Top Five Cloud Computing Stocks to Watch for 2025

Cloud computing allows users to access vital computing resources like servers, storage, and software over the Internet on a pay-per-use basis. This technology shifts the focus from traditional, on-site infrastructure to flexible and scalable cloud-based solutions. Organizations are now using shared resources from cloud providers, reducing operational costs, increasing productivity, and enhancing scalability.

Based on recent analysis, we have identified five cloud computing stocks that show promise for significant returns in the near future: Five9 Inc. (FIVN), Affirm Holdings Inc. (AFRM), Microsoft Corp. (MSFT), Juniper Networks Inc. (JNPR), and Tyler Technologies Inc. (TYL).

Promising Cloud Computing Stocks

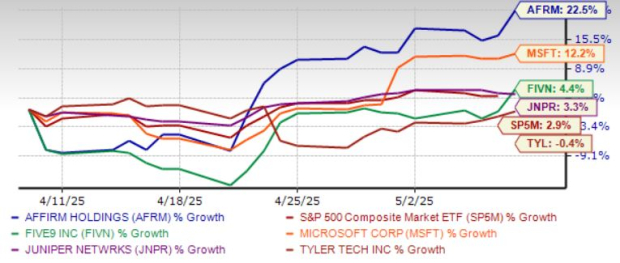

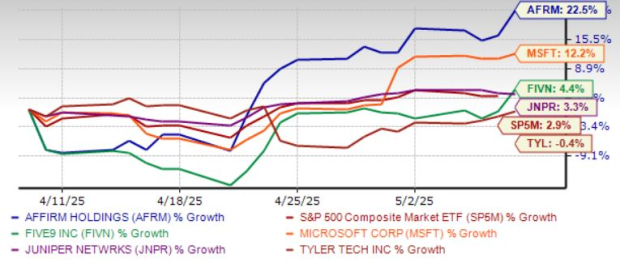

These stocks are projected to have robust earnings and revenue growth possibilities through 2025. All five have received positive earnings estimate revisions over the last 60 days and currently hold a Zacks Rank of #1 (Strong Buy) or #2 (Buy). The chart below illustrates their price performance over the past month.

Image Source: Zacks Investment Research

Five9 Inc.

With a Zacks Rank of #2, Five9 specializes in cloud software for contact centers both in the U.S. and internationally. Its virtual contact center platform offers a suite of applications for customer service, sales, and marketing.

The platform features interactive virtual agents, workflow automation, and AI-driven insights, facilitating management of customer interactions across various channels. Five9’s recent launch of its Intelligent CX Platform utilizing Five9 Genius AI on Google Cloud exemplifies its commitment to artificial intelligence within its services.

The company anticipates revenue and earnings growth rates of 9.6% and 10.9%, respectively, for the current year. Recent earnings estimates have increased by 6% over the past week.

Affirm Holdings Inc.

Ranked #1 by Zacks, Affirm Holdings has shown commendable revenue growth through diverse income sources including merchant fees and interest from loans. In fiscal 2025, the firm expects revenues between $3.13 billion and $3.19 billion, driven by rising numbers of active merchants and improving loan balances.

Key partnerships with platforms like Apple Pay and Hotels.com bolster Affirm’s growth, enhancing its presence in the travel and tech sectors. Affirm anticipates a substantial revenue growth rate of 37.1% and a striking earnings growth rate of 96.4% for this fiscal year, with earnings predictions rising by 60% over the last 60 days.

Microsoft Corp.

Microsoft holds a Zacks Rank of #2. Its third-quarter fiscal 2025 results exceeded expectations, primarily due to strong performance in its AI sector and growth in Azure’s cloud infrastructure. The company experienced growth in its Productivity and Business Processes segment, bolstered by Office 365 Commercial adoption.

The Intelligent Cloud division benefited from Azure’s AI services and increased demand for AI Copilot. Microsoft predicts revenue and earnings growth rates of 13.7% and 12.7%, respectively, for the current year, with earnings estimates improving by 1.4% in the past week.

Juniper Networks Inc.

With a Zacks Rank of #1, Juniper Networks recently reported robust first-quarter 2025 earnings, surpassing Zacks Consensus Estimates. Solid growth in the Enterprise vertical has been fueled by demand for AI-driven solutions and professional services.

Leveraging advancements in data center virtualization and cloud computing, Juniper aims to capture emerging market opportunities within hyperscale switching. This year, it anticipates revenue growth of 7.3% and earnings growth of 21.5%, with current earnings estimates improving by 0.5% over the past week.

Tyler Technologies Inc.

Holding a Zacks Rank of #2, Tyler Technologies is capitalizing on increasing recurring revenues and a market rebound post-pandemic. The public sector’s shift from outdated systems to cloud-based solutions aligns well with Tyler’s offerings.

Tyler Technologies Shows Promising Growth Amid Remote Work Surge

The hybrid working trend is significantly boosting demand for connectivity and cloud services offered by Tyler Technologies (TYL). With a robust liquidity position, the company is well-positioned to pursue acquisitions aimed at enhancing growth.

Revenue and Earnings Growth Projections

Tyler Technologies anticipates a revenue growth rate of 8.9% and an earnings growth rate of 15.6% for the current fiscal year. Notably, the Zacks Consensus Estimate for current-year earnings has seen a slight uptick of 0.1% over the past 30 days.

Research Insights on High-Growth Stocks

In a separate analysis, Zacks’ Research Chief has identified a stock with significant potential for doubling its value. This stock is part of a select group of five, highlighted by Director of Research Sheraz Mian for its impressive growth trajectory.

This leading pick is recognized for its innovation and diverse solutions, catering to a growing customer base that exceeds 50 million. While not all elite selections achieve success, this stock is poised to potentially outperform previously highlighted Zacks stocks, such as Nano-X Imaging, which soared by 129.6% in just over nine months.

For those interested in further insights, Zacks Investment Research offers access to the seven best stocks to consider in the upcoming 30 days. Interested investors can find additional information and reports to guide their decisions.

To explore stock analysis for notable companies such as Microsoft Corporation (MSFT), Juniper Networks, Inc. (JNPR), and others, reports are available for individual review.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.