“`html

U.S. stocks, especially in the tech sector, continue a significant upward trend in 2025, despite high valuations and challenges like President Trump’s tariffs and a weakening U.S. labor market. The CME FedWatch tool indicates a 100% probability of a 25-basis-point interest rate cut by the Federal Reserve at its upcoming FOMC meeting, which could further benefit stock investors.

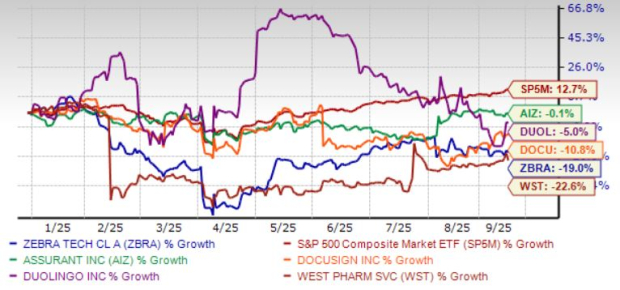

Large-cap AI stocks have shown mixed results year-to-date, with five notable stocks identified as having strong price upside potential according to their Zacks Rank. These include Assurant Inc. (AIZ), DocuSign Inc. (DOCU), Duolingo Inc. (DUOL), West Pharmaceutical Services Inc. (WST), and Zebra Technologies Corp. (ZBRA). For example, DUOL is expected to grow its revenue by 36.2% and earnings by 66% in 2025, with a target price indicating a potential upside of 94.9% from its last closing price of $307.91.

Assurant has a projected revenue growth of 5.7% and earnings growth of 5.8% for the year. The average target price for AIZ signifies a possible increase of 12.4% from its last closing price of $213.01. In contrast, Zebra Technologies is expected to achieve a revenue growth rate of 6.3% and earnings growth of 15.9%, with an average target price suggesting a 31.8% upside from $312.65.

“`