Retail Sector on the Rise as Consumer Spending Boosts Sales

The retail industry faced significant challenges for months, but signs of recovery emerged in the latter half of last year when the Federal Reserve began lowering interest rates, which helped alleviate inflation. Although the sector is not entirely out of the woods, retail sales have seen impressive gains in recent months, capped by strong consumer spending during the holiday season.

With inflation slowing in December, the outlook for the retail sector continues to brighten, reducing price pressures further. As a result, investing in retail stocks appears to be a strategic move.

Strong Growth in Retail Sales

According to the Commerce Department, retail sales reached $994.1 billion in December, an increase of 0.4% following a revised upward 0.8% rise in the previous month. Year-over-year, retail sales showed a robust growth of 3.9% in December.

In the third quarter of 2024, retail sales increased by 3.7% from the previous year. Notably, sales at auto dealerships grew by 0.7% in December, following a 3.1% increase the prior month. Sales also surged by 2.3% at furniture stores and 1.5% at clothing stores. Additionally, sales in sporting goods, hobbies, musical instruments, and bookstores climbed by 2.6%.

Excluding categories such as automobiles and gasoline, retail sales rose an impressive 0.7% in December after a constant increase of 0.4% in November.

Consumer Spending Drives Improvement

The retail sector grappled with rising prices after the Federal Reserve implemented substantial interest rate hikes to combat inflation. However, as inflation sharply decreased last year, the Fed started cutting rates in September.

Since then, the Fed has reduced rates by 100 basis points, significantly alleviating price pressures and lowering borrowing costs. This shift has provided a much-needed boost to the retail sector, leading to higher sales in the final months of 2024.

The holiday shopping period saw consumers spending freely, contributing to a spike in overall retail sales during November and December. Economists estimate that consumer spending grew by an impressive 3.3% year-over-year in the fourth quarter, following a 3.7% increase in the third quarter of 2024.

While the Federal Reserve is not anticipated to implement rate cuts in the upcoming months, further cuts are expected in the future, which should continue to support retail growth.

Top 5 Retail Stocks to Consider

Amazon.com, Inc.

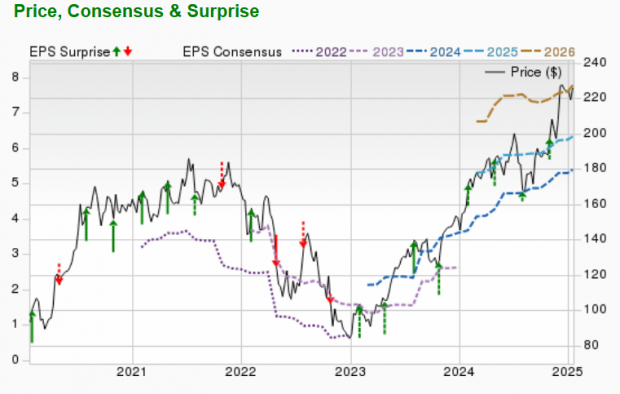

Amazon.com, Inc. is one of the leading e-commerce companies, with extensive operations in North America and an expanding global presence. The company’s online retail strategy hinges on its Prime program, bolstered by a vast distribution network. Furthermore, the acquisition of Whole Foods Market has allowed Amazon to make significant inroads into the physical grocery market. Additionally, Amazon Web Services has solidified its dominance in the cloud-computing sector.

Amazon is expected to achieve an 82.4% growth in earnings this year, with the Zacks Consensus Estimate for earnings improving by 2.3% over the last 60 days. Currently, AMZN holds a Zacks Rank of #1.

Image Source: Zacks Investment Research

Walmart Inc.

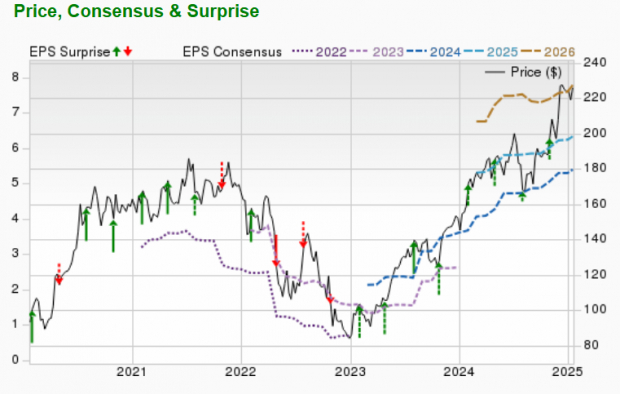

Walmart has transformed its business model from a traditional retailer to a comprehensive omnichannel player. WMT offers a diversified range of products, from groceries and cosmetics to electronics and home furnishings.

The expected earnings growth rate for Walmart in the current year stands at 11.3%, with the Zacks Consensus Estimate for earnings rising by 1.2% in the last 60 days. WMT currently has a Zacks Rank of #2.

Image Source: Zacks Investment Research

Urban Outfitters, Inc.

