“`html

Key Points

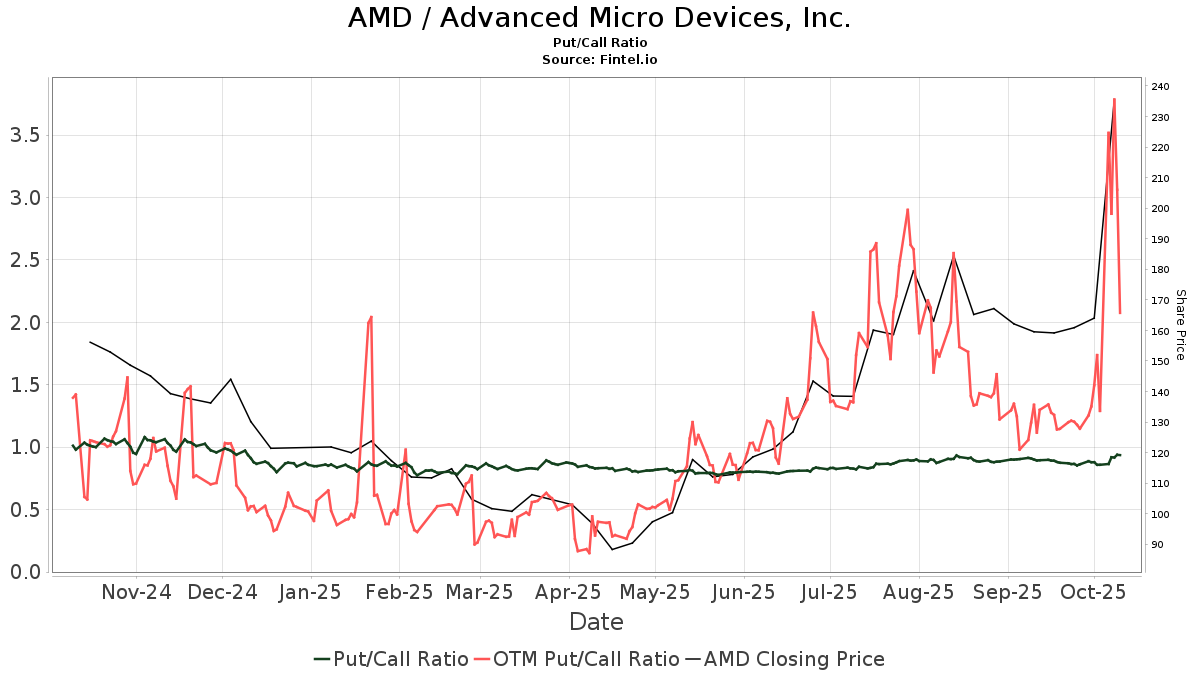

Advanced Micro Devices (NASDAQ: AMD) recently announced a deal to supply OpenAI with 6 gigawatts worth of chips over the next several years. This announcement has contributed to AMD’s share price reaching $234, reflecting a forward P/E ratio of 37 based on 2026 earnings estimates. Analysts predict more than 20% year-over-year revenue growth for AMD next year, which may increase further due to the OpenAI deal.

AMD’s hardware is set to be deployed by major companies, including Microsoft, Meta Platforms, Oracle, Tesla, and xAI, with the upcoming Instinct MI450 series of GPUs expected to launch next year. This strategic expansion positions AMD as a competitor in the GPU market, historically dominated by Nvidia.

“`