Market Review: S&P 500 Gains Amid Q1 Turbulence, Focus on Cheap Stocks

The S&P 500 surged on the last day of March, ending a challenging quarter with renewed optimism. Despite this uptick, the benchmark index still experienced a 6% decline in Q1, while the Nasdaq fell by more than 10%. Factors such as tariff uncertainties and profit-taking following a strong rebound from 2022 lows contributed to this downturn.

As Wall Street steps into the second quarter, it grapples with uncertainty, awaiting President Trump’s tariff update scheduled for April 2.

Market Outlook and Earnings Growth

The future remains unpredictable. However, the Nasdaq has retreated from some of its highest Relative Strength Index (RSI) levels of the past two decades, landing at a more neutral position. Moreover, expectations for earnings growth remain positive, and the Federal Reserve is projected to implement two more interest rate cuts in 2025.

This environment may instill confidence in long-term investors looking to capitalize on the current market volatility.

In this context, we will examine affordable stocks priced at $10 per share or lower that investors may want to consider for April.

These stocks not only have low price points, but also receive favorable evaluations from Wall Street analysts, supported by improving earnings outlooks reflected in their strong Zacks Ranks.

Understanding Penny Stocks and Stocks Under $10

Traditionally, “penny stocks” referred to shares priced at one dollar or less. Today, this classification has expanded to include stocks trading under $5, as defined by the SEC. Many investors shy away from these stocks due to their speculative nature.

Penny stocks also typically experience lower trading volumes and wider bid/ask spreads, resulting in significant volatility. Nevertheless, the potential for strong performance keeps these stocks appealing to certain investors.

Next in line are stocks priced between $5 and $10, which are generally perceived as less risky than penny stocks. Investors may be more familiar with these companies, yet they still carry speculative elements compared to higher-priced stocks.

Identifying winning stocks under $10 is possible with careful selection. Today, we have narrowed down a large pool of these stocks to highlight those with potential for portfolio enhancement.

Screening Criteria for Stock Selection

- • Price less than or equal to $10

- • Volume greater than or equal to 1,000,000

- • Zacks Rank less than or equal to 2

- (No Holds, Sells, or Strong Sells.)

- • Average Broker Rating less than or equal to 3.5

- (Average Broker Rating of a Hold or better.)

- • Number of Analysts in Rating greater than or equal to 2

- (At least two analysts covering the stock.)

- • % Change in F1 Earnings Estimate Revisions — 12 Weeks greater than or equal to 0

- (Preferably upward revisions, with no downward adjustments.)

Out of nearly 70 highly ranked stocks trading under $10 that met these criteria, one stands out today:

Spotlight on a Promising Stock: Rolls-Royce

Rolls-Royce RYCEY is a renowned manufacturer of engines, now advancing into innovative power and propulsion solutions for a variety of applications, including aircraft and maritime. The company is leveraging its expertise in nuclear propulsion to design small modular nuclear reactors (SMRs) and micro-reactors.

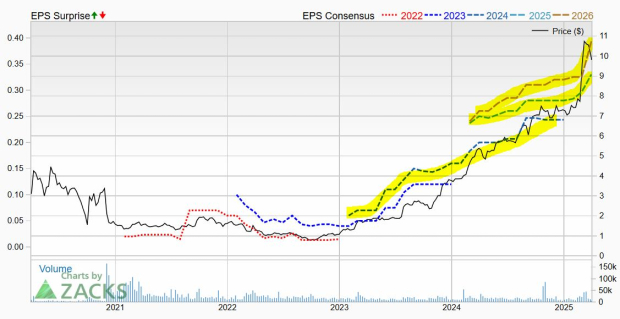

Image Source: Zacks Investment Research

Rolls-Royce is undergoing a significant transformation to enhance profitability after a challenging decade. Appointed in January 2023, CEO Tufan Erginbilgic is spearheading this effort. In 2024, RYCEY reported a 55% increase in operating profit, driven by a 16% increase in sales, positioning the company ahead of its target to quadruple profits by the end of 2028.

The engine maker has reinstated its dividend and announced a share buyback program. Additionally, Rolls-Royce is poised to expand further into the narrowbody aircraft market. Projected growth indicates a 19% revenue increase in 2025 and an 8% rise in 2026, which will likely support adjusted earnings growth of 27% and 19%, respectively. As earnings estimates continue to rise, Rolls-Royce has achieved a Zacks Rank of #2 (Buy).

Image Source: Zacks

Rolls-Royce Shares Surge 650% Yet Still Below Price Target

Rolls-Royce shares have surged more than 650% over the past three years. Currently trading at $10, RYCEY remains 49% below its average Zacks price target of $14.60 per share. In terms of valuation, Rolls-Royce is on par with its 10-year median, trading close to its industry at a multiple of 28.4X forward 12-month earnings.

Explore Additional Investment Opportunities

To learn more about stocks that meet these criteria and discover potential winning investments, consider utilizing the Research Wizard. Start screening for promising companies with a free trial today!

Click here to sign up for a free trial to the Research Wizard today.

To stay informed about more articles from this author, scroll to the top of this article and click the FOLLOW AUTHOR button for email notifications upon publication of new content.

Important Disclosures

Disclosure: Officers, directors, and/or employees of Zacks Investment Research may own or have sold short securities mentioned here. An affiliated investment advisory firm may also hold or trade positions in these securities.

For performance data regarding Zacks’ portfolios and strategies, visit: www.zacks.com/performance_disclosure

Today’s Picks from Zacks’ Best Screens

Starting today, you can access the latest stock picks from our proven performance screens. Since 2000, these screens have delivered returns significantly above market averages. For example, while the S&P 500 averaged +7.0% annually, our Small-Cap Growth category saw returns of +44.9%, Filtered Zacks Rank5 at +48.4%, and Big Money Zacks at +55.2%.

We invite you to use Zacks’ Research Wizard stock-picking software to screen stocks quickly. Create market-beating strategies with no credit card required and at no cost.

Rolls-Royce Holdings PLC (RYCEY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.