Dividend Stocks Shine Amid Market Optimism

2024 was a remarkable year for many mega-cap growth stocks, lifting broader indexes like the S&P 500 (SNPINDEX: ^GSPC) to impressive levels. Nonetheless, some investors are beginning to question whether the rally may be stretching too far.

Even struggling companies can see their stock prices rise during periods of investor enthusiasm. However, over time, the stocks that perform best are those that meet investor expectations and foster ongoing innovation. As the S&P 500 hovers near an all-time high, it’s crucial to invest in companies with solid fundamentals.

Start Your Mornings Smarter! Get the latest market updates with Breakfast news delivered to your inbox daily. Sign Up For Free »

Top Dividend Growth Stocks to Watch

Recent quarterly earnings reports from Broadcom and Visa revealed substantial dividend increases for 2025. Broadcom raised its payout by 11%, while Visa’s dividend saw a 13% increase. Expectations are high for both companies to announce further hikes of 10% or more later this year.

Broadcom and Visa exemplify high-quality, dividend-paying growth stocks with strong business models. Broadcom excels in network connectivity and artificial intelligence (AI), while Visa operates a global payment processing network for debit and credit cards.

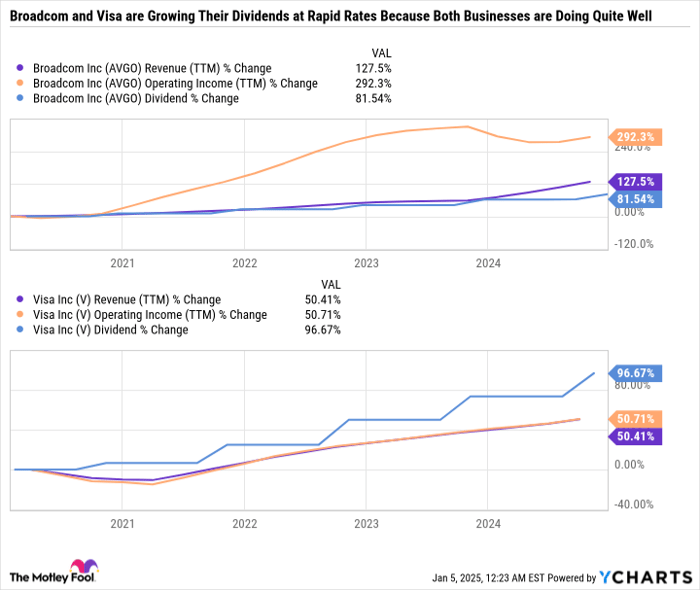

The solid sales and operating income growth at both companies allows them to share a portion of their profits with investors through dividends. Over the past five years, Broadcom has increased its dividend by 81.5%, and Visa has nearly doubled its payout. Crucially, their dividends are not excessively large, which would hinder further investment.

AVGO Revenue (TTM) data by YCharts

Long-term investors prefer Broadcom to rapidly expand its AI product range rather than direct capital to a bloated dividend. Visa opts for buybacks, utilizing the majority of its capital return program there, resulting in a reduced share count by 11% over the last five years. This strategy has helped grow earnings per share at a faster pace than net income, maintaining a reasonable valuation.

With Broadcom yielding 1.2% and Visa providing 0.8%, the lower yields reflect substantial capital gains, not a lack of commitment to increasing dividends.

Emerging Dividend Stocks Making Their Mark

Meta Platforms, Salesforce, and Alphabet all introduced dividends in 2024. Meta started its dividend on February 1, during the announcement of its fourth-quarter and full-year 2023 results. Salesforce followed suit on February 28, revealing its dividend while announcing its fiscal 2024 results.

Alphabet joined the dividend club when it announced its first-ever dividend on April 25, coinciding with its first-quarter 2024 results. It’s anticipated that these companies will continue to increase their dividends annually around the same time as their initial announcements.

Currently, all three companies have yields of 0.5% or less, but there are strong expectations for double-digit annual increases in the coming years, positioning them similarly to Broadcom and Visa as dividend-growth stocks.

Each company enjoys strong profitability and generates considerable free cash flow (FCF) despite increased spending on AI. The concept of FCF yield, calculated as FCF per share divided by share price, serves as a useful measure of potential payouts.

CRM Free Cash Flow Yield data by YCharts

With solid cash positions, each company can afford to increase its payouts significantly without hampering growth efforts.

Five Stocks Worth Considering for 2025

Although Broadcom, Visa, Salesforce, Meta, and Alphabet may not stand out as high-yield options for income investors, their potential for impressive payout growth in the coming years is noteworthy.

Presently, each company’s dividend serves as an additional benefit to an already compelling investment case.

Investors aiming to bolster retirement income might look for stocks with higher yields and long histories of increasing payouts. However, those more focused on total returns (gains plus dividends) should prioritize a company’s capacity to enhance earnings and dividends over time, even if current yields are modest.

Broadcom, Visa, Salesforce, Meta, and Alphabet boast promising pathways for growth, making them worthy candidates for dividend programs in 2025.

Don’t Miss This Opportunity for Potential Gains

Feel like you missed out on purchasing some of the most successful stocks? Here’s your chance.

Occasionally, our expert team identifies a “Double Down” stock recommendation, signaling companies poised for significant gains. If you believe the opportunity has passed, now might be the right time to invest before it’s too late. The numbers are compelling:

- Nvidia: had you invested $1,000 when we doubled down in 2009, you’d now have $363,307!*

- Apple: a $1,000 investment in 2008 would have grown to $45,963!*

- Netflix: turning $1,000 into $471,880 since 2004!*

We are presently issuing “Double Down” alerts for three outstanding companies, and this opportunity may not come around again soon.

Discover the 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, a former director at Facebook and sister of CEO Mark Zuckerberg, holds a position on The Motley Fool’s board. Suzanne Frey, an executive at Alphabet, is also on the board. Daniel Foelber holds no positions in the stocks mentioned. The Motley Fool invests in and recommends Alphabet, Apple, Meta Platforms, Microsoft, Salesforce, and Visa, and also recommends Broadcom. The Motley Fool has a disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.