Taiwan Semiconductor Manufacturing Company (TSMC) reported its fourth-quarter results on Thursday, revealing a significant boost from artificial intelligence, with revenue expected to grow by 30% in 2026. The company increased its capital expenditure guidance to between $52 billion to $56 billion, up from $40.9 billion in 2025, underscoring the strong demand spurred by AI advancements.

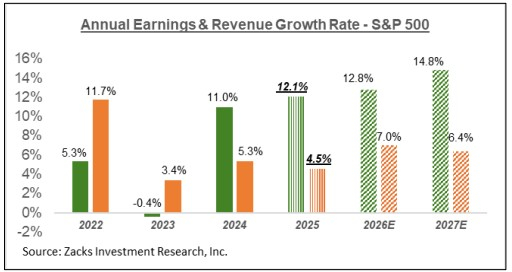

Additionally, the semiconductor and AI sectors are witnessing heightened investor interest as Wall Street anticipates robust earnings growth across all sectors for the first time since 2018. The total S&P 500 earnings are projected to increase by 12.8% in 2026, with a significant contribution from the technology sector, expected to expand by 20%. This optimism is reflected in companies like Advanced Micro Devices (AMD) and Vertiv Holdings Co. (VRT), which are positioning themselves to capitalize on the AI infrastructure and chip markets.

AMD expects its revenue to climb from $25.8 billion in 2024 to $43.43 billion by 2026, with a compounded annual growth rate (CAGR) of over 35% in its AI-related segments. Similarly, Vertiv anticipates a revenue increase of 22% in FY 2026, reaching $12.43 billion, indicating substantial growth potential as the AI market evolves.