Bitcoin Surges Past $100,000: What It Means for Investors

Key Insights

- Bitcoin has surpassed $100,000 again after reaching an all-time high of $106,533 in December.

- Investing in stocks of companies linked to Bitcoin offers investors potential gains aligned with the cryptocurrency.

- Companies like Nvidia, Robinhood Markets, Shopify, Interactive Brokers, and Coinbase are poised to benefit from increasing Bitcoin prices.

The year 2024 started strong for stocks, though market volatility crept back by December’s end. In contrast, the cryptocurrency market has shown resilience. Bitcoin (BTC) recently resumed its upward trajectory after a minor setback following its record high in December.

On Wednesday, Bitcoin once again crossed the $100,000 threshold. This surge came after the release of December’s consumer price index (CPI) data, which indicated a slight easing of inflation by year-end. The excitement around cryptocurrencies has ramped up following Donald Trump’s victory in the U.S. Presidential election, with many anticipating his pro-crypto initiatives will help Bitcoin reach new records.

In light of this positive sentiment, investors may find opportunities in Bitcoin-centric stocks such as NVIDIA Corporation (NVDA), Robinhood Markets, Inc. (HOOD), Shopify Inc. (SHOP), Interactive Brokers Group, Inc. (IBKR), and Coinbase Global, Inc. (COIN). These companies exhibit promising growth potential for 2025, bolstered by favorable earnings revisions over the past two months.

Bitcoin Climbs Back Above $100,000

Following a peak of $106,533 on December 22, Bitcoin experienced a dip of more than 12% at the start of January. Nevertheless, it surpassed $100,000 again recently, buoyed by encouraging inflation data and regulatory developments viewed as positive for the cryptocurrency market.

By Friday morning, Bitcoin had climbed past $102,000, although it was hovering around $101,600 while this article was being prepared.

This surge was fueled by fresh data revealing that the consumer price index (CPI) had increased by 0.4% month-over-month in December, slightly above the anticipated rise of 0.3%. On the year-over-year front, CPI grew 2.9%, aligning with the consensus projection.

The core CPI, which excludes volatile items such as food and energy, increased by 0.2% month-over-month in December, 0.1% under the consensus forecast, and 3.2% compared to the previous year, faring slightly better than the anticipated 3.3% rise.

Optimism Grows Ahead of Trump Inauguration

Bitcoin’s price surge arrived just days before Trump’s inauguration, a move attributed to his anticipated crypto-friendly policies. Many expect that his administration will create an environment supportive of cryptocurrency.

Trump has appointed several pro-crypto figures to significant regulatory and cabinet roles. During his campaign, he pledged to position the United States as the “crypto capital of the world,” outlining plans for a strategic Bitcoin reserve and appointing favorable regulators.

Industry experts predict that loosening cryptocurrency regulations could have a positive impact on Bitcoin, suggesting that 2025 could see record-setting performance. Historically, Bitcoin has reached new heights every four years throughout its two most recent bullish cycles. In these periods, it achieved astonishing gains of 2300% and 1700%, followed by corrections of 70% to 80%.

From its low of $16,000 in early 2023, Bitcoin has escalated by nearly 600%, showcasing significant potential for ongoing growth over the upcoming two years.

Top 5 Crypto-Related Stocks to Watch

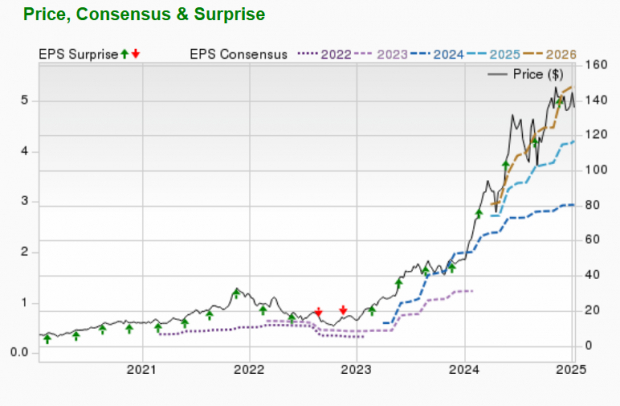

NVIDIA Corporation

NVIDIA Corporation has emerged as a leading player in the semiconductor market, achieving remarkable success in 2023. As a top designer of graphic processing units (GPUs), NVDA’s stock typically rises with the cryptocurrency market, driven by the essential role GPUs play in data centers, artificial intelligence, and crypto mining.

NVIDIA’s expected earnings growth rate for the current year exceeds 100%. The Zacks Consensus Estimate for its current-year earnings has risen 3.5% in the last 60 days, with NVIDIA holding a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

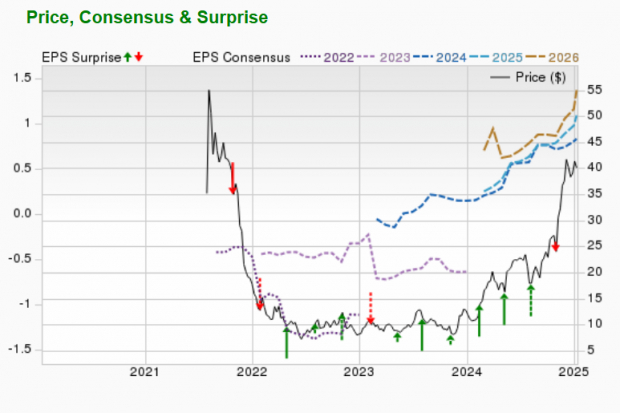

Robinhood Markets

Robinhood Markets, Inc. operates a financial services platform that allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. Through its Robinhood Crypto feature, HOOD facilitates transactions of Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies.

