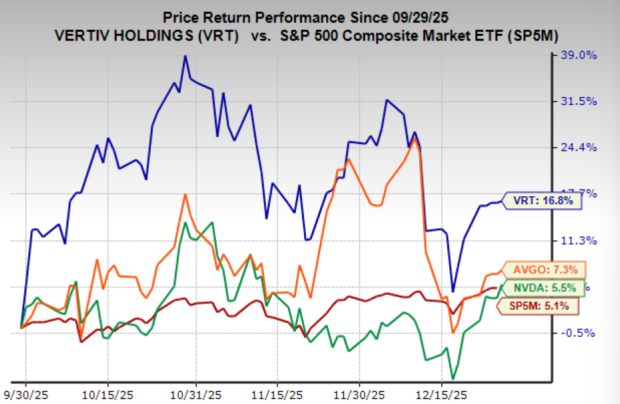

AI capital spending is projected to reach approximately $571 billion by 2026, with key companies Nvidia (NVDA), Broadcom (AVGO), and Vertiv (VRT) positioned at the forefront of this expansion. Recent volatility has characterized the market, but the long-term outlook for these stocks remains favorable, as evidenced by their strong earnings potential and ongoing demand in AI infrastructure.

Nvidia recently advanced a major acquisition of AI chip startup Groq, valued at around $20 billion, solidifying its competitive edge in AI semiconductors. Analysts have raised Nvidia’s earnings estimates by nearly 16% over the past two months, with an expected annual EPS growth of 46.3% in the next three to five years. Broadcom, integral to Google’s AI infrastructure, requires custom silicon for efficient operations, projecting a 35.7% annual EPS growth. Vertiv, focused on AI-driven thermal management solutions for data centers, holds significant partnerships and a strong backlog, forecasting a 30.2% annual EPS growth.

Despite short-term uncertainty, analysts indicate an attractive risk-reward profile for these stocks as the AI investment cycle continues into 2026 and beyond.