Property and Casualty Insurance Industry Adjusts Amid Changing Market Dynamics

The Property and Casualty Insurance (P&C) industry is positioned to gain from improvements in pricing, strategic underwriting, and increased exposure. Leading companies such as Berkshire Hathaway (BRK.B), The Progressive Corporation (PGR), Chubb Limited (CB), The Travelers Companies (TRV), and The Allstate Corporation (ALL) are set for growth despite challenges posed by rising catastrophe events. Active catastrophe conditions are likely to enhance policy renewal rates, while advancements in technology and the rise of insurtechs will facilitate smoother operations for industry players.

In the third quarter of 2024, insurers faced a pricing decline after over seven years of increases; however, a recovery began in the fourth quarter. The past year showed three interest rate cuts, with potential additional cuts this year, raising concerns for insurers who typically benefit from improved rates. Tariffs imposed by the former administration and rising inflation are also exerting pressure on pricing. Nevertheless, growth in surplus and economic activities create a favorable backdrop for mergers and acquisitions (M&A). According to Fitch Ratings, the personal auto segment is expected to remain robust, and improved investment outcomes along with reduced claims should bolster insurers’ performance in 2025.

About the Property and Casualty Insurance Industry

The Zacks Property and Casualty Insurance sector includes companies providing both commercial and personal property insurance and casualty products. This coverage protects properties against natural and man-made disasters. Some firms also offer liability coverage. Their offerings encompass vehicles, professional risks, marine insurance, excess casualty, aviation, personal accidents, commercial multi-peril, and surety bonds. Premiums form the primary revenue source for these companies, supported by improved pricing and enhanced exposure. While they invest a portion of premiums to fulfill policyholder commitments, recent rate cuts and additional anticipated cuts raise concerns.

Trends Impacting the Property and Casualty Insurance Industry

Pricing Strategies to Address Claims: Increased catastrophe events have forced insurers to raise rates to cover substantial claims. MarketScout’s Market Barometer shows a 3% hike in commercial insurance rates and a 4.9% rise in personal lines in the first quarter of 2025. Fitch Ratings anticipates strong performance in personal auto insurance, driven by improved investment returns and lower claims. S&P Global forecasts stabilization in underwriting profits in this market as insurers work to grow policy volumes while maintaining steady or slightly reduced rates. Deloitte projects gross premiums to reach $722 billion by 2030, with over two-thirds of growth driven by China and North America. Swiss Re expects premium growth of 5% in 2025 and 4% in 2026.

Volatility from Catastrophe Losses: The property and casualty sector is vulnerable to catastrophe events, adversely affecting underwriting profits. Aon estimates that first-quarter insured losses from natural disasters will surpass $53 billion, the second-highest total recorded after the first quarter of 2011. California wildfires alone accounted for about $38 billion, or 71% of these losses. Intact Financial Corporation projects that total catastrophe losses will reach $244 million in the first quarter of 2025. Swiss Re anticipates slight improvement in the combined ratio, moving from 98.5% in 2023 to 99% in 2026, impacted by personal lines losing ground amid higher catastrophe losses. However, growth in exposure, effective pricing, careful underwriting, and positive reserve development should help mitigate potential pressures.

Mergers and Acquisitions Activity: Consolidation within the P&C industry is expected to persist as firms diversify into new business lines and regions. Acquisitions of similar businesses will also continue as companies aim to enhance market share. A solid capital position will support numerous mergers, acquisitions, and consolidations in the industry.

Technology Adoption Trends: The industry is increasingly embracing technologies such as blockchain, artificial intelligence, advanced analytics, telematics, cloud computing, and robotic process automation. These innovations streamline operations and reduce costs. Insurtech firms focused on the P&C market are emerging. Insurers are investing heavily in technologies like generative AI, forecasting improvements in efficiency. However, increased technology use also introduces potential cyber threats.

Zacks Industry Rank and Outlook

The Zacks Industry Rank reflects positive prospects for the sector. The Property and Casualty Insurance industry, part of the broader Zacks Finance sector, holds a Zacks Industry Rank of #37, indicating placement within the top 15% of over 250 Zacks industries. Historical data suggests that companies in the top 50% rank consistently outperform those in the bottom 50% by more than two to one.

This strong positioning for the industry stems from an optimistic earnings outlook for the constituent companies. Looking ahead, let’s examine recent stock-market trends and valuation metrics for the sector.