Robinhood Markets is also expected to see earnings grow by more than 100% this year. The Zacks Consensus Estimate for its current-year earnings has increased by 26.4% in the past 60 days, leading to a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

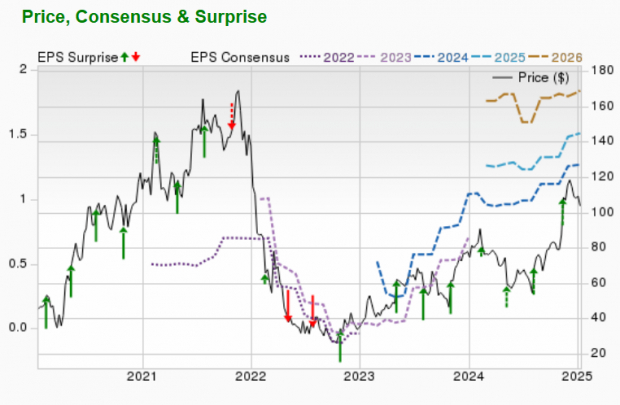

Shopify

Shopify Inc. is an e-commerce giant offering a platform that enables merchants to accept cryptocurrencies. The company has partnered with CoinPayments, allowing it to process cryptocurrency transactions seamlessly.

Shopify expects a 70.3% earnings growth rate for the current year, and the Zacks Consensus Estimate for its earnings has improved by 12.5% in the last 90 days. SHOP currently boasts a Zacks Rank #1.

Image Source: Zacks Investment Research

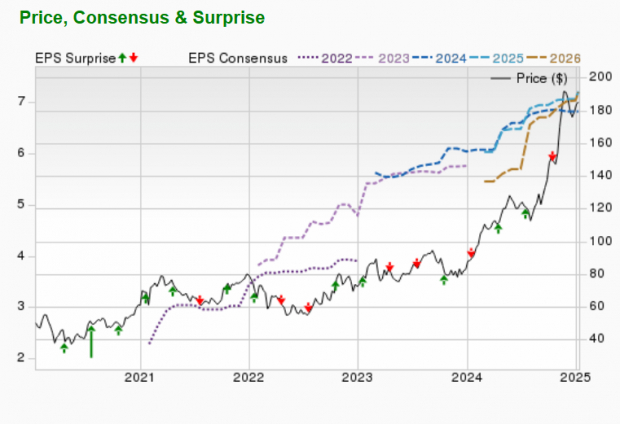

Interactive Brokers Group, Inc.

Interactive Brokers Group, Inc. stands as a global automated electronic broker, facilitating cryptocurrency trading. The IBKR commodities futures trading desk offers clients an opportunity to trade cryptocurrencies.

Strong Earnings Growth Anticipated for Interactive Brokers and Coinbase

Interactive Brokers: Strong Outlook for Earnings Growth

Interactive Brokers Group is projected to achieve an earnings growth rate of 20% for the current year. Over the last 60 days, the Zacks Consensus Estimate for their current-year earnings has seen an increase of 1.3%. Currently, IBKR holds a Zacks Rank of #2, indicating a favorable outlook.

Image Source: Zacks Investment Research

Coinbase Global: A Leader in Cryptocurrency Services

Coinbase Global, Inc. plays a crucial role in the global cryptocurrency economy by providing financial infrastructure and technology. It offers a primary financial account for consumers, a marketplace for institutional crypto transactions, and tools for developers to create crypto applications and accept cryptocurrency payments securely.

For the current year, Coinbase Global has an expected earnings growth rate exceeding 100%. The Zacks Consensus Estimate for its annual earnings has improved by 11.4% over the past two months. Presently, COIN has achieved a Zacks Rank of #1, signifying a strong performance outlook.

Image Source: Zacks Investment Research

Discover the Zacks Top 10 Stocks for 2025

Act now to discover our 10 recommended stocks for 2025. These selections, curated by Zacks Director of Research Sheraz Mian, have demonstrated outstanding success. Since the initiative’s start in 2012 through November 2024, the Zacks Top 10 Stocks have achieved an impressive gain of +2,112.6%, significantly outperforming the S&P 500’s +475.6%. After careful analysis of 4,400 companies covered by the Zacks Rank, Sheraz has identified the top 10 stocks to buy and hold for the upcoming year.

Don’t miss out—explore the New Top 10 Stocks >>

For the latest insights from Zacks Investment Research, download the report on the 7 Best Stocks for the Next 30 Days. Get your free report now.

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Coinbase Global, Inc. (COIN): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

For more details, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.