October’s Mixed Signals: Earnings Up and Markets Down

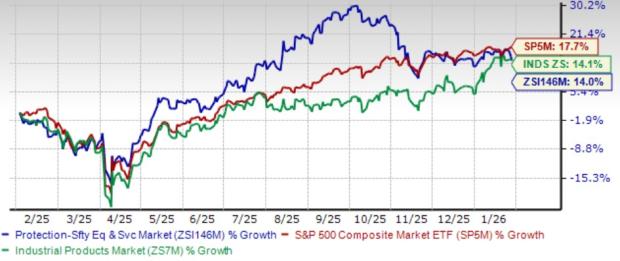

Wall Street showed a lackluster performance in October. As of October 31, 2024, the S&P 500 declined by 0.09%, while the Dow Jones dropped 1.3%, and the Nasdaq fell 0.4% (see: Nasdaq Hits All-Time High Ahead of Earnings: Will ETFs Soar Further?). Strong earnings helped the financial sector, with the XLF fund rising by 4%. Despite some tech giants posting positive results, others failed to meet investor expectations.

Tech Earnings Highlights

The recent surge in artificial intelligence (AI) has impacted tech earnings significantly. Tesla (TSLA) shares fell 1.6% for the month but rallied after a report showed improved margins and optimistic future guidance. In contrast, Netflix (NFLX) gained 6.3% as upbeat earnings bolstered its fundamentals (see: Should Netflix Replace Tesla in “Mag 7”? ETFs in Focus).

Following the closing bell on Wednesday, Meta (META) revealed third-quarter earnings that surpassed analysts’ expectations for both revenue and profit. However, CEO Mark Zuckerberg warned of increased capital expenses in 2025 due to continued investments in infrastructure and projects related to the metaverse and AI glasses, which led to a drop in META shares post-announcement.

Analysts remain hopeful about Microsoft (MSFT), predicting long-term success with Azure and AI growth. Although the earnings report showed strong performance, shares faced a slight setback after guidance revealed Azure growth expectations at 31-32%, slightly lower than the anticipated 32-33% increase.

In another positive twist, Alphabet (GOOGL) reported better-than-expected third-quarter earnings on October 29, spurred on by strong cloud services growth, even amid fierce competition from Microsoft and Amazon (AMZN).

At the end of October, Amazon also posted third-quarter earnings that beat expectations, leading to a 5.7% rise in after-hours trading, despite providing softer guidance for the next quarter. The company reiterated its focus on enhancing AI capabilities.

Apple (AAPL) exceeded earnings expectations with its flagship iPhone line generating $46.22 billion, reflecting high early demand for the iPhone 16. However, disappointing revenues from its Mac and iPad sales pointed to potential demand shifts, resulting in a 1.8% drop in shares after hours on October 31.

U.S. Economy Surprises with Growth

The U.S. economy showcased unexpected resilience, growing at a 2.8% annual rate in Q3, driven by robust consumer spending. Economists had forecasted a 2.6% growth rate for the period ending in September, down slightly from the previous quarter’s 3% growth.

Jobs Report Shows Mixed Signals

The September jobs report painted a cautiously optimistic picture for U.S. markets. Job gains reached the highest level seen in six months, while the unemployment rate fell to 4.1%. For October, projections indicated employers added about 120,000 jobs, a decrease from September’s 254,000, influenced by factors like recent hurricanes and an East Coast port strike, according to FactSet.

Geopolitical Tensions Rise

Tensions flared in the Middle East in early October due to an Iranian missile attack on Israel, leading investors to seek safe-haven assets amid fears of escalating conflict. By the end of the month, Israel conducted retaliatory airstrikes targeting Iran’s Russia-made S-300 air defense systems, as reported by U.S. and Israeli officials.

Highlighted ETFs

Given the current climate, several exchange-traded funds (ETFs) have performed well over the past month (as of October 31, 2024).

AdvisorShares Psychedelics ETF (PSIL) – Up 61.6%

A reverse stock split helped push the price of PSIL significantly higher. Additionally, top holdings like Mind Medicine, which comprises 14.43% of the ETF, gained 11% in October, while Cybin, contributing 10.19%, rose by 11.5%. This ETF focuses on companies in the mental health sector.

Valkyrie Bitcoin Miners ETF (WGMI) – Up 18.7%

Bitcoin values skyrocketed in October, reaching $73,000 amid political developments and increased mainstream acceptance, along with fears of inflation, coinciding with the Fed’s planned rate cuts (see: 5 Factors to Bet on Bitcoin ETFs).

Simplify Interest Rate Hedge ETF (PFIX) – Up 20.9%

As of October 30, 2024, benchmark U.S. treasury yields climbed to 4.29%, up from 3.74% at the start of the month, reflecting a slowdown in yearly inflation to 2.4% for September. This trend may lessen the likelihood of an upcoming Fed rate cut and subsequently drive bond yields higher.

Range Nuclear Renaissance Index ETF (NUKZ) – Up 14.1%

NUKZ follows the performance of companies involved in nuclear fuel and energy, especially in advanced reactor technologies and related services. The tech sector’s increasing demand for nuclear energy—due to its potential to power AI-driven data centers—has further driven interest in nuclear ETFs (see: Uranium ETFs Surge as Big Tech Powers Up With Nuclear Energy).

abrdn Physical Palladium Shares ETF (PALL) – Up 11.7%

Palladium prices have continued to rise, reaching a 10-month high in late October. The U.S. government’s recent commitment to G7 nations to explore options for limiting Russian revenues in the metals industry may have influenced this price surge.

Stay Updated with Key ETF Insights

Sign up for Zacks’ free Fund Newsletter to receive weekly updates on top news, analysis, and high-performing ETFs.

Get it free >>

Looking for the latest recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Financial Select Sector SPDR ETF (XLF): ETF Research Reports

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

abrdn Physical Palladium Shares ETF (PALL): ETF Research Reports

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Range Nuclear Renaissance Index ETF (NUKZ): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.