“`html

Key Points

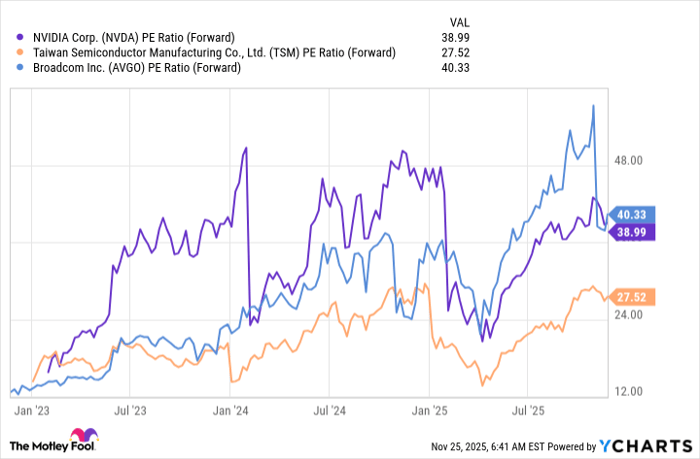

As fund managers shift their focus to 2026, several growth stocks are emerging as attractive investment opportunities. Notably, Nvidia (NASDAQ: NVDA) reported a revenue increase of 62% year-over-year for Q3 fiscal 2026, totaling $57 billion, and has visibility of $500 billion in sales from its Blackwell and Rubin chips over the next two years.

Broadcom (NASDAQ: AVGO) is gaining attention due to its custom AI chips, particularly its collaboration with Google to provide Tensor Processing Units, which may attract clients like Meta Platforms (NASDAQ: META). Taiwan Semiconductor Manufacturing (NYSE: TSM) recorded a 41% revenue growth year-over-year in Q3, making it a safer buy in the semiconductor space.

In Q3, Meta’s revenue rose by 26% year-over-year, while Alphabet (NASDAQ: GOOGL) saw a 16% revenue increase and a 35% rise in diluted earnings per share. Amazon (NASDAQ: AMZN) reported a 13% revenue growth, driven by cloud computing and advertising segments, positioning these companies as solid investments going into 2026.

“`