Investing in stocks over a longer period—decades instead of months—can be a game changer. This broader view helps investors understand the major global trends shaping our economy. By selecting and holding shares in leading companies that drive these trends, investors can build wealth and potentially outpace the overall market.

Today, technology plays a critical role in rapid advancements, with breakthroughs in artificial intelligence, cloud computing, robotics, and more.

Curious about where to invest $1,000 right now? Our analysts have identified the 10 best stocks to consider. Explore the 10 stocks »

If you’re seeking a durable portfolio that evolves with innovation, think about investing in these leading technology stocks over the next decade. The focus should not solely be on what these companies do today, but also on their future direction.

In short, keep the big picture in mind.

1. Nvidia

The AI chip giant Nvidia (NASDAQ: NVDA) represents a solid investment for any tech enthusiast. With the AI chip market expected to grow annually by 20%, reaching over $300 billion by 2029, Nvidia is on a path of substantial growth. Its recent ventures into diverse AI applications generate excitement about the company’s future prospects.

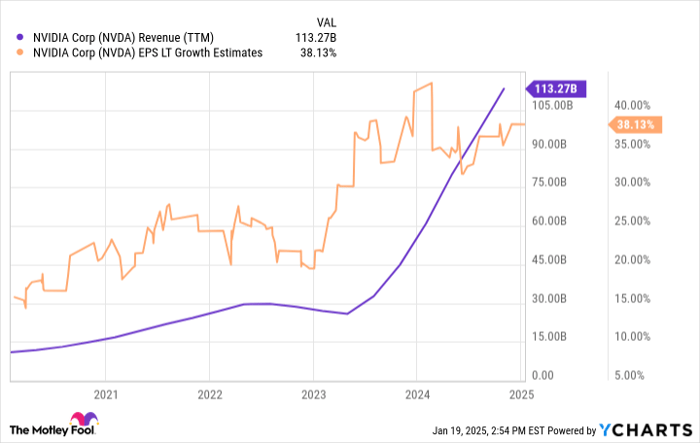

NVDA Revenue (TTM) data by YCharts

Nvidia’s introduction of a compact AI supercomputer for individual developers marks a strategic move beyond data centers. This shift may position it advantageously within emerging markets like robotics over the upcoming decade.

2. Alphabet

As the parent company of Google, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) is at the forefront of innovation. Its profitable Google brand, including its search engine and software, has established it as one of the world’s most significant companies. Alphabet is also exploring advanced technologies such as self-driving cars (Waymo) and quantum computing (Google Quantum AI).

GOOGL Revenue (TTM) data by YCharts

Additionally, Alphabet ranks third in cloud services with Google Cloud, holds a wealth of data from users to enhance AI, and utilizes in-house AI models (Gemini). This makes Alphabet a strong candidate for growth in the next decade, potentially outpacing its competitors in the “Magnificent Seven.”

3. Netflix

As a streaming pioneer, Netflix (NASDAQ: NFLX) remains a leader in an increasingly competitive market. With around 283 million paid memberships, Netflix has achieved global acclaim, evidenced by hit shows like Squid Game, which resonate with diverse audiences across the globe.

NFLX Revenue (TTM) data by YCharts

Investing in Netflix promises several growth opportunities. The company is transitioning from a pure subscription model to include advertising and has begun exploring new areas such as mobile gaming and live sports. Expect Netflix to further develop these sectors in the coming years.

4. Amazon

Known primarily for its e-commerce prowess, Amazon (NASDAQ: AMZN) commands nearly 40% of U.S. e-commerce sales. However, this just scratches the surface, as e-commerce constitutes only 16% of total retail spending, indicating continued growth potential. Beyond retail, Amazon operates the leading cloud platform, AWS, which comprises over 30% of the market.

AMZN Revenue (TTM) data by YCharts

With over 200 million Prime memberships, Amazon has crafted a consumer ecosystem, adding offerings like telehealth, video streaming, and smart home devices (Alexa). Furthermore, its digital advertising sector is becoming increasingly important, making Amazon a notable choice for long-term investment.

5. Microsoft

Microsoft (NASDAQ: MSFT) is a longstanding player in technology, with over three decades of innovation. Originally known for Windows, the company has expanded its empire, encompassing Microsoft 365, Xbox, GitHub, and Azure, the second-largest cloud platform globally.

MSFT Revenue (TTM) data by YCharts

With its software embedded in countless devices, Microsoft boasts a competitive edge. The company is heavily investing in AI capabilities, leveraging its Azure cloud services. The AI cloud market is expected to grow by 16% annually, reaching over $2.7 trillion by 2034, promising ample opportunity for Microsoft.

Is Now the Time to Invest in Nvidia?

Before you decide to invest in Nvidia, keep this in mind:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for immediate investment… and Nvidia did not make the list. The selected stocks could yield significant returns in the near future.

For perspective, when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth $901,323!*

Stock Advisor offers a straightforward roadmap for successful investing, delivering regular updates from analysts and two new stock picks every month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times*.

Learn more »

*Stock Advisor returns as of January 21, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is also a board member. Justin Pope does not hold any positions in the companies mentioned. The Motley Fool has stock positions in and recommends Alphabet, Amazon, Microsoft, Netflix, and Nvidia. The Motley Fool recommends options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.