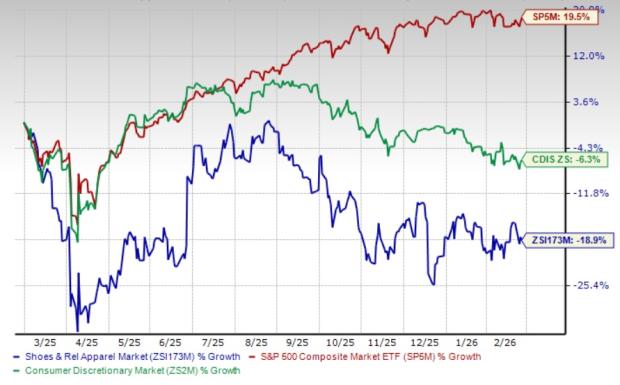

Industry Performance Relative to Sector and the S&P 500

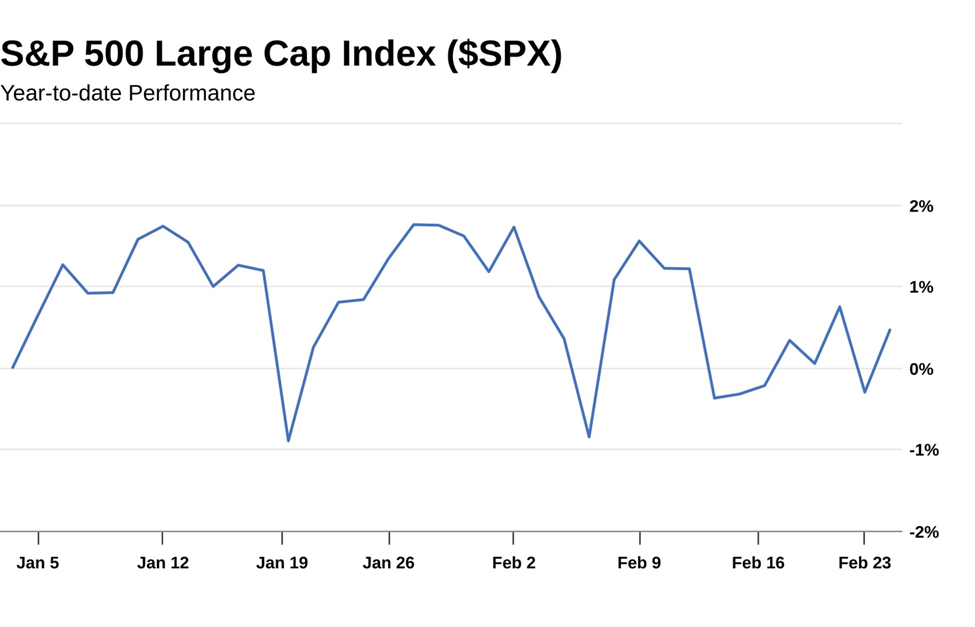

The Property and Casualty Insurance industry has outpaced its sector and the Zacks S&P 500 composite so far this year. Stocks in this sector have risen by 15.3%, while the sector itself has seen only a 1.4% increase. In contrast, the Zacks S&P 500 composite has declined by 23.6% during the same period.

