“`html

Wall Street Volatility: Five Stocks Demonstrating Resilience Amid Turmoil

April has brought considerable volatility to Wall Street, driven by President Donald Trump’s tariffs and trade policies. With only two trading days remaining in the month, major stock indexes reflect negative performance year-to-date. Many economists and analysts have raised alarms about a potential near-term recession.

Ongoing trade negotiations involve the Trump administration and several key nations. Amid significant declines in stock prices across corporate giants, a few companies managed to navigate these turbulent waters. Optimistically, some financial analysts have identified stocks that show promise.

Resilient Stocks Amid Market Turmoil

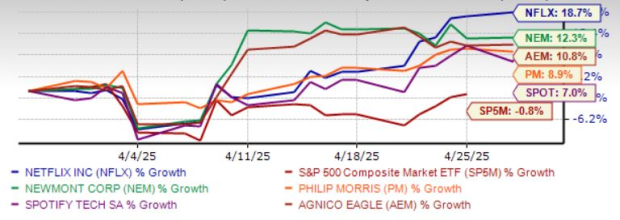

A select group of corporate giants (market capitalization exceeding $50 billion) have performed well despite the market’s chaos in April. Specifically, five stocks have provided returns exceeding 5% month-to-date, making them notable picks with a favorable Zacks Rank.

These recommended stocks include Netflix Inc. (NFLX), Newmont Corp. (NEM), Philip Morris International Inc. (PM), Agnico Eagle Mines Ltd. (AEM), and Spotify Technology S.A. (SPOT). All these stocks exhibit strong revenue and earnings potential for 2025, along with recent positive earnings estimate revisions. Each holds a Zacks Rank of #2 (Buy).

The chart below illustrates the price performance of these five stocks over the past month.

Image Source: Zacks Investment Research

Analysis of Select Stocks

Netflix Inc. (NFLX)

Netflix exceeded the Zacks Consensus Estimate for earnings while revenue results were mostly in line for the first quarter of 2025. Despite headwinds from trade and tariffs, NFLX has maintained strong user engagement. The company has reaffirmed its guidance for 2025, even amid recession fears.

Brokerage firms have revised their revenue and earnings estimates upward due to Netflix’s robust business visibility. On April 1, Netflix launched its Ad Suite in the United States and plans to expand internationally. This initiative aims to drive subscriber growth and improve average revenue per user (ARPU).

Furthermore, Netflix’s strategies, which include lower-priced ad-supported tiers and stricter password-sharing policies, position it as a defensive choice ahead of economic shifts. The company also leverages artificial intelligence and data science to enhance viewer recommendations and optimize service delivery.

For 2025, Netflix anticipates a revenue growth rate of 14% and a significant earnings growth rate of 27.7%, with a 1.8% upward revision in earnings estimates over the past week.

Newmont Corp. (NEM)

Newmont has made advancements in its growth projects, notably the Tanami expansion, and the acquisition of Newcrest enhances its portfolio. The company has received full funding approval for its Ahafo North project, anticipating commercial production to begin in the latter half of 2025.

With an investment of $950 million to $1.05 billion for Ahafo North in Ghana, Newmont remains focused on operational efficiency and shareholder value. The expected growth rates for revenue and earnings for this year are 0.9% and 16.4%, respectively. The Zacks Consensus Estimate for earnings has improved by 2% in the past week.

Philip Morris International Inc. (PM)

Philip Morris continues to gain from its pricing power and expansion of smoke-free products. The company’s commitment to becoming substantially smoke-free by 2030 is evident through its successful products like IQOS and ZYN. For 2025, Philip Morris expects a volume growth of 2%, marking its fifth consecutive year of growth.

Expected growth rates for revenue and earnings stand at 7.3% and 13.2%, respectively, with a recent 2.9% positive adjustment in earnings estimates. Smoke-free products are a significant growth driver, projected to increase by 12-14%.

Agnico Eagle Mines Ltd. (AEM)

Agnico Eagle Mines focuses on projects poised to boost production. The Kittila expansion is set to decrease costs, while acquisitions like Hope Bay and the merger with Kirkland Lake Gold strengthen its market position. This merger has positioned AEM as a leading senior gold producer, benefiting from higher gold prices.

Agnico Eagle’s expected revenue and earnings growth rates are currently not specified but indicate a positive outlook driven by strategic diversification and sound financial management.

“`# Spotify Technology Reports Strong User Growth and Earnings Growth for 2023

## Overview of Spotify Technology

Spotify Technology provides audio streaming services globally, operating through two main segments: Premium and Ad-Supported. The Premium segment offers subscribers unlimited streaming of music and podcasts without any commercials. In contrast, the Ad-Supported segment allows users on various devices, such as computers and mobile devices, to access music and podcasts on-demand, albeit with commercials.

## User Statistics and Performance

In the latest quarter, Spotify reported a total of 675 million Monthly Active Users (MAUs), surpassing the consensus estimate of 665.25 million. Of this total, 425 million users were from the Ad-Supported segment, exceeding expectations of 420.15 million. The number of Premium Subscribers reached 263 million, outperforming the consensus estimate of 259.99 million.

## Financial Growth Projections

The expected revenue growth for Spotify stands at 14.8% for the current year, while earnings are projected to grow by 75.8%. Over the past week, the Zacks Consensus Estimate for current-year earnings has risen by 1.6%.

## Semiconductor Market Insights

In other news, Zacks Investment Research has identified a top semiconductor stock, noting that it is just 1/9,000th the size of NVIDIA, which saw an increase of over 800% since its recommendation. The new chip stock is expected to capitalize on the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is projected to grow from $452 billion in 2021 to $803 billion by 2028.

For additional stock analysis reports, including Netflix, Philip Morris, Newmont Corporation, and Agnico Eagle Mines, visit Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.