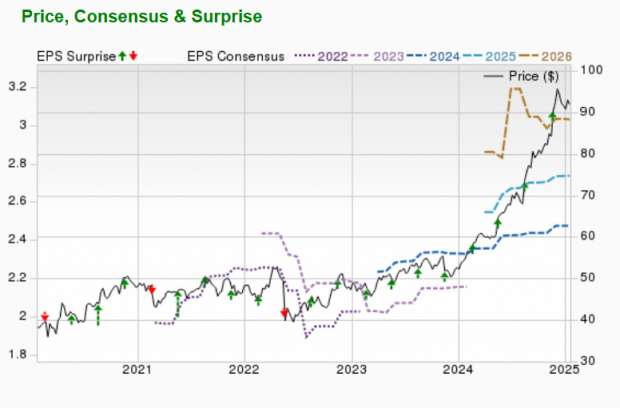

Urban Outfitters is a lifestyle retailer that specializes in fashion apparel, footwear, home décor, and gifts. The company’s offerings are available through various channels, including physical stores and e-commerce platforms. Its operations span the U.S., Canada, and Europe.

Urban Outfitters projects an expected earnings growth rate of 20% for the current year, with the Zacks Consensus Estimate for earnings increasing by 7.1% over the past 60 days. URBN currently holds a Zacks Rank of #1.

Image Source: Zacks Investment Research

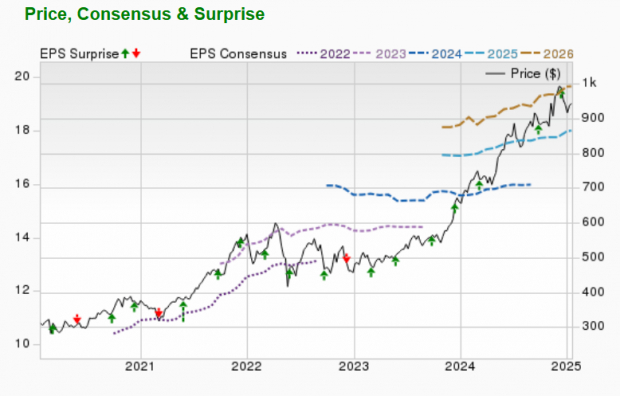

Costco Wholesale Corporation

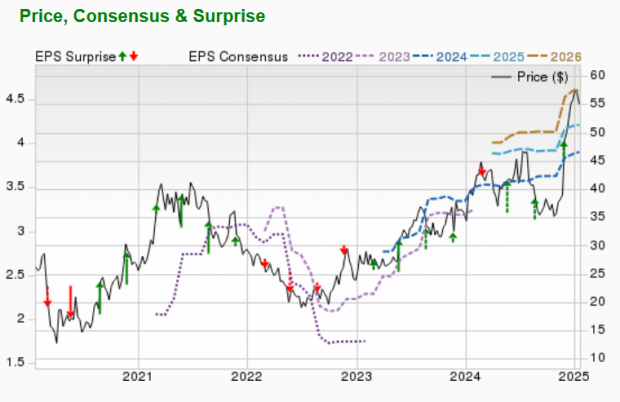

Costco Wholesale Corporation operates membership warehouses, selling a large volume of food and general merchandise at discounted prices. As one of the largest warehouse club operators in the U.S., Costco also has e-commerce websites in several countries including Canada, the U.K., and Japan.

Costco’s expected earnings growth rate for the current year is 11.8%, with the Zacks Consensus Estimate improving by 0.8% in the past 60 days. COST currently carries a Zacks Rank of #2.

Image Source: Zacks Investment Research

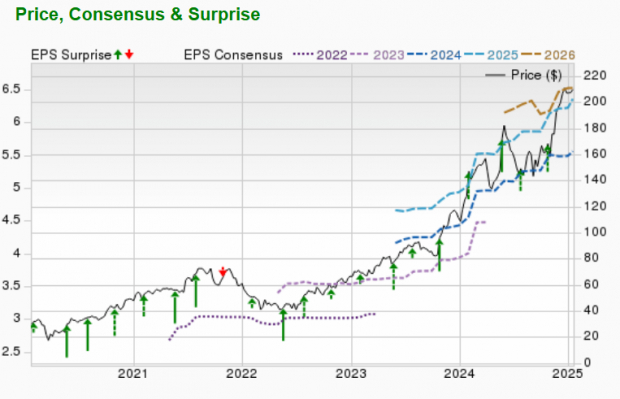

Deckers Outdoor Corporation

Deckers Outdoor Corporation is renowned for designing and marketing specialty footwear and accessories focused on outdoor sports and lifestyle activities. The company’s products are primarily offered under five brands: UGG, HOKA, Teva, Sanuk, and others, including Koolaburra.

Deckers’ expected earnings growth rate for the upcoming year is 14.4%, while the Zacks Consensus Estimate for earnings has risen by 1.5% over the past 60 days. DECK currently has a Zacks Rank of #1.

Image Source: Zacks Investment Research

Investing in Potential Winners

Experts from Zacks research have identified five stocks with high potential for doubling in value by the end of 2024. While past performances aren’t guaranteed to continue, previous recommendations have achieved remarkable gains of up to +673.0%.

If you’re looking for promising investment opportunities, consider these picks highlighted in the report.

For more insights and stock evaluations from Zacks Investment Research, download the latest recommendations, including :

- Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

- Walmart Inc. (WMT) : Free Stock Analysis Report

- Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

- Costco Wholesale Corporation (COST) : Free Stock Analysis Report

- Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.