The stock market has experienced dynamic swings early in 2024 following an exceptional leap in 2023. The allure bordering technology stocks gradually dissolved as the yield on the 10-Year U.S. Treasury Note surged northward, landing above 4%.

One primary reason for this upward trajectory pertains to the uncertainty looming over the Federal Reserve’s decision to initiate the first cut in the benchmark interest rate. Recent statements from key Fed FOMC members suggest that while they consider the rate hike era a closed chapter, they remain skeptical about the current economic landscape being ripe for an immediate rate reduction.

The Department of Labor made headlines with the Consumer Price Index (CPI) report, revealing a 0.3% month-over-month surge in January, surpassing the estimated 0.2%. The December CPI showed a 0.2% month-over-month increase. However, the alarming figures lay in the 3.1% January surge, a slight decline from December’s 3.4%.

The Core CPI (which dismisses the volatile food and energy items) witnessed a 0.4% uptick in January, outshining the expected 0.3%. December also noted a 0.3% surge. The year-over-year Core CPI stood at 3.9% in January, exceeding the anticipated 3.7%. This marked a regression from December, which recorded a similar 3.9%, the lowest since May 2021.

These revelations triggered anxiety among market participants, leading to volatile trading. Presently, the CME FedWatch tool exhibits a mere 10% probability of the central bank implementing a 25-basis-point rate cut in the upcoming March FOMC meeting. A stark contrast to the 90% probability at the outset of 2024.

Close to 60% of market respondents anticipate the central bank maintaining the status quo on the lending rate at 5.25-5.5% at the May FOMC meeting. Nonetheless, an overwhelming 82% expect the initial cut in the Fed fund rate to transpire during the June FOMC meeting. Amid this uncertainty, an investment in low-beta stocks accompanied by high dividend yields and a favorable Zacks Rank emerges as a viable sanctuary.

A Glimpse at Our Prime Selections

We have curated a selection of five low-beta (beta >0 <1) stocks, each boasting a substantial dividend yield. These firms exhibit promising growth potential in 2024 and have witnessed positive revisions in earnings estimates during the last 30 days. All our choices hold a Zacks Rank #1 (Strong Buy). You can review the comprehensive list of Zacks #1 Rank stocks for today here.

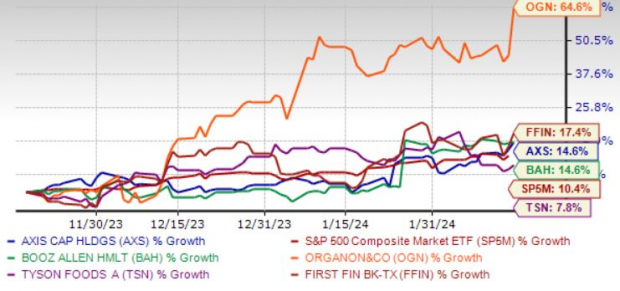

The chart below illustrates the price performance of our five selections over the past three months.

Image Source: Zacks Investment Research

Booz Allen Hamilton Holding Corp. BAH has reaped the benefits of its Vision 2020 strategy, accelerating organic revenue growth, enhancing profitability, and achieving substantial headcount and backlog growth.

BAH’s VoLT strategy emphasizes infusing velocity, leadership, and technology into the transformation process. The organization focalizes on domains such as Artificial Intelligence, advanced engineering, directed energy, and modern digital platforms. We anticipate a 12.4% revenue growth in fiscal 2024.

Booz Allen Hamilton anticipates a 14.3% revenue growth and a 16.7% earnings growth rate for the current fiscal year (ending March 2024). The Zacks Consensus Estimate for current-year earnings has heightened by 0.8% in the last 30 days. BAH boasts a beta of 0.54 and a current dividend yield of 1.41%.

Tyson Foods Inc. TSN has secured market share dominance across various retail categories. Productivity initiatives rooted in procurement, logistics, and digitization are manifesting results. TSN endeavors to expand into international markets and exhibits commitment to shareholder prosperity, evident from its 12th consecutive year of dividend hikes.

Tyson Foods anticipates a 0.1% revenue growth and a whopping 74.6% earnings growth rate for the current fiscal year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has surged by 23.2% in the last 30 days. TSN possesses a beta of 0.77 and a current dividend yield of 3.77%.

AXIS Capital Holdings Ltd. AXS continues to fortify its position in Specialty Insurance, Reinsurance, and Accident and Health, laying the groundwork for prolonged growth. AXS steers attention toward prudent resource allocation, amplified efficiencies, portfolio mix enhancements, and underwriting profitability. The fortification of casualty and professional lines in the insurance segment augurs well for AXS.

AXIS Capital anticipates a 3.6% revenue growth and a 2.5% earnings growth rate for the current year. The Zacks Consensus Estimate for current-year earnings has amplified by 0.5% in the past seven days. AXS touts a beta of 0.79 and a current dividend yield of 2.89%.

First Financial Bankshares Inc. FFIN offers commercial banking products and services in Texas. The organization delivers a broad spectrum of commercial banking services along with securities brokerage services, trust and wealth management services, and a multitude of loan categories.

First Financial Bankshares anticipates a 5.8% revenue growth and a 4.3% earnings growth rate for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has increased by 7.4% in the last 30 days. FFIN displays a beta of 0.82 and a current dividend yield of 2.33%.

Organon & Co. OGN formulates and dispenses health solutions through a suite of prescription therapies and medical devices for women’s health globally. OGN concentrates on women’s health across all life stages.

Organon forecasts a 2% revenue growth and a 5.2% earnings growth rate for the current fiscal year. The Zacks Consensus Estimate for current-year earnings has climbed by 1% in the last seven days. OGN maintains a beta of 0.79 and a current dividend yield of 6.85%.

7 Best Stocks for the Next 30 Days

Just as these stocks brave the storm of fluctuating markets, their resilience shines through, offering investors an oasis of stability amidst volatility. Eyeing stocks with low-beta and high dividends may just be the compass needed to navigate the tempestuous seas of the fiscal realm.

Zacks Analyst Report: Distillation of 7 Elite Stocks

Investors often rummage through a dense jungle of stocks, searching for hidden gems that promise early price pops. The recent pronouncement from Zacks Investment Research is akin to being handed a treasure map. Experts have meticulously combed through a vast list of 220 Zacks Rank #1 Strong Buys and plucked out seven stocks that they deem “Most Likely for Early Price Pops.”

This isn’t just another isolated event. The historical context here is key. Since 1988, Zacks’s complete list has surged past the market by more than two-fold, boasting an average annual gain of a whopping +24.0%. This spectacular track record cannot be dismissed as a mere fluke. Those numbers are equivalent to a seasoned sprinter lapping an amateur on the track; an outstanding feat by any measure.

If we turn the hourglass of time and ask the shrewdest investors, they would agree that immediate attention to these hand-picked seven stocks is not merely a suggestion but a compelling imperative. There’s an old saying: “Strike while the iron is hot.” And these stocks, dubbed as “Most Likely for Early Price Pops,” are indeed the hottest items in the stock market right now. It’s as if Zacks has polished these gems, making them shine brighter and gleam more brilliantly than the rest.

Get a Free Stock Analysis Report for Axis Capital Holdings Limited (AXS)

Obtain a Free Stock Analysis Report for Tyson Foods, Inc. (TSN)

Access a Free Stock Analysis Report for First Financial Bankshares, Inc. (FFIN)

Retrieve a Free Stock Analysis Report for Booz Allen Hamilton Holding Corporation (BAH)

Download a Free Stock Analysis Report for Organon & Co. (OGN)

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.