YTD Price Performance

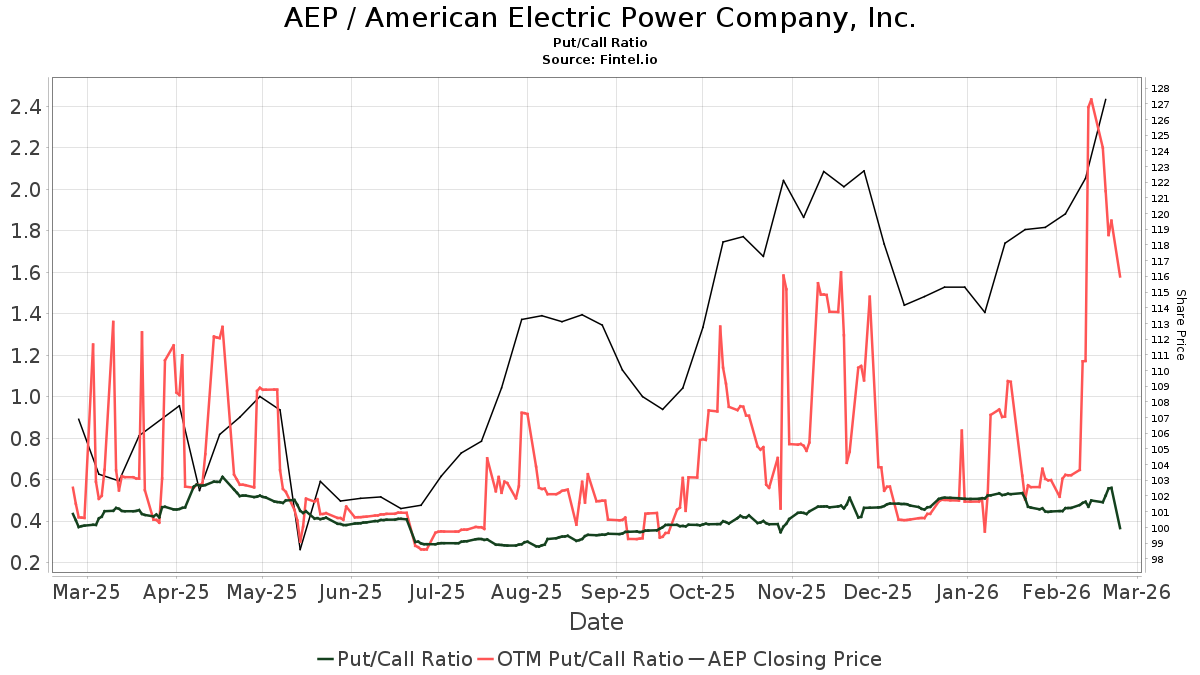

Current Valuation Metrics

Based on the trailing 12-month price-to-book (P/B) ratio, which is often used for valuing insurance stocks, the industry is trading at 1.65X. This compares favorably to the S&P 500’s 7.82X and the sector’s 3.97X valuation. Over the past five years, the industry has seen its P/B trade as high as 1.67X and as low as 1.09X, with a median of 1.34X.

Top Property and Casualty Insurance Stocks to Consider Now

Price-to-Book (P/B) Ratio (TTM)

Five Noteworthy Property and Casualty Insurance Stocks

This analysis highlights one Zacks Rank #2 (Buy) stock alongside four Zacks Rank #3 (Hold) stocks within the Property and Casualty (P&C) Insurance industry.

1. Progressive Corporation

Progressive Corporation, headquartered in Mayfield Village, OH, ranks among the leading auto insurers in the United States. It holds a significant market share in motorcycle and boat policies and leads in commercial auto insurance. Its extensive portfolio and operational expertise support continuous profitability, earning it a Zacks Rank #2.

The Zacks Consensus Estimate predicts Progressive will achieve year-over-year earnings growth of 11.8% for 2025 and 1.9% for 2026. The estimates have recently adjusted upward by 0.1% and 0.6%, respectively. Progressive has recorded an average earnings surprise of 18.45% over the past four quarters, alongside a VGM Score of B and a long-term growth rate projected at 10.4%, surpassing the industry average of 7.4%.

Price and Consensus: PGR

.jpg)

2. Berkshire Hathaway

Berkshire Hathaway, located in Omaha, NE, oversees over 90 subsidiaries in various sectors, including insurance, railroads, and utilities. Classified as one of the largest P&C insurers by premium volume, it holds a Zacks Rank #3. The company’s growth in the Insurance sector, bolstered by its subsidiaries in Manufacturing and Finance, continues to enhance its return on equity.

The Zacks Consensus Estimate expects a 7.7% increase in earnings for 2026, with a long-term growth forecast of 7%.

Price and Consensus: BRK.B

.jpg)

3. Allstate

Based in Northbrook, IL, Allstate holds the distinction of being the third-largest P&C insurer and the largest publicly traded personal lines carrier in the U.S. The company anticipates improved premiums driven by rate hikes in auto and home insurance, as well as strategic growth in its Protection Services segment. Allstate currently has a Zacks Rank #3.

The Zacks Consensus Estimate forecasts an impressive 28.3% year-over-year growth in 2026 earnings, with a recent upward adjustment of 1 cent. Allstate has achieved an average earnings surprise of 127.06% over the past four quarters, with a long-term earnings growth estimate of 10% and a VGM Score of B.

Price and Consensus: ALL

.jpg)

4. Travelers Companies

Travelers Companies, headquartered in New York, NY, is a prominent provider of auto, homeowners, and commercial property-casualty insurance in the U.S. Its mix of high retention, effective pricing, and robust product offerings positions it for growth, holding a Zacks Rank #3.

The Zacks Consensus Estimate suggests a remarkable 31.2% rise in earnings for 2026, with a recent increase of 4.7% in estimates. Travelers has a four-quarter average earnings surprise of 75.37% and a long-term growth rate estimated at 3.6%, accompanied by a VGM Score of B.

Price and Consensus: TRV

.jpg)

5. Chubb Limited

Chubb Limited, headquartered in Zurich, Switzerland, ranks as one of the largest global providers of property and casualty insurance and reinsurance, being the biggest publicly traded P&C insurer by market cap. The firm is targeting long-term growth through middle-market opportunities, core and specialty product enhancements, and focuses on cyber insurance. Chubb maintains a Zacks Rank #3.

The Zacks Consensus Estimate for 2026 indicates a 19.4% year-over-year earnings increase, with a long-term growth rate projected at 3.7%. Recent adjustments in estimates for 2025 and 2026 reflect increases of 1.5% and 0.4%, respectively. Chubb has also delivered an average earnings surprise of 11.48% over the last four quarters.

Price and Consensus: CB

.jpg)

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

.jpg)