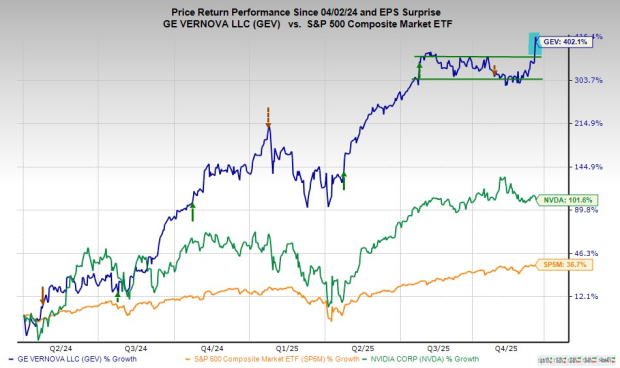

GE Vernova (GEV) stock has surged approximately 400% since its April 2024 IPO, reaching an all-time high earlier this week. This rise follows the company’s announcement of artificial intelligence-enhanced guidance, a doubled dividend, and increased stock buybacks. The company projects its electrification backlog will double within three years due to an anticipated 75% to 100% increase in U.S. electricity demand by 2050, driven by the energy-intensive requirements of AI technologies.

Constellation Energy (CEG), which recently acquired Calpine for $27 billion, is positioned as a key player in nuclear energy, establishing power agreements with major companies like Microsoft and Meta. Meanwhile, NextEra Energy (NEE), a leader in solar and battery storage, expects to add 15 gigawatts of power generation for data centers by 2035, with strong growth projections of 13% revenue increase in the current year and 14% next year.

With AI hyperscalers set to spend approximately $400 billion on capital expenditures in 2025, and global spending on data center infrastructure reaching $7 trillion by 2030, the demand for power solutions from companies like GEV, CEG, and NEE is poised for substantial growth.