Navigating Market Volatility: Stocks and Bonds in Focus

In times of economic uncertainty, staying invested in stocks remains crucial. However, it’s equally important to manage risk effectively.

Market fluctuations, whether due to elections or other external factors, are inevitable but temporary. Avoiding the market during these times can mean missing out on potential gains, especially as investors look to maintain dividend income when volatility rises.

Today, we’ll address two important topics: the strong fundamentals that support the current stock market and how to diversify our investments while enhancing our income stream moving forward.

Strong Fundamentals Fueling High Stock Prices

The S&P 500 has experienced significant growth this year, indicating that stocks are priced high, with the index’s price-to-earnings (P/E) ratio around 27 (a figure above 20 suggests that stocks are expensive).

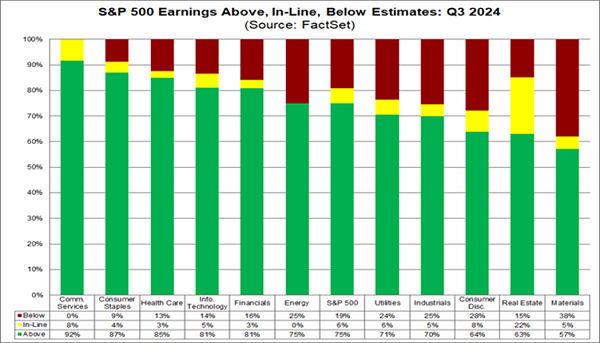

Can we expect further growth? Yes, because despite potential short-term market moves, the economy and corporate earnings are solid. In the third quarter, U.S. companies recorded a 5.1% increase in earnings, with FactSet reporting that 75% of these companies exceeded earnings expectations.

Key sectors contributing to earnings growth include communications services, consumer staples, healthcare, information technology, and financials. These sectors cater directly to consumers, signaling underlying economic strength. In contrast, sectors like industrials, real estate, and materials, which supply essential goods, showcase slower earnings growth, suggesting that overall growth is driven more by demand than by previous pricing power.

Nonetheless, less than half of consumer-discretionary companies exceeded sales expectations, indicating some economic weakness. However, these signs alone are not enough to cause major concern.

The mixed signals from these different sectors suggest ongoing market volatility, implying that while bad news may arise, the overall stock momentum might continue.

Given this landscape, our strategy is clear: capitalize on companies’ rising profit margins while reducing exposure to volatile stock price fluctuations, guiding us toward bonds, particularly high-yield corporate bonds.

Exploring High-Yield Corporate Bonds

Currently, corporate bonds yield approximately 4.7% on average, while high-yield corporate bonds are averaging around 7.1%. As mentioned, corporate sales and earnings are on the rise, and default rates for corporate bonds are declining, which lowers our risks in this space.

The high-yield bond market presents a different picture from stocks this year:

Excluding Income, High-Yield Bonds Hold Steady

The performance of the benchmark SPDR Bloomberg High Yield Bond ETF (JNK) shows only minimal gains this year when excluding the ETF’s 6.6% yield. The surprising stability exists even as the Federal Reserve cuts interest rates, a situation that typically leads to higher bond prices. This gap represents a prime opportunity to invest in undervalued assets benefiting from a strong economy while also balancing our stock portfolio.

To enhance our bond investments further, we recommend looking at CEFs (closed-end funds) like the Pioneer High Income Fund (PHT), which yields 8.5%. This fund offers instant diversification across 313 bonds from various issuers. Notably, PHT has significantly outperformed JNK since the ETF launched in November 2007:

PHT Outperforms

PHT benefits from active management, which is critical in the corporate bond market where strong connections can lead to access to top new issues that indices like JNK cannot offer. With an effective duration of 2.54 years, PHT has the ability to maintain payouts as interest rates decline, ensuring a robust dividend-coverage ratio.

Currently, PHT trades at a 7.5% discount to its net asset value (NAV), marking a significant opportunity considering its strong performance in a reliable economic environment.

High Returns, a Favorable Yield, and a Large Discount

Though corporate bonds are showing dependable returns with greater yields, PHT now holds a larger discount than in recent history, as seen following the pandemic and the subprime mortgage crisis. Given the present strength of the economy, it’s puzzling why there would be such a discount.

PHT represents just one of many CEFs currently available, making this an ideal time to reconsider investment in bonds, especially for those who may have hesitated due to perceived complexities compared to stocks.

If stocks face another downturn—recalling that the S&P 500 lost nearly half of its gains this summer—bonds could serve as a reliable source of income through turbulent times. Increased investor recognition of this reality may lead to a price rise for PHT to pre-pandemic levels.

Take Action: Invest in These 5 Reliable Income Funds

In uncertain periods, stocks and funds that offer monthly dividends provide security beyond just high yields. Monthly payouts coincide with personal expenses, creating comfort during fluctuating market conditions.

That’s why now, amidst uncertainty, I am advocating for a diversified range of five closed-end funds (CEFs) that offer monthly dividends with a substantial average yield of 10.5%.

This means earning over 10% annually on your initial investments in dividends alone. Having steady income deposited in your account each month can make a considerable difference in managing daily expenses.

The time to invest in these five monthly-paying CEFs is now, while they remain undervalued. Click here for details on these “Gibraltar-like” income opportunities, including their names and tickers in a free Special Report.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.