Nasdaq Faces Correction: A Look at Investment Opportunities

The Nasdaq Composite index has officially entered correction territory, having fallen over 13% since its peak on December 16 of last year. Recent economic developments have stoked investor caution, leading to this marked downturn in market sentiment.

Key contributors to this correction include new tariffs imposed by the Trump administration on countries such as Canada, Mexico, and China, alongside a weaker-than-expected jobs report from last month and declining consumer confidence amid concerns about rising inflation.

Where to invest $1,000 right now? Our analyst team has revealed what they believe are the 10 best stocks to buy right now. Learn More »

Yet, this market correction could present a hidden opportunity for astute investors.

Market Corrections Provide Strategic Buying Opportunities

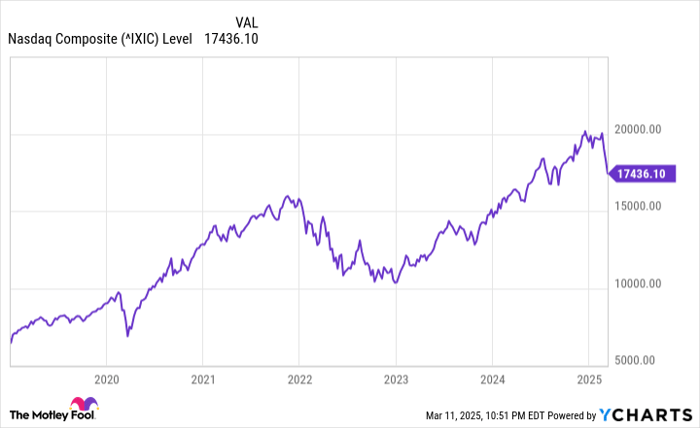

A market correction is defined as a decline of 10% to 20% in major indexes. Investors are advised to remain calm because historical data shows that such corrections are typically followed by robust recoveries. The chart below visualizes this pattern.

^IXIC data by YCharts

For instance, the Nasdaq Composite underwent a correction in early 2020 during the coronavirus pandemic, followed by significant gains through the end of 2021. Similarly, after heavy sell-offs in 2022, the market ultimately rebounded strongly. Investors who seized opportunities during these tough times are now reaping substantial rewards.

Take Nvidia, for example; the company’s shares have surged over 3,000% since 2019 despite fluctuations. Investors who maintained their Nvidia positions during volatility have benefited significantly. This context underscores the importance of seeking companies with long-term growth potential during corrections.

While Nvidia remains a strong candidate, there is another AI stock that is more affordable and may experience quicker growth than Nvidia. Let’s explore this alternative.

Catalysts Could Propel AMD into a Bull Market

Advanced Micro Devices (NASDAQ: AMD) may not have matched Nvidia’s explosive growth since early 2019, but it has still garnered impressive gains of 413%. Currently, however, AMD’s stock has retreated nearly 24% amid the latest Nasdaq correction since December 16. This decline has positioned AMD at an appealing valuation of 21 times forward earnings, which is a discount compared to Nvidia.

Purchasing AMD at this juncture appears strategic, as several growth catalysts could boost its prospects. The company is innovating in AI personal computers (PCs), data center graphics cards, and gaming consoles, making it a strong contender for future investment. In 2024, AMD reported a 14% increase in revenue and a 25% rise in non-GAAP earnings, reaching $3.31 per share.

This impressive performance is largely due to AMD’s record data center revenue, nearly doubling as it made strides in the AI graphics card market and gained market share in server processors. Additionally, AMD’s client processor revenue jumped by 52% in 2024, benefitting from a rebound in the PC market and the company’s expanding presence in that sector.

Looking ahead, AMD is optimistic about achieving growth in these key markets, which constitute over 75% of its total revenue. For instance, the company anticipates its data center graphics card segment will generate “tens of billions of dollars in annual revenue over the coming years,” significantly higher than the $5 billion projected for 2024. With next-generation AI graphics cards set to launch in mid-2025, AMD is ramping up its product development efforts.

Notably, AMD’s new AI graphics cards are gaining traction with major players in cloud computing, including Microsoft, IBM, and Oracle. As the global AI chip market is expected to surpass $500 billion in revenue by 2033, AMD could see significant increases in its data center revenues, building upon last year’s total of $12.6 billion, even if it retains its status as the second-largest data center graphics card provider.

Moreover, the CPU market for AI servers anticipates an annual growth rate of 28% through 2028, which could yield $26 billion in annual revenue. AMD has consistently taken market share from Intel, reporting a 35.5% revenue share of the server CPU market in Q4 2024, a 3.7 percentage point increase year-over-year according to Mercury Research.

If AMD captures 40% of the AI server CPU market by 2028, its revenue from this segment alone could exceed $10 billion, based on the projected market size. This shows that AMD is well-positioned for robust long-term growth in both CPU and graphics card markets.

AMD is also expanding its footprint in PC CPUs, evidenced by an impressive 8.4 percentage point growth in its share of server CPUs in Q4 2024 to 23.8%. The company is enhancing its client CPU market strategy with AI-focused processors. As a result, AMD anticipates that client segment revenue could outpace overall market growth owing to its broad product portfolio and strong design momentum.

Overall, AMD’s ongoing market share gains in both data center and client sectors suggest potential for strong growth. Analysts predict a 42% increase in the company’s earnings this year, followed by a 35% rise next year, reaching $6.33 per share. In contrast, Nvidia’s earnings are anticipated to grow 50% this fiscal year, tapering to 28% the following year.

Consequently, AMD’s attractive valuation and promising growth potential make it a compelling buy amid the current market correction. Should AMD’s earnings reach $6.33 per share, investors stand to gain significantly in the long run.

Advanced Micro Devices: Key Investment Insights and Recommendations

Advanced Micro Devices (AMD) holds potential for significant stock price growth. If AMD manages to trade at 25 times forward earnings based on projections for next year, which aligns with the Nasdaq-100 index’s forward earnings multiple, the stock price could rise to $158. This represents a possible 62% increase from current levels, reinforcing reasons for investors to consider this Stock.

Investing in Advanced Micro Devices: A Cautionary Perspective

Before deciding to invest $1,000 in Advanced Micro Devices, it’s important to evaluate certain considerations:

The Motley Fool Stock Advisor analysts recently identified what they believe to be the 10 best stocks to buy at this moment. Notably, Advanced Micro Devices did not make this list, raising questions about its immediate investment potential. The selected stocks could potentially yield substantial returns in the coming years.

Reflecting on past recommendations, consider when Nvidia was included on April 15, 2005. If an investor put $1,000 into Nvidia at that time, it would have grown to an impressive $708,400 today.*

Stock Advisor provides a straightforward strategy for investors. This includes guidance on portfolio building, regular updates from analysts, and two new Stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns.* Be sure to check out the latest top 10 list available with your Stock Advisor membership.

*Stock Advisor returns as of March 10, 2025

Harsh Chauhan has no positions in the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, International Business Machines, Microsoft, Nvidia, and Oracle. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2025 $30 calls on Intel. The Motley Fool adheres to a disclosure policy.

The views and opinions expressed herein represent those of the author and do not necessarily reflect those of Nasdaq, Inc.