“`html

As major cities like Boston, New York, and San Francisco prepare for a return to office mandates, office REITs (Real Estate Investment Trusts) are seeing renewed interest, with dividend yields reaching up to 14.4%. This shift comes after COVID-19 had led to significant work-from-home trends, prompting concerns about the viability of office space investments.

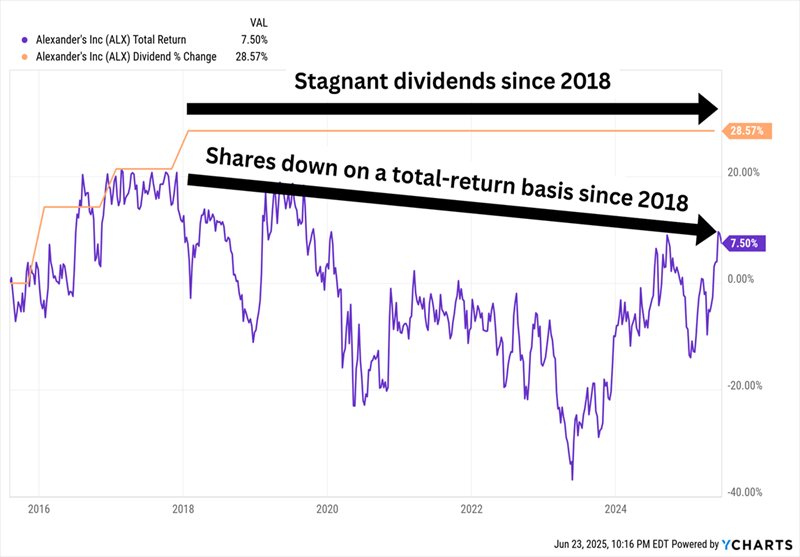

A recent case involves Piedmont Realty Trust, which suspended its dividend for the first time in history due to weak cash flows, with plans to reassess dividends by late 2026. In contrast, Alexander’s REIT, despite its high single-tenant risk with Bloomberg accounting for 60% of revenue, has maintained its dividend and returned 30% over the past five years.

Other notable office REITs include Easterly Government Properties, which recently cut its dividend by a third, and Highwoods Properties, with a 6.4% yield and low debt levels. Brandywine Realty Trust, despite challenges from costly development projects, offers a 14.4% yield but struggles with falling earnings.

“`