarkable 22.1% stock gain over the past six months, significantly outpacing the Zacks Medical sector’s 12.5% growth. Companies such as Amicus Therapeutics, Arcutis Biotherapeutics, and ANI Pharmaceuticals are highlighted as industry performers, with share price increases of 90.2%, 108.7%, and 50.3%, respectively.

However, challenges persist, including pipeline setbacks and rising costs from potential tariffs. The industry struggles with the lengthy drug approval process, often resulting in years before profitability is achieved, emphasizing the delicate balance between innovation and market pressures in biotech.